Reports

Sale

Global Corrugated Boxes Market Size, Trends, Analysis: By Material: Recycled Corrugates, Virgin Corrugates; By End Use: Food Products and Beverages, Personal Care and Household Goods, Electrical and Electronic Goods, Paper Products, Textile Goods, Glassware and Ceramics, Others; Regional Analysis; Competitive Landscape; 2024-2032

Global Corrugated Boxes Market Outlook

The global corrugated boxes market size reached around USD 245.28 billion in 2023. The market is further expected to grow in the forecast period of 2024-2032 at a CAGR of 4.7% to reach USD 371.82 billion by 2032.

Key Takeaways

- The growing need for sustainable packaging is increasing the use of corrugated boxes, owing to their recyclability and renewability.

- The use of various printing technologies, such as offset, flexographic, and gravure, as well as the adoption of iridescent, textured, holographic, and dimensional effects, has led to the production of differentiated packaging products.

- There is a growing availability of customised corrugated boxes that can fit products securely and ensure safe delivery.

Corrugated boxes are cost-effective, lightweight, reliable, and easily transportable. They are also easy-to-customise, versatile, and provide excellent structural integrity; such benefits are boosting their utilisation in diverse end use sectors such as food, textile, industrial, medical, and electronics packaging, among others.

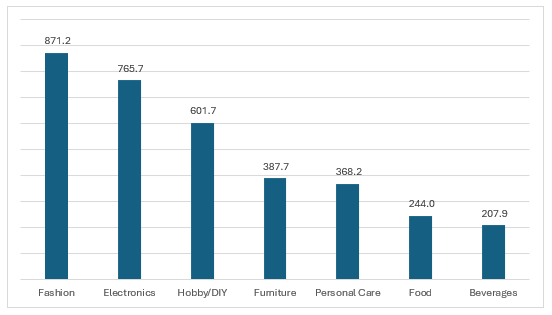

With the trend of online shopping, the demand for corrugated boxes has gained momentum across the globe. Manufacturers are designing corrugated boxes in different shapes and sizes to make the packaging unique and attractive. It has encouraged e-commerce retailers like Flipkart and Amazon to use them widely for storage and shipping purposes. Besides, these boxes are capable of photorealistic image printing, which in turn helps in effective marketing and promotion of the products among consumers. Consequently, they are highly preferred in shelf-ready packaging (SRP) and retail-ready packaging (RRP).

Figure: Largest E-Commerce Sectors- 2022 (USD Billion)

Key Trends and Developments

Rapid advancements in technologies; growing demand for sustainable packaging; Increasing adoption of digital printing solutions; and expansion of D2C sector are the key trends impacting the corrugated boxes market growth

Nov 6, 2023

The Boxery, a cardboard shipping boxes and packaging supplies provider introduced a new line of shipping boxes. The boxes are designed to provide improved safety and security to the enclosed shipped items.

Dec 2, 2022

WestRock Company completed the acquisition of Grupo Gondi, including its four paper mills, nine corrugated packaging plants, and six high graphic plants throughout Mexico for producing sustainable packaging.

Apr 21, 2022

WestRock Company announced a collaboration with Recipe Unlimited to implement recyclable paperboard packaging to divert 31 million plastic containers from Canadian landfills annually.

Mar 22, 2022

ND Paper, the US-based subsidiary of Nine Dragons Paper (Holdings) Limited, announced its plans for converting its B26 paper machine for coated mechanical papers to produce lightweight, high-strength recycled packaging products at the Biron, Wisconsin mill, aiming to build on its growth in packaging products segment.

Technological advancements and innovations

Key players are investing in innovative technologies to lower costs, increase the efficiency of corrugated box production, and lead the development of corrugated boxes with improved functionality and new designs.

Rising demand for sustainable packaging solutions

With the growing trend of sustainability and the transition towards a carbon neutral economy, the demand for corrugated boxes as environmentally friendly and renewable packaging solutions is anticipated to increase. Moreover, the high recovery rate of old corrugated containers (OCC) is likely to enhance their use.

Growing adoption of digital printing solutions

There is a surge in the adoption of digital printing solutions by corrugated box manufacturers due to the rising demand for customised and personalised packaging solutions. In addition, the rising popularity of corrugated displays and point-of-purchase items is further driving the utilisation of high-speed digital printing solutions in the sector.

