Reports

Sale

Global Bauxite Market Size, Share, Trends, Analysis, Report: By Grade: Refractory Grade, Metallurgical Grade; By Application: Alumina Production, Cement, Refractory, Abrasives, Others; Regional Analysis; Market Dynamics: SWOT Analysis, Porter’s Five Forces Analysis, Key Indicators for Demand; Competitive Landscape; 2024-2032

Global Bauxite Market Size

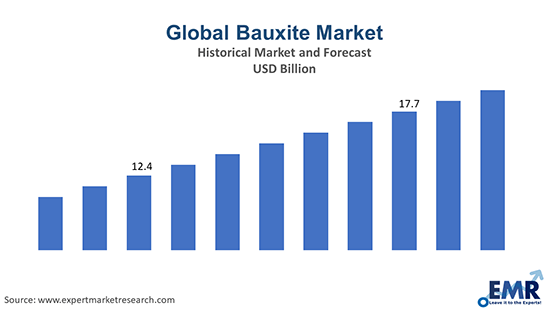

The global bauxite market reached approximately USD 16.75 billion in 2023. The market is projected to grow at a CAGR of 6.10% between 2024 and 2032, reaching a value of around USD 28.59 billion by 2032.

Bauxite Market Outlook

- The emphasis on recycling aluminium to reduce the reliance on primary bauxite extraction is growing.

- Innovations such as improved exploration methods and automation in mining operations are enabling efficient bauxite extraction and alumina production.

- Companies are diversifying their presence by exploring new mining regions and expanding their product range to include value-added products.

Bauxite Market Growth Rate

Bauxite is a silt rock, that has a high aluminium content. It is the main source of aluminium in the world. Primarily, bauxite consists of minerals like gibbsite, hematite, boehmite, anatase, goethite, and ilmenite. It is generally found near the terrain's surface; therefore, strip mining, a form of surface mining, is conducted.

One of the major factors driving the bauxite market development is the usage of bauxite in the manufacture of aluminium chemicals. Aluminium tristearate is used as a lubricating grease, textile finishing agent, and gelling agent in a wide range of applications. Moreover, the product is used as a raw material in the production of refractory products owing to its high melting point. Refractory grade bauxite is employed in the manufacturing of bricks to align the roof of electric arc steel making blast furnaces, furnaces, and stoves, whereas the fusion of calcined bauxite produces abrasive grains for usage in the abrasive sector.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Sustainability and environmental concerns; increasing use of bauxite residue in value-added applications; technological innovations in mining and processing; and rising investment in bauxite mining projects are the major trends impacting the bauxite market expansion

November 6th, 2023

Vedanta Aluminium announced that it has developed a process which can reduce the bauxite residue also known as red mud by 30 percent in the alumina refining process.

October 5th, 2023

Hindalco Industries Ltd announced that it has established a pact with the Odisha Mining Corporation for long-term Bauxite ore supply.

May 19th, 2023

Lindian Resources, an Australian mining company announced that it has entered a six-year bauxite supply agreement with Canadian logistics company C&D Logistics for the supply of 23 million wet metric tonnes (WMT).

February 1st, 2023

Alumina, a Bosnia and Herzegovina based aluminium supplier, announced that it has signed a contract with a local bauxite producer.

Sustainability and environmental concerns in bauxite market

This includes efforts to reduce the environmental impact of bauxite mining and alumina refining, such as improving water management, reducing emissions, and rehabilitating mining sites.

Increasing use of bauxite residue in value-added applications

Research and development efforts are focused on utilising (bauxite residue) red mud in construction materials, soil remediation, and metal recovery.

Technological innovations in mining and processing

These innovations include improved exploration techniques, more efficient ore processing methods, and the development of lower-temperature refining processes.

Rising investment in bauxite mining projects

To meet the anticipated increase in demand, there is significant investment in new bauxite mining projects and the expansion of existing mines around the world.

