Reports

Sale

Global Surgical Sutures Market Size, Share, Price, Trends, Report: By Type: Absorbable, Non-absorbable; By Filament: Monofilament, Multifilament; By Application: Cardiovascular Surgeries, General Surgeries, Gynaecological Surgeries, Ophthalmic Surgeries, Orthopaedic Surgeries, Others; Regional Analysis; Supplier Landscape; 2024-2032

Global Surgical Sutures Market Outlook

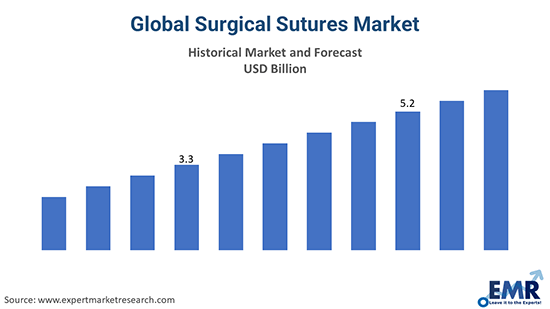

The global surgical sutures market value was USD 4.24 billion in 2023, driven by the increasing number of surgical procedures across the globe. The market size is anticipated to grow at a CAGR of 6% during the forecast period of 2024-2032 to achieve a value of USD 7.16 billion by 2032.

Apart from closing skin wounds, sutures have other applications also, including closing of fascia, intestinal anastomosis and enterotomy, haemostasis, surgical procedures related to the musculoskeletal system, urogenital tract surgery, ocular surgery, cardiovascular surgery, plastic surgery, neurosurgery, and others. Continual technological developments in suture material have led to increased variety of sutures available. North America, Asia and Europe are likely to be key markets.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global Market Likely to be Driven by Uses in Surgical Procedures

Surgical sutures are widely used to close wounds (especially after invasive surgery) in a manner that prevents infection and bleeding. A surgical suture helps hold body tissue together after an injury or post-surgery. A suture is applied with the help of a needle and a connected thread. Sutures are available in different shapes, sizes, and materials. Such available variety is expected to drive the global surgical sutures market.

Surgical Sutures May be Classified in Several Ways

Classification of surgical sutures may be done in many ways. For example, the suture material may be grouped as absorbable suture or non-absorbable suture. Absorbable sutures are naturally absorbed by enzymes present in body tissue, and doctors need not remove them. On the other hand, non-absorbable sutures are generally removed a few days after the surgical procedure. Sometimes, depending on the type of surgery performed, non-absorbable sutures may permanently be left in the body. Absorbable sutures are grouped as Catgut Sutures (natural, monofilament absorbable suture displaying decent tensile strength; fit for use in healing tissue quickly due to the suture’s property of eventual disintegration), Polydioxanone Sutures (synthetic monofilament suture; this polydioxanone suture is used to heal various types of soft-tissue wounds, abdominal closures, and in paediatric cardiac processes), Poliglecaprone Sutures (synthetic monofilament suture, usually employed to repair soft tissues; these sutures enable aesthetic, mark-free healing), Polyglactin Sutures (synthetic braid suture, fit to be used to repair face and hand lacerations; a preferred alternative for general soft tissue approximation).

Non-absorbable Sutures are manufactured from special silk, or synthetic material like nylon, polyester, or poly propylene. Non-absorbable sutures are employed to close wounds on the skin, and may or may not include coatings to enhance performance characteristics. Non-absorbable sutures generally produce lower degrees of scarring which is why these are used in procedures where cosmetic outcomes are significant.

On the basis of suture material structure, a classification may be done. For example, a monofilament suture made of a single thread enables easy passage of the suture through the tissue. On the other hand, a braided suture comprising several small threads interwoven together offers more security, but has a greater potential for infections.

Sutures may also be classified on the basis of being manufactured from natural or synthetic material.

