The electric vehicle (EV) industry can be likened today to the “dot-com” boom (and bust) of the 1990s, including the innovators who are now competing for investment to scale direct lithium extraction (DLE) technologies to commercial levels to produce battery-grade lithium more quickly, in greater quantities, and with a smaller environmental footprint.

Car makers, mining companies, governments and private investors are pouring millions of dollars into DLE startups and research and development (R&D) as the EV industry and grid-scale electrical storage needs expand, causing a deficit in lithium stocks as demand skyrockets.

To not invest would freeze the energy transition in its tracks, considering that, when it comes to high-energy-density batteries, there is no alternative to lithium—yet.

DLE technologies precipitate lithium out of brine using filters, membranes, ceramic beads, or other equipment, which is often housed in a small warehouse, significantly shrinking the environmental footprint of the open-pit mines and multiple football-field-sized evaporation ponds used to produce commercial quantities of lithium traditionally.

The US Department of Energy (DOE) estimates that 70% or more of US lithium deposits are found in brine reserves as opposed to open-pit mines, which are usually strongly opposed by the public.

At an energy conference in March, US Energy Secretary Jennifer Granholm called DLE “a game changer” offering “huge opportunities” and to identify those opportunities, the DOE’s Geothermal Technologies Office (GTO) is funding the “American-Made Geothermal Lithium Extraction Prize” to develop a commercially viable DLE technology for geothermal brines in Southern California’s Salton Sea/Imperial Valley.

In early November, DOE identified 15 teams of university researchers as semifinalists in Phase 1 of the competition and awarded $40,000 grants to each team, which then advanced into Phase 2.

Public-Private Partnerships Bolster “American-Made” Lithium Movement

The government is also partnering with private investors as evidenced by GTO’s $15 million grant to Warren Buffett's Berkshire Hathaway Inc. to test DLE technology, also at Salton Sea, Reuters reported. The DOE explains the urgency and emphasis on “American-made” by pointing out on its website that only 1% of US lithium supply is produced domestically.

In an article last year, the Harvard International Review warned that the global EV industry—however important to the energy transition—could become a 21st century version of yesteryear’s dot-com bubble given the “massive increases in government subsidies, consumer sentiment, and popularity” that can create overly hyped and often hollow private investment opportunities.

This assessment would apply, of course, also to the EV supply chain which includes the manufacturing of batteries and the sourcing of component parts, including commodity metals such as lithium and cobalt.

In researching DLE technology options, the global specialty chemicals giant Albemarle Corp., headquartered in Charlotte, North Carolina, and the world’s largest lithium producer with activities on five continents, concluded that DLE works best if engineered for a specific lithium deposit, Reuters reported.

While this news might dampen hopes for finding a one-size-fits-all solution to produce lithium quickly, and more cleanly, it does open doors for small, innovative technology companies to partner with global players on a project-by-project basis. One such example is a joint venture brewing between Germany’s LANXESS AG and Standard Lithium Ltd., headquartered in Vancouver, British Columbia, on a DLE project in Arkansas.

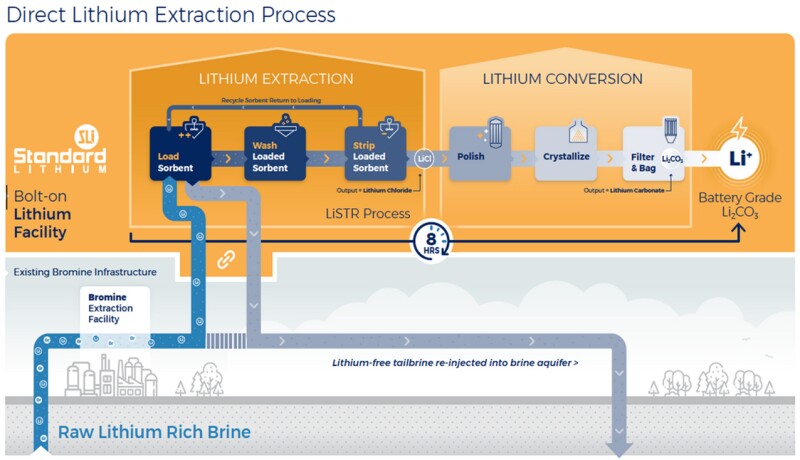

Standard Lithium pilot tested its patent pending LiSTR technology for DLE over 20 months at a LANXESS site on the middle Jurassic Smackover Formation which crosses Arkansas from east Texas to the Florida panhandle, claiming to have demonstrated it could extract lithium from brine in a matter of hours as opposed to the months required in a conventional evaporation pond.

On 24 February the partners agreed to advance to the front-end engineering design (FEED) stage, targeting completion of the study by Q4. If the project proves to be commercially and technically feasible, Standard Lithium “could build a plant” at their own expense to produce “battery-grade lithium carbonate” at one of LANXESS’ three El Dorado, Arkansas, sites, according to LANXESS which has the option of acquiring a stake of up to 49%.

