Consumer Behavior

Two Challenges With Quantifying Virtuous Consumer Behavior

Choosing the right measures and not having a comparison baseline make it tricky.

Posted July 19, 2021 Reviewed by Davia Sills

Key points

- Consumers engage in many virtuous behaviors that help them and the company with which they do business.

- One challenge with quantifying virtuous behaviors is choosing the appropriate units and being able to measure them.

- The second challenge is deciding which comparison baseline to use and how to measure opportunity costs.

“I normally read at least a book a day and get all my books from the library. Even if they were all paperbacks, I estimate my library saves me at least $2,500/year (assuming a paperback is about $7.00). Given that many of the books I get… are hardcovers, that would mean my library saves me over $12,000/year (which is more than my annual taxable income). In short, my library is priceless to me!” —Vel Oakes.

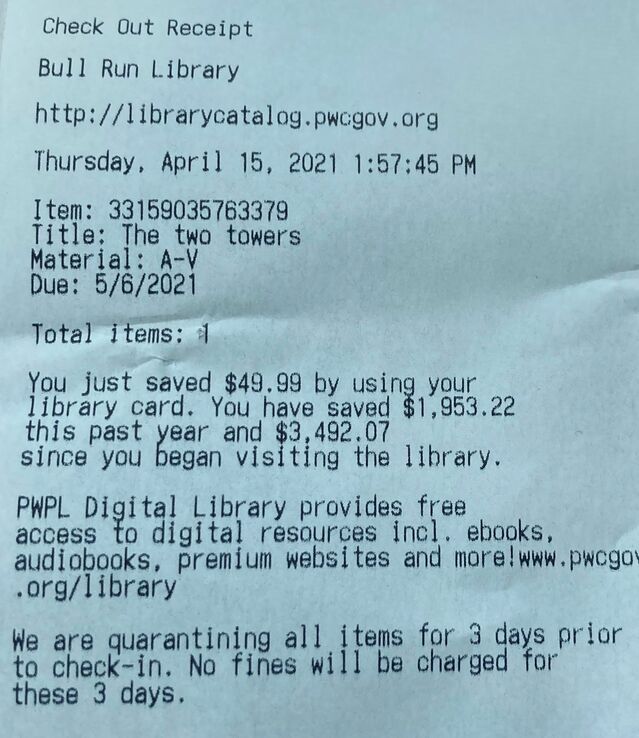

Photographs of receipts from local public libraries like the one below appear on Reddit from time to time. When sharing how much money they saved by borrowing books from the library, posters are basking in the glory of financial prudence. Not every public library in the United States provides a calculation of money saved on patron receipts, but many do, like this one:

The note says:

“You just saved $49.99 by using your library. You have saved $1,953.22 this past year and $3,942.07 since you began using the library.”

Giving library patrons an estimate of how much money they’ve saved by borrowing books is a great idea. It reinforces and quantifies the individual’s virtuous behavior. The simple “money saved” values make people feel good about reading, about using the library, and about seeing their tax dollars at work in a concrete way. Money saved = value realized.

And by providing three amounts, today’s savings, last year’s savings, and total savings, the information avoids the “lonely number” problem of having to interpret standalone numbers. Patrons get a quick, comprehensive, and useful economic accounting of their book-borrowing behavior from just three sentences.

Providing the information also benefits the library. It praises and reinforces the patron behavior that the library values. It encourages patrons to keep borrowing books (and saving money). And it reassures them that the library is providing a service of value and strengthens their relationship with the library.

Despite the win-win for both parties, very few companies and organizations give relational “money saved” information to customers after they’ve purchased the product in any meaningful way. Why?

Which Units Should Be Used and How Should Virtuous Behavior Be Measured?

In the course of their buying activities, consumers engage in numerous behaviors that can be considered virtuous, individually and societally. Here are some examples of virtuous consumer behaviors: purchasing a store brand (vs. a national brand) to receive better value, buying when the product is on sale to save money, using reusable cloth bags instead of plastic bags, walking or biking instead of driving a vehicle, doing laundry during an off-peak period in summer to conserve electricity, keeping the thermostat at a lower temperature in winter to save energy, ordering a lower-calorie entree instead of a steak. The list goes on and on.

Virtuous customer behaviors are difficult to quantify for two reasons. First, it is not always clear which measures are appropriate and meaningful for consumers and the company and should be used for quantifying the behavior’s value. Second, a comparison baseline for assessing value is necessary but is not always available or readily used by consumers.

The following example illustrates both challenges. Let’s say I choose to jog for an hour to support my health. How can I quantify my gains? First, I have to decide which units to use and what to measure. The number of calories I burnt? The intensity of the jogger’s high I experienced? The money I saved from my health improving? It’s not clear which measures are feasible, and of those that can be measured, which one is the best.

Adding to the challenge, I will also need a comparison baseline. What would I have done instead had I not gone running? Only after I determine the alternative activity (i.e., my opportunity cost) can I measure my gain from running in a meaningful way. For example, I may be able to estimate that I burnt 500 calories more from running than if I had just continued to couch-surf.

The library quantifies its patron’s gain in terms of money saved from borrowing books. That’s straightforward. It’s the baseline comparison that’s a bit tricky.

The Wrong Baseline Can Overestimate Virtuous Behavior

In the library receipt displayed earlier, the patron checked out Tolkien’s The Two Towers. The receipt stated they saved $49.99. This savings calculation is based on the library’s replacement cost, i.e., what the patron would have to pay the library if they lost the book. This amount includes what it costs the library to buy the book plus significant processing costs.

The library is calculating the amount saved using its next best alternative, not the patron’s next best alternative. Consequently, the savings estimate is grossly inflated. On Amazon, a mass paperback copy of The Two Towers costs $5.30 (including shipping) and a dollar or two less than that for a used copy. When the correct baseline comparison is used, it turns out that the patron saved around $5, not $50. Not that there’s anything wrong with that.

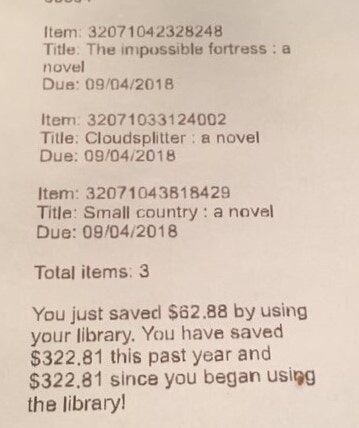

This receipt from another library provides a more reasonable, although still somewhat inflated, estimate. It uses new hardcover copy values to calculate the patron’s savings but omits processing costs:

The Key Takeaway

Despite these challenges, more organizations should be quantifying and providing “money saved” information or information about other virtuous behaviors to their customers. Over the past 15 years or so, I have driven a series of Toyota Prii. I continue to be amazed by how little—by which I mean, virtually none—communication I’ve received from Toyota after I’ve purchased my Prius. Wouldn’t it be nice if they sent me a “Kudos” email or text every quarter with an estimate of how many gallons of gasoline and how much money I had saved by driving my beloved Prius instead of a gas guzzler?