Advanced Sutures Expected to Boost Market Growth

While sutures are employed to close wounds and expedite healing, there have been problems associated with their use, such as damage to soft tissues due to stiff fibres. Advancements in the domain are expected to lead to superior solutions and drive the global surgical sutures market. For example, researchers have devised an advanced tough gel sheathed (TGS) suture, based on the structure of the human tendon. The design of the solution is based on the endotenon sheath, which, due to its double-network structure, is strong and sturdy; it fastens collagen fibres together while its elastin network strengthens it. The next-generation sutures carry a slippery but strong gel envelop that imitates the structure of soft connective tissues. TGS sutures may be designed to offer personalized medicine on the basis of a patient's requirements.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

By Type, the market is divided into:

- Absorbable

- Non-absorbable

By Filament, the market is classified into:

- Monofilament

- Multifilament

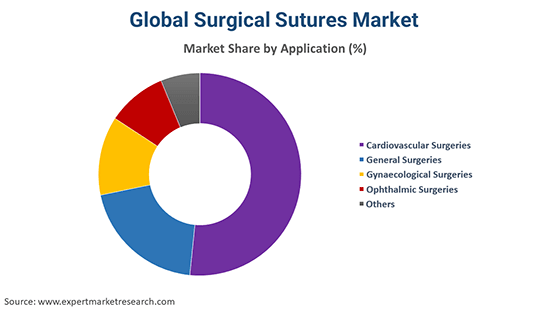

By Application, the market is segmented into:

- Cardiovascular Surgeries

- General Surgeries

- Gynaecological Surgeries

- Ophthalmic Surgeries

- Orthopaedic Surgeries

- Others

By Region, the market is classified into:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Industry Players in the Market

The report presents a detailed analysis of the following key players in the global surgical sutures market, looking into their capacity, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

- B. Braun Melsungen AG

- Johnson & Johnson Services, Inc.

- DemeTECH Corporation

- Healthium Medtech Limited

- Medtronic Plc.

- Others

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2017-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Filament Type |

