Reports

Sale

Global Acetonitrile Market Size, Share, Trends, Forecast: By End Use: Pharmaceuticals, Analytical Industry, Agrochemicals, Extraction Industry, Others; Regional Analysis; Market Dynamics: SWOT Analysis, Porter’s Five Forces Analysis, Key Indicators for Demand, Key Indicators for Price; Competitive Landscape; 2024-2032

Global Acetonitrile Market Outlook

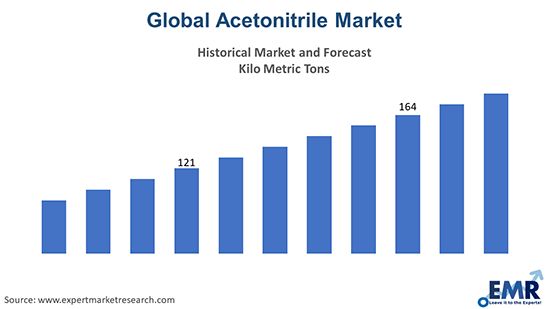

The global acetonitrile market reached a consumption volume of around 141.63 kilo metric tons in 2023. The consumption of acetonitrile is expected to grow at a CAGR of around 5.1% in the forecast period 2024-2032 to reach a volume of around 221.58 kilo metric tons by 2032.

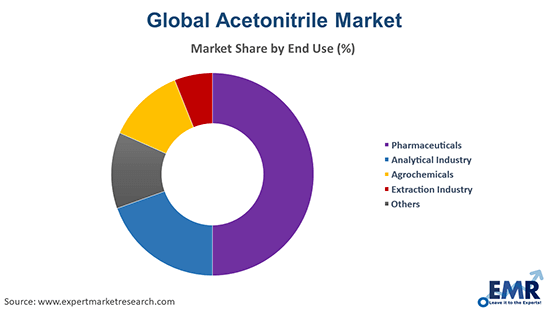

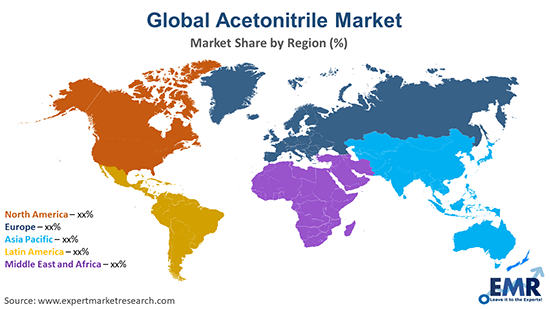

The Asia Pacific region is the leading region in terms of consumption, with China being the largest consumer nation. The region alone accounts for almost 60% of the consumption share, which is more than 70 million tons. The Asia Pacific region is followed by Europe and North America, contributing a significant share to the consumption growth. The end-use sector is dominated significantly by the pharmaceuticals sector, accounting for 70% of the acetonitrile market share.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

China is the leading consumer nation, along with being one of the major producers. In 2017, the total manufacturing output in China reached a volume of around 10 million tons. The rising demand for the product in the region is widely being supported by its increasing application in the end-use industries. The product finds wide end-uses as a solvent, HPLC solvents, semiconductor cleaning agent, and fine chemical intermediates. The rising demand in the application sector has provided an impetus to the growth of the acetonitrile market in China.

The feedstock for acetonitrile includes ammonia and propylene. The largest consumer region for propylene is the Asia Pacific region, followed by North America and Western Europe. Propylene is abundantly used for the production of polypropylene. The market for ammonia is also led by the Asia Pacific region, accounting for nearly 60% of the market share. The Asia Pacific region is followed by Europe and North America. The rising markets for these feedstocks significantly affect the growth of the global acetonitrile market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Properties and Applications

Acetonitrile is a colourless, toxic, water-soluble fluid, with the chemical formula C2H3N, which smells like ether. The chemical is generally used primarily in organic synthesis and as a solvent.

Acetonitrile finds its end uses in the following segments:

- Pharmaceuticals

- Analytical Industry

- Agrochemicals

- Extraction Industry

- Others

The regional acetonitrile markets include North America, Europe, Asia Pacific, South America, and Middle East and Africa.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Analysis

The global acetonitrile market is significantly being driven by the ever-growing pharmaceuticals industry. The demand for pharmaceuticals is rapidly increasing owing to the rising healthcare sector and the advancing technologies. The product is widely being used as solvents in manufacturing insulin and antibiotics. It also finds its uses in DNA synthesis. The pharmaceuticals industry is widely growing, especially in the developing regions of the Asia Pacific regions, with China and India accounting for the highest growth rate.