The rapidly growing D2C sector contributing to the demand for packaging boxes

The rapidly growing direct-to-consumer (D2C) sector supports the packaging segment, driving the demand for corrugated boxes, including scrap, laminated, die cut, UN-approved corrugated boxes and chick boxes. The corrugated boxes market thus benefits from the proliferation of D2C brands in fashion, cosmetics, consumer electronics, and food that directly engage with the rising number of digital shoppers.

Corrugated Boxes Market Trends

Corrugated cardboard boxes are recognised as the backbone of the e-commerce supply chain. The market constantly works with brand owners and consumer packaged goods (CPG) customers to alter box sizes and print high-quality graphics to enhance the purchaser’s in-home experience and communicate brand values.

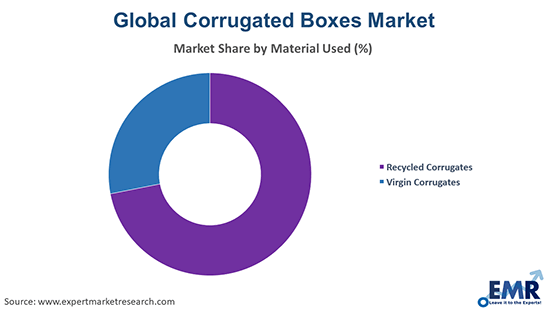

Corrugated boxes produced from corrugated paperboard components can be made from either virgin or recycled wood fibres. The use of recycled wood fibres is increasing as it is considerably cheaper and reduces waste disposal to landfills, aiding in the process of reducing environmental degradation.

The low cost of labour and tools required to manufacture the boxes reduces the manufacturing costs, while the boxes’ lightweight keeps shipping costs lower. The ability to use corrugated boxes for various purposes such as storage, shipping, and advertising also enhances their reusability, as they can be folded back up and stored away to be used later in homes, offices, and stores.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

“Global Corrugated Boxes Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Material

- Recycled Corrugates

- Virgin Corrugates

Market Breakup by End Use

- Food Products and Beverages

- Personal Care and Household Goods

- Electrical and Electronic Goods

- Paper Products

- Textile Goods

- Glassware and Ceramics

- Chemicals

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Based on material, recycled corrugates are expected to account for a significant share of the corrugated boxes market

The rising awareness of sustainability has increased the use of recycled corrugates to produce corrugated boxes, as this helps promote a circular economy while reducing deforestation rates. Recycling corrugated material helps minimise the waste in a landfill, lowering the methane released into the atmosphere as the corrugation waste decomposes. Additionally, recycled corrugated boxes produced from recycled fibres have reduced deforestation due to lowered dependence on virgin wood fibres.

Virgin corrugated boxes, on the other hand, are manufactured from fibres derived from trees such as pine, spruce, birch, and eucalyptus. Virgin corrugated boxes are free of recycled content.

Virgin corrugated boxes can withstand heat and moisture and offer superior protection to products against humid environments. The fibres are long and strong, making the resulting corrugated boxes ideal for transporting heavy-duty products.

Based on end use, food products and beverages dominate the corrugated boxes market share

Food manufacturers are adopting corrugated boxing solutions to enhance the appeal and attractiveness of their products. There is an increasing consumption of packaged food and beverages, which is likely to surge the use of corrugated boxes for packaging and transportation, providing enhanced safety at affordable prices.

As consumers are increasingly focusing on sustainable packaging, the usage of corrugated boxes in beverage applications is anticipated to grow as they are made from recyclable, renewable, and biodegradable resources.

Competitive Landscape

Notable players in the corrugated boxes market offer high-quality, cost-effective products with low end-of-life GHG emissions

International Paper Company

International Paper Company is primarily engaged in the manufacture of renewable fiber-based packaging and pulp products. The company operates 24 pulp and packaging mills, 163 converting and packaging plants, 16 recycling plants and three bag facilities in the US

Nine Dragons Paper (Holdings) Limited

Headquartered in China, Nine Dragons Paper is a leading manufacturer of paper in terms of production capacity. The company uses advanced technology, large-scale state-of-the-art and intelligent equipment to manufacture its products.

Smurfit Kappa Group plc

Founded in 2005, Smurfit Kappa is one of the world's leading providers of paper-based packaging solutions. The company has 241 packaging conversion plants, 35 mills, and 32 other production facilities.