|

| Breakup by Applications |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

1.1 Objectives of the Study

1.2 Key Assumptions

1.3 Report Coverage – Key Segmentation and Scope

1.4 Research Methodology

2 Executive Summary

3 Global Surgical Sutures Market Overview

3.1 Global Surgical Sutures Market Historical Value (2017-2023)

3.2 Global Surgical Sutures Market Forecast Value (2024-2032)

4 Global Surgical Sutures Market Landscape

4.1 Global Surgical Sutures Developers Landscape

4.1.1 Analysis by Year of Establishment

4.1.2 Analysis by Company Size

4.1.3 Analysis by Region

4.2 Global Surgical Sutures Product Landscape

4.2.1 Analysis by Product Type

4.2.2 Analysis by End User

4.2.3 Analysis by Applications

5 Global Surgical Sutures Market Dynamics

5.1 Market Drivers and Constraints

5.2 SWOT Analysis

5.3 Porter’s Five Forces Model

5.4 Key Demand Indicators

5.5 Key Price Indicators

5.6 Industry Events, Initiatives, and Trends

5.7 Value Chain Analysis

6 Global Surgical Sutures Market Segmentation

6.1 Global Surgical Sutures Market, by Product Type

6.1.1 Market Overview

6.1.2 Absorbable

6.1.2.1 Synthetic Suture

6.1.2.1.1 Polyglactin 910 Sutures

6.1.2.1.2 Poliglecaprone 25 Sutures

6.1.2.1.3 Polydioxanone Sutures

6.1.2.1.4 Polyglycolic Acid Sutures

6.1.2.1.5 Other Synthetic Sutures

6.1.3 Non- Absorbable

6.1.3.1 Nylon Sutures

6.1.3.2 Prolene Sutures

6.1.3.3 Stainless Steel Sutures

6.1.3.4 Others

6.2 Global Surgical Sutures Market, by Filament Type

6.2.1 Market Overview

6.2.2 Monofilament

6.2.3 Multifilament

6.3 Global Surgical Sutures Market, by Applications

6.3.1 Market Overview

6.3.2 Ophthalmic Surgery

6.3.3 Cardiovascular

6.3.4 Orthopedic Surgery

6.3.5 Neurological Surgery

6.3.6 Others

6.4 Global Surgical Sutures Market, by End User

6.4.1 Market Overview

6.4.2 Hospitals

6.4.3 Clinics

6.4.4 Ambulatory Surgical Centers

6.4.5 Emergency Medical Services

6.4.6 Others

6.5 Global Surgical Sutures by Region

6.5.1 Market Overview

6.5.2 North America

6.5.3 Europe

6.5.4 Asia Pacific

6.5.5 Latin America

6.5.6 Middle East and Africa

7 North America Surgical Sutures Market

7.1 Market Share by Country

7.2 United States of America

7.3 Canada

8 Europe Surgical Sutures Market

8.1 Market Share by Country

8.2 United Kingdom

8.3 Germany

8.4 France

8.5 Italy

8.6 Others

9 Asia Pacific Surgical Sutures Market

9.1 Market Share by Country

9.2 China

9.3 Japan

9.4 India

9.5 ASEAN

9.6 Australia

9.7 Others

10 Latin America Surgical Sutures Market

10.1 Market Share by Country

10.2 Brazil

10.3 Argentina

10.4 Mexico

10.5 Others

11 Middle East and Africa Surgical Sutures Market

11.1 Market Share by Country

11.2 Saudi Arabia

11.3 United Arab Emirates

11.4 Nigeria

11.5 South Africa

11.6 Others

12 Patent Analysis

12.1 Analysis by Type of Patent

12.2 Analysis by Publication year

12.3 Analysis by Issuing Authority

12.4 Analysis by Patent Age

12.5 Analysis by CPC Analysis

12.6 Analysis by Patent Valuation

12.7 Analysis by Key Players

13 Grants Analysis

13.1 Analysis by year

13.2 Analysis by Amount Awarded

13.3 Analysis by Issuing Authority

13.4 Analysis by Grant Application

13.5 Analysis by Funding Institute

13.6 Analysis by NIH Departments

13.7 Analysis by Recipient Organization

14 Funding Analysis

14.1 Analysis by Funding Instances

14.2 Analysis by Type of Funding

14.3 Analysis by Funding Amount

14.4 Analysis by Leading Players

14.5 Analysis by Leading Investors

14.6 Analysis by Geography

15 Partnership and Collaborations Analysis

15.1 Analysis by Partnership Instances

15.2 Analysis by Type of Partnership

15.3 Analysis by Leading Players

15.4 Analysis by Geography

16 Regulatory Framework

16.1 Regulatory Overview

16.1.1 US FDA

16.1.2 EU EMA

16.1.3 INDIA CDSCO

16.1.4 JAPAN PMDA

16.1.5 Others

17 Supplier Landscape

17.1 CONMED Corporation

17.1.1 Financial Analysis

17.1.2 Product Portfolio

17.1.3 Demographic Reach and Achievements

17.1.4 Mergers and Acquisitions

17.1.5 Certifications

17.2 B. Braun Melsungen AG

17.2.1 Financial Analysis

17.2.2 Product Portfolio

17.2.3 Demographic Reach and Achievements

17.2.4 Mergers and Acquisitions

17.2.5 Certifications

17.3 Johnson & Johnson Private Limited

17.3.1 Financial Analysis

17.3.2 Product Portfolio

17.3.3 Demographic Reach and Achievements

17.3.4 Mergers and Acquisitions

17.3.5 Certifications

17.4 Medtronic

17.4.1 Financial Analysis

17.4.2 Product Portfolio

17.4.3 Demographic Reach and Achievements

17.4.4 Mergers and Acquisitions

17.4.5 Certifications

17.5 Boston Scientific Corporation

17.5.1 Financial Analysis

17.5.2 Product Portfolio

17.5.3 Demographic Reach and Achievements

17.5.4 Mergers and Acquisitions

17.5.5 Certifications

17.6 3M

17.6.1 Financial Analysis

