Reports

Sale

Global High Oleic Oil Market Size, Share, Analysis, Forecast: By Oil Type: Sunflower Oil, Canola / Rapeseed Oil, Soybean Oil, Safflower Oil, Others; By Source: Non-GM / Conventional, GM, Organic Certified; By Application: Food Processing, Biofuel, Others; Regional Analysis; Market Dynamics: SWOT Analysis; Competitive Landscape; 2024-2032

Global High Oleic Oil Market Outlook

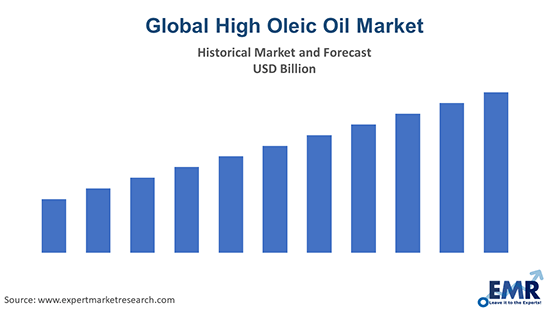

The global high oleic oil market size was USD 5,998.6 million in 2023. The market is projected to grow at a CAGR of 6.5% between 2024 and 2032 to reach USD 6,763.8 million by 2032.

Key Takeaways

- High oleic oils are recognised by the U.S. Food and Drug Administration for their beneficial support of cardiovascular health.

- The rising trend of clean and natural products is increasing the adoption of high oleic oils.

- There is a growing inclination towards sunflower oil with a high oleic acid content, in the range between 70%-75% to 90%.

High-oleic oil is characterised by exceptional oxidative stability, longer shelf life, and the ability to withstand higher temperatures ideal for frying applications.

High oleic vegetable oils have a high percentage of monounsaturated fats and add no trans fats to products. The high quality of monosaturated fats lowers LDL cholesterol reducing the risk of heart disease, attacks, and strokes, proving to be an ideal replacement for trans fatty acids. The high oleic oil market growth is supported by diverse applications of the product in various end use sectors.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Rising demand for healthier oils; presence of regulations limiting the use of fatty acids; rising preference for non-GMO HO oils; and the rising adoption as an alternative to other forms are the key factors impacting the high oleic oil market growth

Apr 14, 2023

Australian-owned Plenty Foods announced the launch of a super high oleic safflower oil with superior cooking qualities and health credentials.

May 2, 2022

Scoular, an international agribusiness, introduced SOYLEIC® soybeans to its diversified solutions for supply chains to expand its portfolio and serve end users. SOYLEIC® soybeans are non-GMO high oleic soybean trait designed in partnership with several organisations and researchers.

Growing demand for healthier oils

The demand for better quality and healthier oils is increasing the consumption of HO oils as they are rich in oleic acids and low in saturated fats that help in maintaining cardiovascular health. Their desirable fatty acid composition provides higher oxidative and thermal stability and a healthier nutritional profile.

Regulations limiting the intake of trans fatty acids

The drastic consequences of trans fats, such as cardiovascular diseases, have necessitated governments across the globe to develop and implement policies and regulations aimed at limiting the presence and consumption of trans fatty acids in foods to improve the health of their citizens.

Consumption of non-GMO HO oils is rising

As people are becoming conscious of the food they consume, they desire environmentally sustainable and healthy foods. This is increasing the consumption of high oleic non-GMO sunflower, soybean, and safflower oils.

HO sunflower oil is an affordable alternative to extra virgin olive oil

High oleic sunflower oil is nutritionally rich and an affordable alternative to extra virgin olive oil. HO sunflower oil is around 3 times cheaper than extra virgin olive oil.

Global High Oleic Oil Market Trends

Around 44% of the US population consider high oleic acid as a healthy way to reduce heart diseases. As per the FDA, daily consumption of around 1 and a half tablespoons of high oleic acid oils, when substituted for fats and oils higher in saturated fat, may minimise the risk of heart diseases. The growing risk of heart disease is likely to propel consumers to shift to healthier food options.