Westrock Company

Westrock Company, based in the US, is engaged in the manufacture and distribution of sustainable fibre-based paper and packaging solutions.

Rengo Co., Ltd

It is primarily engaged in the production and sales of corrugated board, corrugated boxes, folding cartons, paper products, and others. It offers products and solutions for packaging under four major groups which are: paperboard and packaging, flexible packaging, heavy-duty packaging, and overseas businesses.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Corrugated Boxes Market Analysis by Region

Companies in Europe are setting ambitious sustainability targets, due to which they prefer corrugated boxes made from resources that are recyclable in closed-loop systems. In food and beverage applications, innovative corrugated boxes as an alternative to plastic packaging are increasingly being adopted to boost the appeal of end products among consumers. The European corrugated boxes market thus benefits from the growing trend of sustainability and stringent environmental regulations.

Meanwhile, Asia is a significant vegetable and fruit producer in the world owing to the presence of countries such as China and India that are known for their agricultural market. The agricultural segment has adopted recyclable moisture-proof corrugated boxes that suppress the evaporation of water from fruits and vegetables to retain their freshness.

The textile manufacturing segment is a crucial component of the MEA’s economy, with countries such as Jordan, the UAE, Algeria, Morocco, Tunisia, and Egypt constantly developing the sector to become global producers of clothes and fabrics. The growing textile segment in the region is a significant consumer of corrugated box packaging utilised to transport yarns to weavers and finished cloth to the end-users, thereby aiding the corrugated boxes market expansion.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Material |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Corrugated Boxes Market Analysis

8.1 Key Industry Highlights

8.2 Global Corrugated Boxes Historical Market (2018-2023)

8.3 Global Corrugated Boxes Market Forecast (2024-2032)

8.4 Global Corrugated Boxes Market by Material

8.4.1 Recycled Corrugates

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Virgin Corrugates

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.5 Global Corrugated Boxes Market by End Use

8.5.1 Food Products and Beverages

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Personal Care and Household Goods

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Electrical and Electronic Goods

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Paper Products

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Textile Goods

8.5.5.1 Historical Trend (2018-2023)

8.5.5.2 Forecast Trend (2024-2032)

8.5.6 Glassware and Ceramics

8.5.6.1 Historical Trend (2018-2023)

8.5.6.2 Forecast Trend (2024-2032)

8.5.7 Chemicals

8.5.7.1 Historical Trend (2018-2023)

8.5.7.2 Forecast Trend (2024-2032)

8.5.8 Others

8.6 Global Corrugated Boxes Market by Region

8.6.1 North America

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Europe

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Asia Pacific

8.6.3.1 Historical Trend (2018-2023)

8.6.3.2 Forecast Trend (2024-2032)

8.6.4 Latin America

8.6.4.1 Historical Trend (2018-2023)

8.6.4.2 Forecast Trend (2024-2032)

8.6.5 Middle East and Africa

8.6.5.1 Historical Trend (2018-2023)

8.6.5.2 Forecast Trend (2024-2032)

9 North America Corrugated Boxes Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Corrugated Boxes Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Corrugated Boxes Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Corrugated Boxes Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Corrugated Boxes Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Price Analysis

