Reports

Sale

Indian Sanitary Napkin Market Share, Size, Growth, Analysis: By Product: Disposable Menstrual Pads, Biodegradable Menstrual Pads; By Distribution Channel: Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online, Others; Regional Analysis; Market Dynamics: SWOT Analysis; Competitive Landscape; 2024-2032

Indian Sanitary Napkin Market Outlook

The Indian sanitary napkin market size reached a value of nearly INR 10,297.95 crore in 2023. The market is projected to grow at a CAGR of 16.9% between 2024 and 2032 and reach around INR 42,127.30 crore by 2032.

Key Takeaways

- Government schemes such as the Menstrual Hygiene Scheme and the Rashtriya Kishor Swasthya Karyakram, set out by the central government have been aiding in promoting menstrual hygiene in the country.

- The Procter & Gamble Company, Urban Essentials Private Limited, and Lagom Labs Private Limited are a few of the major companies in the Indian sanitary napkin market.

- The growing trend of sustainability and the concerns regarding waste disposal in India are leading to an increase in the number of startups offering biodegradable or reusable sanitary napkins.

The changing perception of menstruation, once considered taboo in Indian society, has boosted the demand for sanitary napkins in the country. In 2022, the literacy rate among women in India accounted for 77%. Hence, improving literacy rates and reducing stigma around menstruation aid the Indian sanitary napkin market expansion.

The increasing awareness of poor menstrual hygiene-related diseases like fungal infections, reproductive tract infections, and STDs, among others, is supporting the adoption of sanitary napkins to promote women's health and safety. Additionally, the increasing availability of sanitary napkins on e-commerce platforms has improved their convenience and accessibility while enhancing brand recognition and sales. Reportedly, India’s e-commerce sector is booming and is expected to reach USD 200 billion by 2026.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Government initiatives promoting menstrual hygiene; the rapidly growing e-commerce sector in India; the growing demand for biodegradable sanitary napkins; and the surging preference for thin and innovative sanitary napkins are aiding the Indian sanitary napkin market growth

March 2023

Ernakulam district jail in Kerala established a production unit for sanitary napkins, marketed under the brand name "Freedom Care" at an affordable price.

January 2023

The Brihanmumbai Municipal Corporation (BMC) revealed its initiative to deploy 5,000 sanitary napkin vending machines throughout Mumbai.

December 2022

Dabur India strategically entered the women's personal hygiene sector with the launch of Fem Ultra Care Sanitary Napkins, exclusively available for online purchase.

September 2022

Niine Private Limited, a prominent sanitary napkin manufacturer, unveiled its ambitious investment plan of INR 500 crore over the next five years to tap into the underpenetrated domestic menstrual hygiene market.

Government initiatives promoting menstrual hygiene

Government schemes such as the Menstrual Hygiene Scheme and the Rashtriya Kishor Swasthya Karyakram have been promoting menstrual hygiene in India, boosting the adoption of sanitary napkins.

Increasing availability of sanitary napkins on e-commerce

Sanitary napkins have been widely available on e-commerce platforms, which has increased brand recognition and accessibility.

Rising Popularity of biodegradable sanitary napkins

The growing eco-consciousness among consumers has surged the preference for biodegradable sanitary pads made from bamboo and banana fibres, which are inexpensive, healthy, and eco-friendly.

Growing adoption of extremely thin and convenient sanitary pads

With a rising number of women engaging in fitness activities, they support the use of extremely thin and convenient sanitary pads that provide them comfort while exercising or jogging.

Growing urbanisation and rising consumer awareness regarding menstrual health

Growing urbanisation is leading to greater recognition of the significance of menstrual hygiene. As a result, the adoption of pads among women is increasing.

Indian Sanitary Napkin Market Trends

India has been a global leader in action on menstrual hygiene, with strong government leadership as well as awareness spread by non-governmental organisations (NGOs). The distribution of affordable sanitary napkins to adolescent girls and women in rural areas also supports the demand for sanitary napkins.

Furthermore, rising environmental concerns support the adoption of biodegradable sanitary pads made from inexpensive bamboo and banana fibres. India, with its abundant supply of bamboo and bananas, offers strong support for biodegradable pads manufacturers by providing them with the necessary raw materials. The necessity to frequently change pads to prevent bacterial growth, maintain hygiene, and prevent odour as well as accidental leaks, further supports the demand for sanitary napkins.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

Indian Sanitary Napkin Market Report and Forecast 2024-2032 offers a detailed analysis of the market based on the following segments:

Market Breakup by Product:

- Disposable Menstrual Pads

- Biodegradable Menstrual Pads

Market Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online

- Others

Market Breakup by Region:

- North India

- East and Central India

- West India

- South India

Disposable sanitary pads are expected to dominate the Indian sanitary napkin market share due to their wide availability and affordability.

Disposable sanitary napkins have been witnessing high preference with the growing awareness of menstrual hygiene and government initiatives to distribute free pads to women. Additionally, the integration of pad vending machines at public toilets, schools, and airports further contributes to the market expansion of sanitary pads in India.