17.6.2 Product Portfolio

17.6.3 Demographic Reach and Achievements

17.6.4 Mergers and Acquisitions

17.6.5 Certifications

17.7 Smith+Nephew

17.7.1 Financial Analysis

17.7.2 Product Portfolio

17.7.3 Demographic Reach and Achievements

17.7.4 Mergers and Acquisitions

17.7.5 Certifications

17.8 General Electric

17.8.1 Financial Analysis

17.8.2 Product Portfolio

17.8.3 Demographic Reach and Achievements

17.8.4 Mergers and Acquisitions

17.8.5 Certifications

17.9 Integra LifeSciences

17.9.1 Financial Analysis

17.9.2 Product Portfolio

17.9.3 Demographic Reach and Achievements

17.9.4 Mergers and Acquisitions

17.9.5 Certifications

17.10 Medline Industries, Inc.

17.10.1 Financial Analysis

17.10.2 Product Portfolio

17.10.3 Demographic Reach and Achievements

17.10.4 Mergers and Acquisitions

17.10.5 Certifications

17.11 Zimmer Biomet

17.11.1 Financial Analysis

17.11.2 Product Portfolio

17.11.3 Demographic Reach and Achievements

17.11.4 Mergers and Acquisitions

17.11.5 Certifications

17.12 Advanced Medical Solutions Group plc.

17.12.1 Financial Analysis

17.12.2 Product Portfolio

17.12.3 Demographic Reach and Achievements

17.12.4 Mergers and Acquisitions

17.12.5 Certifications

17.13 Internacional Farmacéutica S.A. de C.V.

17.13.1 Financial Analysis

17.13.2 Product Portfolio

17.13.3 Demographic Reach and Achievements

17.13.4 Mergers and Acquisitions

17.13.5 Certifications

17.14 Stryker

17.14.1 Financial Analysis

17.14.2 Product Portfolio

17.14.3 Demographic Reach and Achievements

17.14.4 Mergers and Acquisitions

17.14.5 Certifications

17.15 Mellon Medical B.V.

17.15.1 Financial Analysis

17.15.2 Product Portfolio

17.15.3 Demographic Reach and Achievements

17.15.4 Mergers and Acquisitions

17.15.5 Certifications

17.16 Apollo Endosurgery, Inc

17.16.1 Financial Analysis

17.16.2 Product Portfolio

17.16.3 Demographic Reach and Achievements

17.16.4 Mergers and Acquisitions

17.16.5 Certifications

17.17 Surgical Specialties Corporation

17.17.1 Financial Analysis

17.17.2 Product Portfolio

17.17.3 Demographic Reach and Achievements

17.17.4 Mergers and Acquisitions

17.17.5 Certifications

17.18 DemeTECH Corporation

17.18.1 Financial Analysis

17.18.2 Product Portfolio

17.18.3 Demographic Reach and Achievements

17.18.4 Mergers and Acquisitions

17.18.5 Certifications

17.19 Teleflex Incorporated

17.19.1 Financial Analysis

17.19.2 Product Portfolio

17.19.3 Demographic Reach and Achievements

17.19.4 Mergers and Acquisitions

17.19.5 Certifications

17.20 Coloplast

17.20.1 Financial Analysis

17.20.2 Product Portfolio

17.20.3 Demographic Reach and Achievements

17.20.4 Mergers and Acquisitions

17.20.5 Certifications

18 Global Surgical Sutures Market-Distribution Model (Additional Insight)

18.1 Overview

18.2 Potential Distributors

18.3 Key Parameters for Distribution Partner Assessment

19 Key Opinion Leaders (KOL) Insights (Additional Insight)

20 Company Competitiveness Analysis (Additional Insight)

20.1 Very Small Companies

20.2 Small Companies

20.3 Mid-Sized Companies

20.4 Large Companies

20.5 Very Large Companies

21 Pricing Models and Strategies (Additional Insight)

21.1 Overview

21.2 Cost Model

21.2.1 Manufacturing Cost Analysis

21.2.2 Procurement Cost Analysis

21.2.3 Clinical Trial Cost Factors

21.3 Pricing Strategies

21.3.1 Competitor Pricing Analysis

21.3.2 Key Assessment of Product Attributes

21.3.3 Pricing Benchmark

*Additional insights provided are customisable as per client requirements.

The surgical sutures market was valued at USD 4.24 billion in 2023.

The market is expected to grow at a CAGR of 6% from 2024 to 2032 to reach a value of USD 7.16 billion by 2032.

The major drivers of the industry, such as the increased prevalence of chronic illnesses worldwide, growing geriatric population, heightened investments in the healthcare infrastructure, and increasing initiatives organised by international organisations to raise awareness pertaining to road accidents and injury treatments, are expected to aid the market growth.

The key market trends guiding the growth of the industry include the heightened prevalence of road accidents worldwide.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The significant products available in the market are automated suturing device and sutures.

The different materials considered within the market report include monofilament and multifilament.

The significant applications of the product include cardiovascular surgeries, general surgeries, gynaecological surgeries, ophthalmic surgeries, and others.

The major players in the industry are Braun Melsungen AG, Boston Scientific Corporation, ConMed Corporation, DemeTECH Corporation, Surgical Specialties Corporation, and others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.