16.1 North America Historical Price Trends (2018-2023) and Forecast (2024-2032)

16.2 Europe Historical Price Trends (2018-2023) and Forecast (2024-2032)

16.3 Asia Pacific Historical Price Trends (2018-2023) and Forecast (2024-2032)

16.4 Latin America Historical Price Trends (2018-2023) and Forecast (2024-2032)

16.5 Middle East and Africa Historical Price Trends (2018-2023) and Forecast (2024-2032)

17 Manufacturing Process

17.1 Detailed Process Flow

17.2 Operations Involved

17.3 Mass Balance and Material Requirements

18 Project Requirement and Cost Analysis

18.1 Land Requirements and Expenditures

18.2 Construction Requirements and Expenditures

18.3 Plant Machinery

18.4 Raw Material Requirements and Expenditures

18.5 Packaging

18.6 Transportation

18.7 Utilities

18.8 Manpower

18.9 Other Capital Investment

19 Project Economics

19.1 Capital Cost of the Project

19.2 Techno-Economic Parameters

19.3 Product Pricing and Margins Across Various Levels of the Supply Chain

19.4 Taxation and Depreciation

19.5 Income Projections

19.6 Expenditure Projections

19.7 Financial Analysis

19.8 Profit Analysis

20 Competitive Landscape

20.1 Market Structure

20.2 Company Profiles

20.2.1 International Paper Company

20.2.1.1 Company Overview

20.2.1.2 Product Portfolio

20.2.1.3 Demographic Reach and Achievements

20.2.1.4 Financial Summary

20.2.1.5 Certifications

20.2.2 Nine Dragons Paper (Holdings) Limited

20.2.2.1 Company Overview

20.2.2.2 Product Portfolio

20.2.2.3 Demographic Reach and Achievements

20.2.2.4 Financial Summary

20.2.2.5 Certifications

20.2.3 Smurfit Kappa Group plc

20.2.3.1 Company Overview

20.2.3.2 Product Portfolio

20.2.3.3 Demographic Reach and Achievements

20.2.3.4 Financial Summary

20.2.3.5 Certifications

20.2.4 Westrock Company

20.2.4.1 Company Overview

20.2.4.2 Product Portfolio

20.2.4.3 Demographic Reach and Achievements

20.2.4.4 Financial Summary

20.2.4.5 Certifications

20.2.5 Rengo Co., Ltd.

20.2.5.1 Company Overview

20.2.5.2 Product Portfolio

20.2.5.3 Demographic Reach and Achievements

20.2.5.4 Financial Summary

20.2.5.5 Certifications

20.2.6 Others

21 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Corrugated Boxes Market: Key Industry Highlights, 2018 and 2032

2. Global Corrugated Boxes Historical Market: Breakup by Material (USD Billion), 2018-2023

3. Global Corrugated Boxes Market Forecast: Breakup by Material (USD Billion), 2024-2032

4. Global Corrugated Boxes Historical Market: Breakup by End Use (USD Billion), 2018-2023

5. Global Corrugated Boxes Market Forecast: Breakup by End Use (USD Billion), 2024-2032

6. Global Corrugated Boxes Historical Market: Breakup by Region (USD Billion), 2018-2023

7. Global Corrugated Boxes Market Forecast: Breakup by Region (USD Billion), 2024-2032

8. North America Corrugated Boxes Historical Market: Breakup by Country (USD Billion), 2018-2023

9. North America Corrugated Boxes Market Forecast: Breakup by Country (USD Billion), 2024-2032

10. Europe Corrugated Boxes Historical Market: Breakup by Country (USD Billion), 2018-2023

11. Europe Corrugated Boxes Market Forecast: Breakup by Country (USD Billion), 2024-2032

12. Asia Pacific Corrugated Boxes Historical Market: Breakup by Country (USD Billion), 2018-2023

13. Asia Pacific Corrugated Boxes Market Forecast: Breakup by Country (USD Billion), 2024-2032

14. Latin America Corrugated Boxes Historical Market: Breakup by Country (USD Billion), 2018-2023

15. Latin America Corrugated Boxes Market Forecast: Breakup by Country (USD Billion), 2024-2032

16. Middle East and Africa Corrugated Boxes Historical Market: Breakup by Country (USD Billion), 2018-2023

17. Middle East and Africa Corrugated Boxes Market Forecast: Breakup by Country (USD Billion), 2024-2032

18. North America Historical Price Trends and Forecast 2018-2032

19. Europe Historical Price Trends and Forecast 2018-2032

20. Asia Pacific Historical Price Trends and Forecast 2018-2032

21. Latin America Historical Price Trends and Forecast 2018-2032

22. Middle East and Africa Historical Price Trends and Forecast 2018-2032

23. Global Corrugated Boxes Market Structure

The market attained a value of USD 245.28 billion in 2023.

The market is further expected to grow in the forecast period of 2024-2032 at a CAGR of 4.7%.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach a value of USD 371.82 billion by 2032.

The different materials used for corrugated boxes include recycled corrugates and virgin corrugates.

The key regional markets for corrugated boxes are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The end uses include food products and beverages, personal care and household goods, electrical and electronic goods, paper products, textile goods, glassware and ceramics, chemicals, and others.

The factors driving the market include increasing e-commerce purchases, rising technological improvements, and a growing inclination towards sustainable packaging.

The key players in the market include International Paper Company, Nine Dragons Paper (Holdings) Limited, Smurfit Kappa Group plc, Westrock Company, and Rengo Co., Ltd, among others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.