Biodegradable sanitary napkins are gaining popularity as chemical, toxin-free, and sustainable menstrual hygiene solutions. Moreover, favourable government initiatives, like NABARD’s ‘My Pad My Right’, aimed at promoting the production of biodegradable pads while supporting the livelihood of rural women are expected to favour the market for sustainable sanitary napkins in the forecast period.

Competitive Landscape

Major players in the Indian sanitary napkin market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

The Procter & Gamble Company

Procter & Gamble Company, headquartered in the USA and founded in 1837, is a leading company in the consumer goods industry, providing superior quality and value to global consumers. The company provides an extensive range of sanitary napkin products within the feminine care product segment, marketed under the brand name Whisper.

Johnson and Johnson

Johnson & Johnson, along with its subsidiaries, is involved in various aspects of the healthcare industry, including researching and developing products, manufacturing, and sales. The company offers sanitary napkins suitable for periods under its brands Carefree, Stayfree, and O.B., providing safe, comfortable, and effective solutions.

Lagom Labs Private Limited

Headquartered in India and founded in 2016, the company provides a diverse range of sanitary napkin products, including Ultra-Thin Pads with Wings, Cramp Comfort Heat Patch, and Nua Multi-Purpose Pouch. Additionally, the company offers various other products across different segments, such as period and intimate care, skin care, and Project Prerna, among others.

Soothe Healthcare Private Limited

Headquartered in India and founded in 2012, the company prides itself on an extensive lineup of sanitary napkin products, renowned under the brand names Paree and Pariz.

Other key players in the Indian sanitary napkin market include Redcliffe Hygiene Private Limited, BellaPremier Happy HygieneCare Pvt. Ltd., Saathi Eco Innovations India Private Limited, Unicharm Corporation and Urban Essentials Private Limited, among others.

Indian Sanitary Napkin Market Analysis by Region

North India accounts for a major market share due to the installation of pad vending machines by the UP government. In October 2020, the Uttar Pradesh government announced the installation of sanitary pad vending and incinerator machines at 1,000 government-run girls’ intermediate colleges and high schools to promote hygienic and safe sanitary practices and reduce the high-school dropout rate of girls due to menstrual hygiene issues. Additionally, the expansion of the sanitary napkin production plant in this region further drives market growth.

East India districts like Purnia in Bihar are installing period Hygiene Management (MHM)-friendly toilets with sanitary pads (following its 2022 approval) as Bihar has poor awareness of and limited accessibility to safe period hygiene products. Additionally, NABARD opened a sanitary pad production facility at Aalubari, Namsai, Arunachal Pradesh, in August 2021.

In West India, governments are funding the installation of sanitary pad vending and disposal machines for schools (like in Gujarat), focusing to eradicate social taboo and stigma associated with menstruation, and raising awareness about the proper disposal of menstrual waste. In May 2022, the Maharashtra government announced a scheme to provide 10 sanitary napkins at INR 1 for women belonging to self-help groups and below the poverty line as an endeavour to enhance menstrual hygiene.

In South India, in February 2021, the Chennai Metro Rail Limited, along with Geo India Foundation and Rotary Club, installed vending machines to provide free sanitary napkins across its 39 metro stations and support the menstrual hygiene of women passengers.

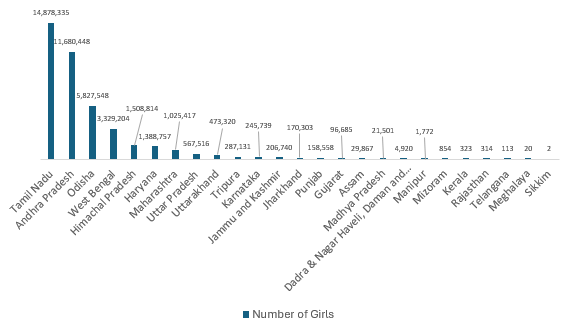

Figure: List of Sanitary Napkins Distribution under the Menstrual Hygiene Scheme to Girls of Age 10-19 years by State, 2021-22 (Number of Girls)

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

7 Opportunities and Challenges in the Market

8 Global Sanitary Napkin Market Overview

8.1 Key Industry Highlights

8.2 Global Sanitary Napkin Historical Market (2018-2023)

8.3 Global Sanitary Napkin Market Forecast (2024-2032)

8.4 Global Sanitary Napkin Market Share by Region

8.4.1 North America

8.4.2 Europe

8.4.3 Asia Pacific

8.4.4 Latin America

8.4.5 Middle East and Africa

9 Indian Sanitary Napkin Market Overview

9.1 Key Industry Highlights

9.2 Indian Sanitary Napkin Historical Market (2018-2023)

9.3 Indian Sanitary Napkin Market Forecast (2024-2032)

10 Indian Sanitary Napkin Market by Product

10.1 Disposable Menstrual Pads

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Biodegradable Menstrual Pads