Standard Lithium’s process uses “a solid ceramic adsorbent material with a crystal lattice” to “selectively” pull lithium ions from the brine and then release the element for recovery. With the brine temperature at approximately 160°F (70°C), “additional energy” is not needed to create the chemical reaction, the company said.

In October, Koch Strategic Platforms invested $100 million in Standard Lithium, and in December, Standard Lithium signed a Letter of Intent with Koch Engineered Solutions to form the integrated project management team to execute the pre-FEED work.

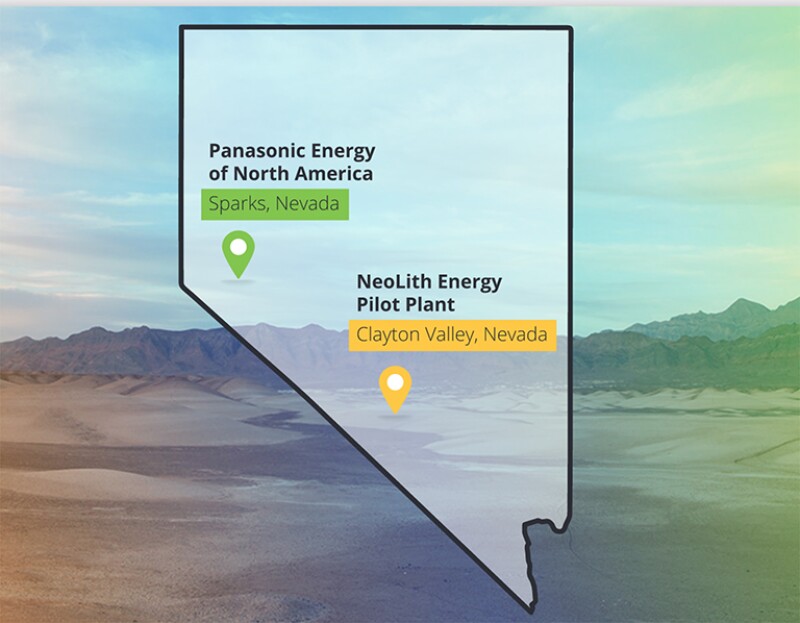

Meanwhile, Schlumberger’s New Energy business division inked a partnership in the spring of 2021 with Panasonic Energy of North America (a battery supplier to Tesla) and Vancouver-based Pure Energy Minerals to develop an “innovative and sustainable” lithium extraction process for New Energy’s NeoLith Energy pilot project in Clayton Valley, Nevada.

As project operator, Schlumberger is seeking to reduce water consumption at NeoLith energy “by over 85% compared to current methods of lithium extraction from brine,” the company said in a news release. Many DLE processes use large quantities of potable water, a downside to a technology that seems to cure one environmental sin by creating another.

General Motors Co., for example, relies on a technology to supply a large amount of its lithium from the Salton Sea that Reuters said “uses 10 tons of potable water for every ton of lithium produced,” while privately held Lilac Solutions Inc., backed by BMW and Bill Gates' Breakthrough Energy Ventures, suggests brackish water could be filtered through a desalination plant to avoid using potable water.

In early May, Schlumberger and TechMet Ltd., a private industrial company based in Ireland, invested in EnergySource Minerals with intent to create a strategic partnership to integrate the ILiAD lithium extraction platform into the front end of the process used by NeoLith Energy.

Schlumberger said it will scale up testing of the platform (which has been piloted on other brines over 6 years) at NeoLith Energy’s pilot plant in Nevada and deploy it at a global scale.

DOE Names Semi-Finalists in “American-Made” Geothermal Lithium Extraction Prize

The US Department of Energy’s Geothermal Technologies Office announced the following semi-finalists will be advancing to Phase 2 of the $4 million competition to develop direct lithium extraction technologies for application to geothermal brines in California’s Salton Sea/Imperial Valley.

Each team will receive a $40,000 grant and will advance their proposals during the second phase to demonstrate their design abilities. Those who advance to Phase 3 will fabricate and test their designs.

University of Wyoming—Goldilocks ligands for direct lithium recovery

Boston University—DLE to LiOH with ion-conducting ceramic membranes

George Washington University—Direct LiOH production from geothermal brines

Massachusetts Institute of Technology—Lithium from hybrid osmotic-electrokinetic membrane extraction utilizing a cascading membrane separation approach

Massachusetts Institute of Technology University—Filtering lithium ions with graphene Oregon State University—Li2CO3 using two-stage thermal-cyclonic desalination

Rice University—Highly selective electrodialysis for Li extraction

Texas Tech University—DLE with intensified membrane-based process University of Illinois Urbana-Champaign—Redox membrane for LiOH extraction

University of Massachusetts Dartmouth—LiRIX-Nano

University of Miami—Innovative electrochemical lithium extraction

University of Texas at Austin—Direct production of LiOH via selective BPED (bipolar membrane electrodialysis)

University of Utah—Engineered lithium ion-sieve technology

University of Virginia—Use of a selective solid intercalation material, electrodialysis, and downstream separation to capture lithium

University of Wyoming—A selective membrane for LiOH in one step