The use of high oleic soybean oil is witnessing a surge in the industrial sector. The market is witnessing a growing trend of high oleic soybean oil being used as an alternative to petroleum in motor oil, tires, asphalt and other products.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

“Global High Oleic Oil Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Oil Type

- Sunflower Oil

- Canola/Rapeseed Oil

- Soybean Oil

- Safflower Oil

- Others

Market Breakup by Source

- Non-GM/Conventional

- GM

- Organic Certified

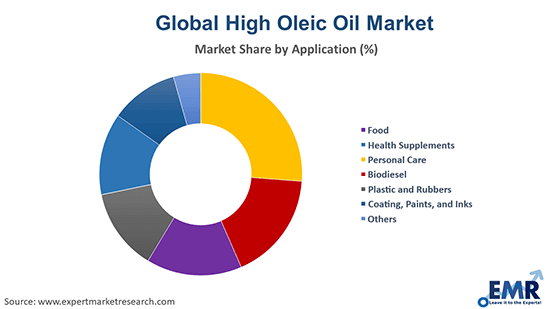

Market Breakup by Application

- Food Processing

- Biofuel

- Others

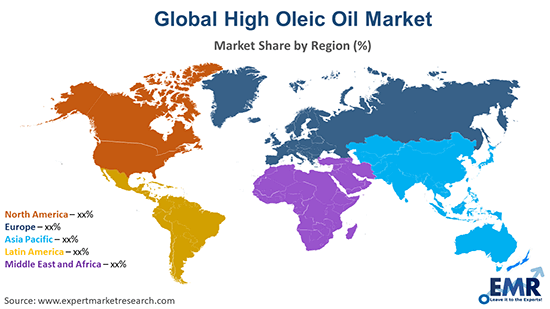

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Based on oil type, sunflower oil dominates the high oleic oil market share

High oleic sunflower oil has at least 80% oleic acid against the 20% present in traditional sunflower oil. It has a neutral taste and good stability, meaning it has a lower rate of oxidation, making a great alternative for frying or for application in packaged products.

The growing demand for omega-3 fatty acids is prompting breeders to produce a new omega-3-rich high oleic canola oil that comprises docosahexaenoic acid (DHA). DHA is shown to be important for brain development and function.

There are super high oleic safflower oils produced which are a renewable and biodegradable substitute to petroleum-based raw materials and find application in bio-lubricants, biochemical, and bioplastics sectors.

The food processing sector is a significant contributor to the global high oleic oil market revenue

The consumption of high oleic oil lowers LDL cholesterol without reducing HDL cholesterol levels, thereby resulting in reduced risks of cardiovascular diseases and strokes. Thus, the heightened health consciousness among the global population is catering to a growing demand for food that includes high oleic oil in the ingredients.

The increasing production of biodiesel using high oleic oil, such as soy and canola, is due to the escalating eco-consciousness and the growing use of biodiesel as an alternative, non-toxic and biodegradable fuel that can also be blended with petroleum. Government policies, rising transport fuel demand, and spiking crude oil costs are factors influencing the demand for biodiesel.

Competitive Landscape

The companies in the high oleic oil market are focusing on offering high-quality products that offer superior performance in food applications.

Archer Daniels Midland Company

Headquartered in the US, it is one of the largest nutrition companies offering both human and animal nutrition products. It offers a wide range of solutions and services for livestock, aquaculture, and pets.

Cargill, Incorporated

Cargill, Incorporated is a global food company based in the United States. It is engaged in agriculture, finance, and industrial products business globally.

Marbacher Ölmühle GmbH

Established in 1899, Marbacher Ölmühle GmbH is primarily engaged in manufacturing and refining of high-quality vegetable oils.

Adams Group

Headquartered in the US, Adams Group conducts its business through companies such as Adams Grain, Adams Vegetable Oils Inc, Adams Trucking and Adams Seed.

Colorado Mills LLC

Colorado Mills, based in the US, offers sunflower products such as heart-healthy oil and use the byproducts in its feed and grain.

Manufacturers are upgrading their product portfolios and incorporating the latest capabilities to innovate their offerings and meet the evolving demands of consumers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global High Oleic Oil Market Analysis by Region

Countries such as Germany and France are amongst the key producers of sunflower seeds and the demand for high oleic sunflower oil from hybrid sunflower seeds is rising in the European market.