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

11 Indian Sanitary Napkin Market by Distribution Channel

11.1 Supermarkets and Hypermarkets

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Pharmacies

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 Convenience Stores

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 Online

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Others

12 Indian Sanitary Napkin Market by Region

12.1 North India

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 East and Central India

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 West India

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 South India

12.4.1 Historical Trend (2018-2023)

12.4.2 Forecast Trend (2024-2032)

13 Market Dynamics

13.1 SWOT Analysis

13.1.1 Strengths

13.1.2 Weaknesses

13.1.3 Opportunities

13.1.4 Threats

13.2 Porter’s Five Forces Analysis

13.2.1 Supplier’s Power

13.2.2 Buyer’s Power

13.2.3 Threat of New Entrants

13.2.4 Degree of Rivalry

13.2.5 Threat of Substitutes

13.3 Key Indicators for Demand

13.4 Key Indicators for Price

14 Value Chain Analysis

15 Government Policies

16 Cost Analysis

17 Product Landscape

18 Competitive Landscape

18.1 Market Structure

18.2 Company Profiles

18.2.1 The Procter & Gamble Company

18.2.1.1 Company Overview

18.2.1.2 Product Portfolio

18.2.1.3 Demographic Reach and Achievements

18.2.1.4 Certifications

18.2.2 Johnson and Johnson

18.2.2.1 Company Overview

18.2.2.2 Product Portfolio

18.2.2.3 Demographic Reach and Achievements

18.2.2.4 Certifications

18.2.3 Lagom Labs Private Limited

18.2.3.1 Company Overview

18.2.3.2 Product Portfolio

18.2.3.3 Demographic Reach and Achievements

18.2.3.4 Certifications

18.2.4 Soothe Healthcare Private Limited

18.2.4.1 Company Overview

18.2.4.2 Product Portfolio

18.2.4.3 Demographic Reach and Achievements

18.2.4.4 Certifications

18.2.5 Redcliffe Hygiene Private Limited

18.2.5.1 Company Overview

18.2.5.2 Product Portfolio

18.2.5.3 Demographic Reach and Achievements

18.2.5.4 Certifications

18.2.6 BellaPremier Happy HygieneCare Pvt. Ltd.

18.2.6.1 Company Overview

18.2.6.2 Product Portfolio

18.2.6.3 Demographic Reach and Achievements

18.2.6.4 Certifications

18.2.7 Saathi Eco Innovations India Private Limited

18.2.7.1 Company Overview

18.2.7.2 Product Portfolio

18.2.7.3 Demographic Reach and Achievements

18.2.7.4 Certifications

18.2.8 Unicharm Corporation

18.2.8.1 Company Overview

18.2.8.2 Product Portfolio

18.2.8.3 Demographic Reach and Achievements

18.2.8.4 Certifications

18.2.9 Urban Essentials India Pvt Ltd

18.2.9.1 Company Overview

18.2.9.2 Product Portfolio

18.2.9.3 Demographic Reach and Achievements

18.2.9.4 Certifications

18.2.10 Others

16 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Sanitary Napkin Market: Key Industry Highlights, 2018 and 2032

2. Indian Sanitary Napkin Market: Key Industry Highlights, 2018 and 2032

3. Indian Sanitary Napkin Historical Market: Breakup by Product (INR Crore), 2018-2023

4. Indian Sanitary Napkin Market Forecast: Breakup by Product (INR Crore), 2024-2032

5. Indian Sanitary Napkin Historical Market: Breakup by Distribution Channel (INR Crore), 2018-2023

6. Indian Sanitary Napkin Market Forecast: Breakup by Distribution Channel (INR Crore), 2024-2032

7. Indian Sanitary Napkin Historical Market: Breakup by Region (INR Crore), 2018-2023

8. Indian Sanitary Napkin Market Forecast: Breakup by Region (INR Crore), 2024-2032

9. Indian Sanitary Napkin Market Structure

In 2023, the market value was about INR 10,297.95 crore.

The market is assessed to grow at a CAGR of 16.9% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach around INR 42,127.30 crore by 2032.

The major drivers include government initiatives aimed at promoting menstrual hygiene, increasing availability of sanitary napkins on e-commerce, and increasing awareness of menstrual hygiene-related diseases.

The key trends aiding the market include the growing demand for biodegradable sanitary napkins derived from bamboo and banana fibre and the rising popularity of ultra-thin sanitary pads that provide comfort while exercising.

The different products considered in the market report include disposable menstrual pads and biodegradable menstrual pads.

The major distribution channels of sanitary napkin include supermarkets and hypermarkets, pharmacies, convenience stores, and online, among others.

The major players in the market include The Procter & Gamble Company, Johnson and Johnson, Lagom Labs Private Limited, Soothe Healthcare Private Limited, Redcliffe Hygiene Private Limited, BellaPremier Happy HygieneCare Pvt. Ltd., Saathi Eco Innovations India Private Limited, Unicharm Corporation and Urban Essentials Private Limited, among others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.