Reports

Sale

Global Seeds Market Size, Share, Trends, Growth, Forecast: By Crop Type: Oilseeds, Cereals and Grains, Fruits and Vegetables, Others; By Seed Type: Genetically Modified Seeds, Conventional Seeds; By Genetically Modified Seed Traits; By Seed Treatment; By Seed Availability; Regional Analysis; Competitive Landscape; 2024-2032

Global Seeds Market Outlook

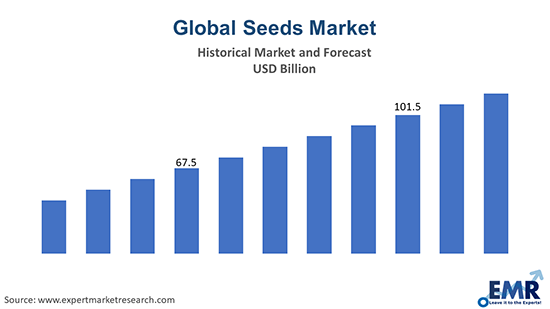

The global seeds market size reached almost USD 75.02 billion in the year 2023. The market is further expected to grow at a CAGR of 7% between 2023 and 2028 to reach a value of almost USD 112.64 billion by 2032.

Seeds perform several functions for the plant, such as dispersing to new locations, providing nourishment to the embryo, and dormancy in unfavourable weather conditions. Seeds are classified based on the number of cotyledons (seed leaves) in the embryo, with dicots having two and monocots one. Seeds have a wide range of applications across various fields. They are the primary means of propagation for many plants, including crops. Their selection and breeding are crucial for improving crop yields and qualities.

Many seeds, such as grains, legumes, and nuts, are vital food sources rich in proteins, fats, and carbohydrates. Seeds like sunflower, rapeseed, and flaxseed are used to extract oils for cooking and industrial purposes. Some of them also have medicinal properties and are used in traditional and modern medicine. The global seeds market growth is being driven by the growing food demands of the rising population and the increased demand for oilseeds due to their diverse applications.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Seeds Market Segmentation

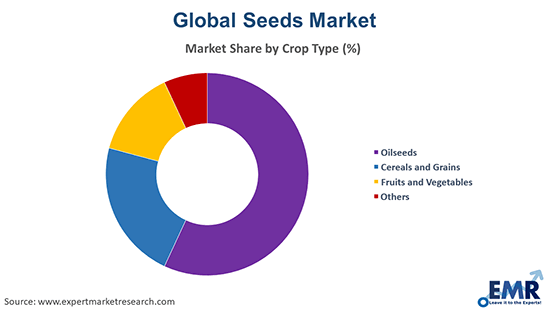

The market is segmented on the basis of crop type into:

- Oilseeds

- Cereals and Grains

- Fruits and Vegetables

- Others

Oilseeds are further divided into soybean, sunflower, cotton, and canola/rapeseed. Cereals and grains are sub-divided into corn, wheat, rice, and sorghum. Fruits and vegetables are further divided into tomatoes, melons, brassica, pepper, lettuce, onion, and carrot. Other seeds are further divided into alfalfa, clovers, and other forage, flower seed, and turf grasses.

Currently, the oilseeds segment accounts for the majority of the seeds market share. The increasing demand for healthy and organic oilseed-processed products, molecular breeding in oilseeds, and public-private partnerships in varietal development are some of the key drivers. Furthermore, sunflower seeds, known for their high protein and calcium content, are expected to have a significant demand in the coming years.

A diverse range of oilseeds, including copra, cottonseed, palm kernel, peanut, rapeseed, soybean, and sunflower seeds, are cultivated for oil extraction. The oil extracted is used in food products for human consumption, while the residue is used as animal feed. The edible oil extracted from oilseeds is also a feedstock for biodiesel production.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

On the basis of type, the market is bifurcated into:

- Genetically Modified

- Conventional

Presently, the conventional seeds market exhibits an upward trajectory, followed by the market for genetically modified seeds. Conventional seeds are those not genetically modified and are produced through traditional breeding methods. They are crucial in agriculture for their adaptability to various environmental conditions and their natural resistance to pests and diseases. These seeds are essential in maintaining biodiversity and traditional farming practices.