The acetonitrile market is also being aided by its rising application in the HPCL sector, that is, high-performance liquid chromatography. The rising use of acetonitrile in synthesising several nutrients is also propelling the market growth further. Acetonitrile has wide applications as a solvent in UV spectroscopy, polarography, and lithium batteries. The product helps in the casting, as well as moulding of plastic materials and for spinning fibres. It is also used as a solvent for extracting oleochemicals like fatty acids from animal and vegetable oils. In chemical laboratories, it can be used to detect chemical residues. The increasing use of acetonitrile as a semiconductor cleaning agent and as fine chemical intermediates is also providing an impetus to the acetonitrile market growth.

Competitive Landscape

The report gives a detailed analysis of the following key players in the global acetonitrile market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

- Ineos AG

- Asahi Kasei Corporation

- Formosa Plastic Corporation

- Imperial Chemical Corporation

- Others

The comprehensive EMR report provides an in-depth assessment of the acetonitrile market based on the Porter's five forces model along with giving a SWOT analysis.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 Global

6.2 Regional

7 Industry Opportunities and Challenges

8 Global Acetonitrile Market Analysis

8.1 Key Industry Highlights

8.2 Global Acetonitrile Historical Market (2018-2023)

8.3 Global Acetonitrile Market Forecast (2024-2032)

8.4 Global Acetonitrile Market by End Use

8.4.1 Pharmaceuticals

8.4.1.1 Market Share

8.4.1.2 Historical Trend (2018-2023)

8.4.1.3 Forecast Trend (2024-2032)

8.4.2 Analytical Industry

8.4.2.1 Market Share

8.4.2.2 Historical Trend (2018-2023)

8.4.2.3 Forecast Trend (2024-2032)

8.4.3 Agrochemicals

8.4.3.1 Market Share

8.4.3.2 Historical Trend (2018-2023)

8.4.3.3 Forecast Trend (2024-2032)

8.4.4 Extraction Industry

8.4.4.1 Market Share

8.4.4.2 Historical Trend (2018-2023)

8.4.4.3 Forecast Trend (2024-2032)

8.4.5 Others

8.5 Global Acetonitrile Market by Region

8.5.1 Market Share

8.5.1.1 North America

8.5.1.2 Europe

8.5.1.3 Asia Pacific

8.5.1.4 Latin America

8.5.1.5 Middle East and Africa

9 Regional Analysis

9.1 North America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.1.3 Breakup by Country

9.1.3.1 United States of America

9.1.3.2 Canada

9.2 Europe

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

9.2.3 Breakup by Country

9.2.3.1 United Kingdom

9.2.3.2 Germany

9.2.3.3 France

9.2.3.4 Italy

9.2.3.5 Others

9.3 Asia Pacific

9.3.1 Historical Trend (2018-2023)

9.3.2 Forecast Trend (2024-2032)

9.3.3 Breakup by Country

9.3.3.1 China

9.3.3.2 Japan

9.3.3.3 India

9.3.3.4 ASEAN

9.3.3.5 Australia

9.3.3.6 Others

9.4 Latin America

9.4.1 Historical Trend (2018-2023)

9.4.2 Forecast Trend (2024-2032)

9.4.3 Breakup by Country

9.4.3.1 Brazil

9.4.3.2 Argentina

9.4.3.3 Mexico

9.4.3.4 Others

9.5 Middle East and Africa

9.5.1 Historical Trend (2018-2023)

9.5.2 Forecast Trend (2024-2032)

9.5.3 Breakup by Country

9.5.3.1 Saudi Arabia

9.5.3.2 United Arab Emirates

9.5.3.3 Nigeria

9.5.3.4 South Africa

9.5.3.5 Others

10 Market Dynamics

10.1 SWOT Analysis

10.1.1 Strengths

10.1.2 Weaknesses

10.1.3 Opportunities

10.1.4 Threats

10.2 Porter’s Five Forces Analysis

10.2.1 Supplier’s Power

10.2.2 Buyers Power

10.2.3 Threat of New Entrants

10.2.4 Degree of Rivalry

10.2.5 Threat of Substitutes

10.3 Key Indicators for Demand

10.4 Key Indicators for Price

11 Value Chain Analysis

12 Trade Data Analysis

12.1 Major Importing Countries

12.1.1 By Volume

12.1.2 By Value

12.2 Major Exporting Countries

12.2.1 By Volume

12.2.2 By Value

13 Price Analysis