Rapeseed oil is commonly used as a feedstock for biodiesel production in EU as it mixes well even at a lower temperature when compared to other feedstocks and is a more suitable fuel for colder regions.

To meet the demand for high oleic oils, Asia Pacific highly depends on oil imported from Argentina, North America, and regions in the European Union, among others. High oleic soy oil is preferred for industrial use, to substitute partially hydrogenated vegetable oils and to produce processed foods such as snacks. Moreover, manufacturers in the region have developed organic high-quality sunflower oleic oil that lowers bad cholesterol level.

In North America, the demand for high oleic variety of canola has seen a robust demand in Canada. With the rising mandate for biodiesel, the demand for palm oil has been diverted in its application from leading oil producers such as Malaysia and Indonesia.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Oil Type |

|

| Breakup by Source |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global High Oleic Oil Market Analysis

8.1 Key Industry Highlights by Volume

8.2 Key Industry Highlights by Value

8.3 Global High Oleic Oil Historical Market (2018-2023)

8.4 Global High Oleic Oil Market Forecast (2024-2032)

8.5 Global High Oleic Oil Market by Oil Type

8.5.1 Sunflower Oil

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Canola / Rapeseed Oil

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Soybean Oil

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Safflower Oil

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Others

8.6 Global High Oleic Oil Market by Source

8.6.1 Non-GM/Conventional

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 GM

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.2 Organic Certified

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.7 Global High Oleic Oil Market by Application

8.7.1 Food Processing

8.7.1.1 Historical Trend (2018-2023)

8.7.1.2 Forecast Trend (2024-2032)

8.7.2 Biofuel

8.7.2.1 Historical Trend (2018-2023)

8.7.2.2 Forecast Trend (2024-2032)

8.7.3 Others

8.8 Global High Oleic Oil Market by Region

8.8.1 North America

8.8.1.1 Historical Trend (2018-2023)

8.8.1.2 Forecast Trend (2024-2032)

8.8.2 Europe

8.8.2.1 Historical Trend (2018-2023)

8.8.2.2 Forecast Trend (2024-2032)

8.8.3 Asia Pacific

8.8.3.1 Historical Trend (2018-2023)

8.8.3.2 Forecast Trend (2024-2032)

8.8.4 Latin America

8.8.4.1 Historical Trend (2018-2023)

8.8.4.2 Forecast Trend (2024-2032)

8.8.5 Middle East and Africa

8.8.5.1 Historical Trend (2018-2023)

8.8.5.2 Forecast Trend (2024-2032)

9 North America High Oleic Oil Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe High Oleic Oil Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Spain

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.6 Others

11 Asia Pacific High Oleic Oil Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America High Oleic Oil Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Colombia