Bauxite Market Trends

Advances in technology are significantly transforming the bauxite mining and alumina refining processes, leading to increased efficiency, reduced environmental impact, and lower operational costs. For example, modern exploration techniques utilise satellite imagery, aerial photography, and geospatial data to identify bauxite deposits more accurately and efficiently. These technologies allow for the detailed mapping of geological features and the assessment of ore quality and quantity without the need for extensive ground surveys. Moreover, advanced geophysical techniques, such as seismic reflection and resistivity imaging, alongside geochemical analysis of soil and rock samples, provide deeper insights into the subsurface structure.

Market players are establishing pacts for the supply of bauxite ores which to strengthen their strategic position in the market. Hindalco Industries Ltd announced in October 2023 that it has established an agreement with the Odisha Mining Corporation for long-term Bauxite ore supply. This agreement ensures a stable and secure supply of bauxite ore for Hindalco Industries, critical for its aluminium production operations. Bauxite is the primary raw material for producing alumina, which is then processed to produce aluminium.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Bauxite Industry Segmentation

“Bauxite Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Grade

- Refractory Grade

- Metallurgical Grade

Market Breakup by Application

- Alumina Production

- Cement

- Refractory

- Abrasives

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Bauxite Market Share

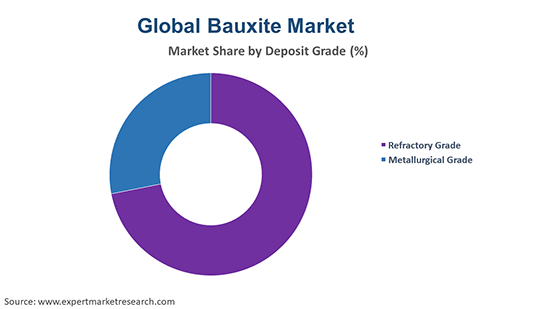

Metallurgical grade segment occupies a sizeable share as it is the primary raw material used in the production of aluminium

Metallurgical grade bauxite holds a significant market share because it is the main raw material for producing alumina, which is then used to produce aluminium metal. Metallurgical grade bauxite has a high alumina content compared to other grades as it typically contains between 40 to 60 per cent of alumina. This high alumina content is essential for the efficient production of alumina, making it more economically viable for aluminium production compared to lower-grade bauxite. Metallurgical grade bauxite is further preferred for aluminium production because it requires less energy and resources to process compared to other materials and the efficiency in processing reduces overall production costs.

Refractory grade bauxite is anticipated to witness sizeable growth in the bauxite market in the forecast period. This bauxite is highly resistant to high temperatures, making it an ideal material for manufacturing refractory products. These products are essential for high-temperature operations in various industrial sectors, including steel, glass, cement, and ceramics manufacturing. The ability to withstand extreme temperatures without degrading makes refractory-grade bauxite a critical component in these industrial sectors.

Alumina production maintains its dominance in the market as it is the primary process for the conversion of bauxite ore

Alumina production holds a sizeable share of the bauxite market because it is the primary process through which bauxite ore is converted into aluminium oxide (alumina), which is then used to produce aluminium metal, one of the most versatile and widely used metals in the world. The global demand for aluminium continues to grow due to its advantageous properties such as lightweight, strength, recyclability, and conductivity. Industrial sectors such as automotive, aerospace, construction, and packaging are increasingly using aluminium to improve the efficiency, sustainability, and performance of their products which in turn, drives the demand for alumina.

The refractory segment witnesses a substantial share in the bauxite market as bauxite is a primary source of alumina (aluminium oxide, Al2O3), which is crucial for refractory materials. Refractories made from high alumina content are known for their ability to withstand high temperatures, making them ideal for industrial sectors that operate at extreme temperatures, such as steel, glass, and cement manufacturing.

Leading Companies in Bauxite Market

The key players are expanding their existing mining operations and investing in new mines to meet the growing global demand for bauxite

Alcoa Corporation, founded in 1888 in Pennsylvania, United States, specialises in producing primary aluminum, fabricated aluminum, and alumina.