13.1 North America Historical Price Trends (2018-2023) and Forecast (2024-2032)

13.2 Europe Historical Price Trends (2018-2023) and Forecast (2024-2032)

13.3 Asia Pacific Historical Price Trends (2018-2023) and Forecast (2024-2032)

13.4 Latin America Historical Price Trends (2018-2023) and Forecast (2024-2032)

13.5 Middle East and Africa Historical Price Trends (2018-2023) and Forecast (2024-2032)

14 Manufacturing Process

14.1 Detailed Process Flow

14.2 Operations Involved

14.3 Mass Balance

15 Feedstock Analysis

15.1 Global Propylene Market Analysis

15.1.1 Key Industry Highlights

15.1.2 Global Propylene Historical Market (2018-2023)

15.1.3 Global Propylene Market Forecast (2024-2032)

15.1.4 Global Propylene Market by End Use

15.1.5 Global Propylene Market by Region

15.1.5.1 Market Share

15.1.5.1.1 North America

15.1.5.1.2 Europe

15.1.5.1.3 Asia Pacific

15.1.5.1.4 Latin America

15.1.5.1.5 Middle East and Africa

15.1.6 Historical Price Trends (2018-2023) and Forecast (2024-2032)

15.2 Global Ammonia Market Analysis

15.2.1 Key Industry Highlights

15.2.2 Global Ammonia Historical Market (2018-2023)

15.2.3 Global Ammonia Market Forecast (2024-2032)

15.2.4 Global Ammonia Market by End Use

15.2.5 Global Ammonia Market by Region

15.2.5.1 Market Share

15.1.5.1.1 North America

15.1.5.1.2 Europe

15.1.5.1.3 Asia Pacific

15.1.5.1.4 Latin America

15.1.5.1.5 Middle East and Africa

15.2.6 Historical Price Trends (2018-2023) and Forecast (2024-2032)

16 Competitive Landscape

16.1 Market Structure

16.2 Key Players' Market Share

16.3 Company Profiles

16.3.1 Ineos AG

16.3.1.1 Company Overview

16.3.1.2 Product Portfolio

16.3.1.3 Demographic Reach and Achievements

16.3.1.4 Financial Summary

16.3.1.5 Certifications

16.3.2 Asahi Kasei Corporation

16.3.2.1 Company Overview

16.3.2.2 Product Portfolio

16.3.2.3 Demographic Reach and Achievements

16.3.2.4 Financial Summary

16.3.2.5 Certifications

16.3.3 Formosa Plastic Corporation

16.3.3.1 Company Overview

16.3.3.2 Product Portfolio

16.3.3.3 Demographic Reach and Achievements

16.3.3.4 Financial Summary

16.3.3.5 Certifications

16.3.4 Imperial Chemical Corporation

16.3.4.1 Company Overview

16.3.4.2 Product Portfolio

16.3.4.3 Demographic Reach and Achievements

16.3.4.4 Financial Summary

16.3.4.5 Certifications

16.3.5 Others

17 Industry Events and Developments

List of Key Figures and Tables

1. Global Acetonitrile Market: Key Industry Highlights, 2018 and 2032

2. Global Acetonitrile Historical Market: Breakup by End Use (Kilo Metric Tons), 2018-2023

3. Global Acetonitrile Market Forecast: Breakup by End Use (Kilo Metric Tons), 2024-2032

4. Global Acetonitrile Historical Market: Breakup by Region (Kilo Metric Tons), 2018-2023

5. Global Acetonitrile Market Forecast: Breakup by Region (Kilo Metric Tons), 2024-2032

6. North America Acetonitrile Historical Market: Breakup by Country (Kilo Metric Tons), 2018-2023

7. North America Acetonitrile Market Forecast: Breakup by Country (Kilo Metric Tons), 2024-2032

8. Europe Acetonitrile Historical Market: Breakup by Country (Kilo Metric Tons), 2018-2023

9. Europe Acetonitrile Market Forecast: Breakup by Country (Kilo Metric Tons), 2024-2032

10. Asia Pacific Acetonitrile Historical Market: Breakup by Country (Kilo Metric Tons), 2018-2023

11. Asia Pacific Acetonitrile Market Forecast: Breakup by Country (Kilo Metric Tons), 2024-2032

12. Latin America Acetonitrile Historical Market: Breakup by Country (Kilo Metric Tons), 2018-2023

13. Latin America Acetonitrile Market Forecast: Breakup by Country (Kilo Metric Tons), 2024-2032

14. Middle East and Africa Acetonitrile Historical Market: Breakup by Country (Kilo Metric Tons), 2018-2023

15. Middle East and Africa Acetonitrile Market Forecast: Breakup by Country (Kilo Metric Tons), 2024-2032