12.4.1 Historical Trend (2018-2023)

12.4.2 Forecast Trend (2024-2032)

12.5 Others

13 Middle East and Africa High Oleic Oil Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Turkey

13.5.1 Historical Trend (2018-2023)

13.5.2 Forecast Trend (2024-2032)

13.6 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Price Analysis

16.1 High Oleic Sunflower Oil Historical Price Trends (2018-2023) & Forecast (2024-2032)

16.2 High Oleic Safflower Oil Historical Price Trends (2018-2023) & Forecast (2024-2032)

16.3 High Oleic Soybean Oil Historical Price Trends (2018-2023) & Forecast (2024-2032)

16.4 High Oleic Canola Oil Historical Price Trends (2018-2023) & Forecast (2024-2032)

17 Manufacturing Process

17.1 Overview

17.2 Detailed Process Flow

17.2 Operations Involved

17.3 Key Responsibility Areas of Processors/Exporters

18 Competitive Landscape

18.1 Market Structure

18.2 Company Profiles

18.2.1 Archer Daniels Midland Company

18.2.1.1 Company Overview

18.2.1.2 Product Portfolio

18.2.1.3 Demographic Reach and Achievements

18.2.1.4 Certifications

18.2.2 Cargill, Incorporated.

18.2.2.1 Company Overview

18.2.2.2 Product Portfolio

18.2.2.3 Demographic Reach and Achievements

18.2.2.4 Certifications

18.2.3 Marbacher Ölmühle GmbH

18.2.3.1 Company Overview

18.2.3.2 Product Portfolio

18.2.3.3 Demographic Reach and Achievements

18.2.3.4 Certifications

18.2.4 Adams Group

18.2.4.1 Company Overview

18.2.4.2 Product Portfolio

18.2.4.3 Demographic Reach and Achievements

18.2.4.4 Certifications

18.2.5 Colorado Mills LLC

18.2.5.1 Company Overview

18.2.5.2 Product Portfolio

18.2.5.3 Demographic Reach and Achievements

18.2.5.4 Certifications

18.2.6 Others

19 Key Trends and Developments in the Market

Additional Customisations Available

1 Project Requirements and Cost Analysis

1.1 Land, Location, and Site Development

1.2 Construction

1.3 Plant Machinery

1.4 Raw Material

1.5 Packaging

1.6 Transportation

1.7 Utilities

1.8 Manpower

1.9 Other Capital Investments

List of Key Figures and Tables

1. Global High Oleic Oil Market: Key Industry Highlights, 2018 and 2032

2. Global High Oleic Oil Historical Market: Breakup by Oil Type (USD Million), 2018-2023

3. Global High Oleic Oil Market Forecast: Breakup by Oil Type (USD Million), 2024-2032

4. Global High Oleic Oil Historical Market: Breakup by Source (USD Million), 2018-2023

5. Global High Oleic Oil Market Forecast: Breakup by Source (USD Million), 2024-2032

6. Global High Oleic Oil Historical Market: Breakup by Application (USD Million), 2018-2023

7. Global High Oleic Oil Market Forecast: Breakup by Application (USD Million), 2024-2032

8. Global High Oleic Oil Historical Market: Breakup by Region (USD Million), 2018-2023

9. Global High Oleic Oil Market Forecast: Breakup by Region (USD Million), 2024-2032

10. North America High Oleic Oil Historical Market: Breakup by Country (USD Million), 2018-2023

11. North America High Oleic Oil Market Forecast: Breakup by Country (USD Million), 2024-2032

12. Europe High Oleic Oil Historical Market: Breakup by Country (USD Million), 2018-2023

13. Europe High Oleic Oil Market Forecast: Breakup by Country (USD Million), 2024-2032

14. Asia Pacific High Oleic Oil Historical Market: Breakup by Country (USD Million), 2018-2023

15. Asia Pacific High Oleic Oil Market Forecast: Breakup by Country (USD Million), 2024-2032

16. Latin America High Oleic Oil Historical Market: Breakup by Country (USD Million), 2018-2023

17. Latin America High Oleic Oil Market Forecast: Breakup by Country (USD Million), 2024-2032

18. Middle East and Africa High Oleic Oil Historical Market: Breakup by Country (USD Million), 2018-2023

19. Middle East and Africa High Oleic Oil Market Forecast: Breakup by Country (USD Million), 2024-2032

20. High Oleic Sunflower Oil Historical Price Trends (2018-2023) & Forecast (2024-2032)

21. High Oleic Safflower Oil Historical Price Trends (2018-2023) & Forecast (2024-2032)

22. High Oleic Soybean Oil Historical Price Trends (2018-2023) & Forecast (2024-2032)

23. High Oleic Canola Oil Historical Price Trends (2018-2023) & Forecast (2024-2032)

24. Global High Oleic Oil Market Structure

The market attained a value of USD 5,998.6 million in 2023.

The market is projected to grow at a CAGR of 6.5% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach a value of USD 6,763.8 million by 2032.

The different types of oil include sunflower oil, canola/rapeseed oil, soybean oil, safflower oil, and others.

The key regional markets are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The sources include non-gm/conventional, GM, and organic certified.

The applications include food processing and biofuel, among others.

The key players in the market include Archer Daniels Midland Company, Cargill, Incorporated, Marbacher Ölmühle GmbH, Adams Group, and Colorado Mills LLC, among others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.