Norsk Hydro ASA, established in 1905 in Oslo, Norway, focuses on manufacturing rolled and extruded aluminum products and building systems.

South32 Limited, founded in 2015 in Perth, Australia, produces alumina, aluminum, coal, manganese, nickel, silver, lead, and zinc.

Aluminum Corporation of China Limited, established in 2001 in Beijing, China, specializes in aluminum products like sheets, foil, and extruded products.

Players such as Rio Tinto Limited, among others in the bauxite market engage in a variety of strategies to navigate and capitalise on the evolving market dynamics. These strategies are driven by the need to ensure sustainability, increase efficiency, and maximise profitability while also addressing environmental concerns and regulatory requirements.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Bauxite Market Analysis by Region

North America is predicted to hold a significant market share for bauxite over the forecast period. The automotive sector in North America, particularly in the United States, is a significant consumer of aluminium for manufacturing vehicles. The trend towards lightweight vehicles to improve fuel efficiency and reduce emissions has led to an increased use of aluminum in car and truck manufacturing, which in turn, boosts the demand for bauxite as a raw material.

The rising demand for bauxite market in the Asia Pacific can be attributed to the increasing demand for aluminium, which finds usage in various end-use sectors such as automotive and consumer electronics, among others. The market is further aided by the expected rapid expansion of bauxite mining in Latin America and the Middle East and Africa regions over the forecast period. The product is extensively used in the chemical, abrasive, steel, cement, refractory, and other industrial sectors. Bauxite is also directly used in chemicals for the manufacture of aluminium sulphate, which is employed as a flocculating agent in water and sewage treatment.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Grade |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Bauxite Market Analysis

8.1 Key Industry Highlights

8.2 Global Bauxite Historical Market (2018-2023)

8.3 Global Bauxite Market Forecast (2024-2032)

8.4 Global Bauxite Market by Grade

8.4.1 Refractory Grade

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Metallurgical Grade

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.5 Global Bauxite Market by Application

8.5.1 Alumina Production

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Cement

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Refractory

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Abrasives

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Others

8.6 Global Bauxite Market by Region

8.6.1 North America

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Europe

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Asia Pacific

8.6.3.1 Historical Trend (2018-2023)

8.6.3.2 Forecast Trend (2024-2032)

8.6.4 Latin America

8.6.4.1 Historical Trend (2018-2023)

8.6.4.2 Forecast Trend (2024-2032)

8.6.5 Middle East and Africa

8.6.5.1 Historical Trend (2018-2023)

8.6.5.2 Forecast Trend (2024-2032)

9 North America Bauxite Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Bauxite Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Bauxite Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Bauxite Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Bauxite Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Price Analysis

16.1 North America Historical Price Trends (2018-2023) and Forecast (2024-2032)

16.2 Europe Historical Price Trends (2018-2023) and Forecast (2024-2032)

16.3 Asia Pacific Historical Price Trends (2018-2023) and Forecast (2024-2032)

16.4 Latin America Historical Price Trends (2018-2023) and Forecast (2024-2032)

16.5 Middle East and Africa Historical Price Trends (2018-2023) and Forecast (2024-2032)

17 Competitive Landscape

17.1 Market Structure

17.2 Company Profiles

17.2.1 Alcoa Corporation

17.2.1.1 Company Overview

17.2.1.2 Product Portfolio

17.2.1.3 Demographic Reach and Achievements

17.2.1.4 Certifications

17.2.2 Norsk Hydro ASA

17.2.2.1 Company Overview

17.2.2.2 Product Portfolio

17.2.2.3 Demographic Reach and Achievements

17.2.2.4 Certifications

17.2.3 South32 Limited

17.2.3.1 Company Overview

17.2.3.2 Product Portfolio

17.2.3.3 Demographic Reach and Achievements

17.2.3.4 Certifications

17.2.4 Aluminum Corporation of China Limited

17.2.4.1 Company Overview

17.2.4.2 Product Portfolio

17.2.4.3 Demographic Reach and Achievements

17.2.4.4 Certifications

17.2.5 Rio Tinto Limited

17.2.5.1 Company Overview

17.2.5.2 Product Portfolio

17.2.5.3 Demographic Reach and Achievements

17.2.5.4 Certifications

17.2.6 Others

18 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Bauxite Market: Key Industry Highlights, 2018 and 2032