16. Major Importing Countries by Volume

17. Major Exporting Countries by Volume

18. Major Importing Countries by Value

19. Major Exporting Countries by Value

20. North America Historical Price Trends and Forecast 2018-2032

21. Europe Historical Price Trends and Forecast 2018-2032

22. Asia Pacific Historical Price Trends and Forecast 2018-2032

23. Latin America Historical Price Trends and Forecast 2018-2032

24. Middle East and Africa Historical Price Trends and Forecast 2018-2032

25. Global Propylene Market: Key Industry Highlights, 2018 and 2032

26. Global Propylene Historical Market: Breakup by End Use (Kilo Metric Tons), 2018-2023

27. Global Propylene Market Forecast: Breakup by End Use (Kilo Metric Tons), 2024-2032

28. Global Propylene Historical Market: Breakup by Region (Kilo Metric Tons), 2018-2023

29. Global Propylene Market Forecast: Breakup by Region (Kilo Metric Tons), 2024-2032

30. Propylene Price Trends and Forecast 2018-2032

31. Global Ammonia Market: Key Industry Highlights, 2018 and 2032

32. Global Ammonia Historical Market: Breakup by End Use (Kilo Metric Tons), 2018-2023

33. Global Ammonia Market Forecast: Breakup by End Use (Kilo Metric Tons), 2024-2032

34. Global Ammonia Historical Market: Breakup by Region (Kilo Metric Tons), 2018-2023

35. Global Ammonia Market Forecast: Breakup by Region (Kilo Metric Tons), 2024-2032

36. Ammonia Price Trends and Forecast 2018-2032

37. Global Acetonitrile Market Structure

The global acetonitrile market reached a volume of around 141.63 kilo metric tons in 2023.

The market is projected to grow at a CAGR of nearly 5.1% in the forecast period of 2024-2032.

The market is estimated to reach a volume of around 221.58 kilo metric tons by 2032.

The major market drivers include the growing use of acetonitrile in the pharmaceutical sector and the surging applications of acetonitrile as a semiconductor cleaning agent.

The key trends guiding the market include technological advancements and innovations in the healthcare sector, rising applications of acetonitrile in the HPCL sector, and the surging use of acetonitrile for detecting chemical residues.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

The significant end uses of acetonitrile are pharmaceuticals, analytical industry, agrochemicals, and extraction industry, among others.

The leading players in the market are Ineos AG, Asahi Kasei Corporation, Formosa Plastic Corporation, and Imperial Chemical Corporation, among others.

The global acetonitrile market attained a volume of around 141.63 kilo metric tons in 2023 driven by the growth in the pharmaceuticals industry. Aided by the rising healthcare sector, the industry is expected to witness a further growth in the forecast period of 2024-2032, growing at a CAGR of 5.1%. The global acetonitrile market is projected to reach a volume of around 221.58 kilo metric tons by 2032.

EMR’s meticulous research methodology delves deep into the industry, covering the macro and micro aspects of the industry. On the basis of end-uses, the pharmaceuticals sector accounts for the largest share in the global acetonitrile market of 70%. The major regional markets for acetonitrile are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa, with the Asia Pacific accounting for the largest share of the market of 60%. The key players in the above industry include Ineos AG, Asahi Kasei Corporation, Formosa Plastic Corporation, and Imperial Chemical Corporation, among others.

EMR’s research methodology uses a combination of cutting-edge analytical tools and the expertise of their highly accomplished team, thus, providing their customers with market insights that are accurate, actionable, and help them remain ahead of their competition.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.