2. Global Bauxite Historical Market: Breakup by Product (USD Billion), 2018-2023

3. Global Bauxite Market Forecast: Breakup by Product (USD Billion), 2024-2032

4. Global Bauxite Historical Market: Breakup by Application (USD Billion), 2018-2023

5. Global Bauxite Market Forecast: Breakup by Application (USD Billion), 2024-2032

6. Global Bauxite Historical Market: Breakup by Region (USD Billion), 2018-2023

7. Global Bauxite Market Forecast: Breakup by Region (USD Billion), 2024-2032

8. North America Bauxite Historical Market: Breakup by Country (USD Billion), 2018-2023

9. North America Bauxite Market Forecast: Breakup by Country (USD Billion), 2024-2032

10. Europe Bauxite Historical Market: Breakup by Country (USD Billion), 2018-2023

11. Europe Bauxite Market Forecast: Breakup by Country (USD Billion), 2024-2032

12. Asia Pacific Bauxite Historical Market: Breakup by Country (USD Billion), 2018-2023

13. Asia Pacific Bauxite Market Forecast: Breakup by Country (USD Billion), 2024-2032

14. Latin America Bauxite Historical Market: Breakup by Country (USD Billion), 2018-2023

15. Latin America Bauxite Market Forecast: Breakup by Country (USD Billion), 2024-2032

16. Middle East and Africa Bauxite Historical Market: Breakup by Country (USD Billion), 2018-2023

17. Middle East and Africa Bauxite Market Forecast: Breakup by Country (USD Billion), 2024-2032

18. North America Historical Price Trends and Forecast 2018-2032

19. Europe Historical Price Trends and Forecast 2018-2032

20. Asia Pacific Historical Price Trends and Forecast 2018-2032

21. Latin America Historical Price Trends and Forecast 2018-2032

22. Middle East and Africa Historical Price Trends and Forecast 2018-2032

23. Global Bauxite Market Structure

In 2023, the market size attained a value of approximately USD 16.75 billion.

The market is projected to grow at a CAGR of 6.10% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach about USD 28.59 billion by 2032.

The major drivers of the market are the rising demand for energy, and the growing technological advancements.

The key trends guiding the growth of the market include the technological advancements and the rising demand from the developing regions.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading grades of bauxite in the market are refractory grade and metallurgical grade.

The significant deposit types of barite in the market are bedding, residual, vein, and cavity filling, among others.

The major end uses in the market are paints and coatings, textiles, rubber and plastics, adhesives, and pharmaceuticals, among others.

The major players in the market are Alcoa Corporation, Norsk Hydro ASA, South32 Limited, Aluminum Corporation of China Limited, and Rio Tinto Limited, among others.

The global bauxite market attained a value of USD 16.75 billion in 2023, driven by the rising demand for aluminium. Aided by technological advancements, the market is expected to witness a further growth in the forecast period of 2024-2032, growing at a CAGR of 6.10%. The market is projected to reach USD 28.59 billion by 2032.

EMR’s meticulous research methodology delves deep into the market, covering the macro and micro aspects of the industry. Based on grade, the market is bifurcated into refractory grade and metallurgical grade. By application, the industry is divided into alumina production, cement, refractory, and abrasives, among others. The major regional markets for bauxite are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. The key players in the above market include Alcoa Corporation, Norsk Hydro ASA, South32 Limited, Aluminum Corporation of China Limited, and Rio Tinto Limited, among others.

EMR’s research methodology uses a combination of cutting-edge analytical tools and the expertise of their highly accomplished team, thus, providing their customers with market insights that are accurate, actionable, and help them remain ahead of their competition.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.