They are widely used in various crop types, including cereals, grains, oilseeds, pulses, fruits, and vegetables. Conventional seeds are favoured in organic farming and by farmers and consumers who prefer non-GMO products.

On the basis of genetically modified seed traits, the market is divided into:

- Herbicide-Tolerant

- Insecticide-Resistant

- Other Stacked Traits

Amongst all of these, herbicide-tolerant seeds demonstrate a clear dominance in the market. The demand for herbicide-tolerant seeds in the global market is robust, driven by their ability to withstand specific herbicides that would otherwise damage or kill the plant. This trait allows farmers to control weeds effectively without harming the crops.

Herbicide-tolerant seeds are particularly popular in large-scale, mechanised farming practices where efficient weed control is essential for maintaining high crop yields; this demand contributes to the overall seeds market revenue. The adoption of these seeds is significant in crops like soybean, corn, and cotton, especially in regions with intensive farming practices.

On the basis of treatment, the market is categorised into:

- Treated

- Non-Treated

Currently, treated variants dominate the market. These seeds are in high demand, particularly for their enhanced protection against pests, diseases, and environmental conditions. These seeds are coated with fungicides, insecticides, or other protective chemicals to improve germination rates and seedling health. Treated seeds are widely used in both commercial and subsistence farming to increase crop yields and reduce the risk of crop failure.

They are particularly beneficial in regions with challenging environmental conditions or high pest and disease pressures. Their applications span across various crop types, including cereals, grains, vegetables, and fruits.

On the basis of seed availability, the market is bifurcated into:

- Commercial

- Saved

The demand for commercial seeds in the market is driven by the need for high-yield, disease-resistant, and climate-adaptable varieties. These seeds, produced and sold by seed companies, are often genetically improved or treated for better performance.

Commercial seeds are crucial for modern agriculture, meeting the needs of large-scale farms and ensuring consistent crop quality and yield. They are essential in meeting global food production challenges, especially with increasing population and changing climate conditions.

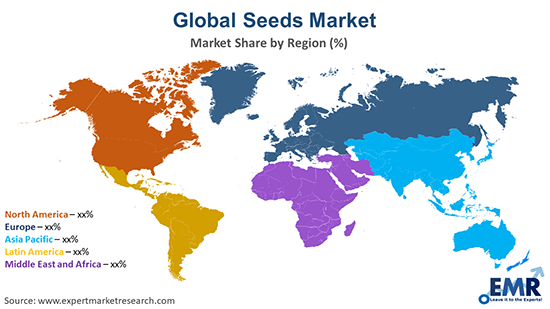

The report also covers the major regional markets for seeds, which are as follows:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Seeds Market Analysis

The market is being supported by the growing population across the globe due to which the demand for food and food production is increasing. Furthermore, owing to rapid urbanisation, the availability of per capita arable land has decreased. However, with the advent of genetically modified (GM) seeds, farmers are now able to enhance the efficiency of their farmlands as GM variants have more yield than non-GM variants. This is expected to drive the demand for GM seeds all over the world, further contributing to the seeds market demand.

In addition to this, in several countries, the government is encouraging the application of biofuel owing to its environmental benefits, further accelerating the demand for crops like soybean and corn, augmenting the demand for seeds of these crops. Expanding applications of biofuels can be attributed to the environmental advantages offered by the same and increasing focus on lowering carbon emissions globally. Besides, due to economic growth and increasing disposable incomes, the demand for agricultural produce from the food as well as non-food sectors has constantly been growing in a number of emerging markets, like India, China, the Middle East, and others, thereby invigorating the market growth in the forecast period.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Share by Region

The Asia Pacific region holds the largest share of the overall seeds market value. This prominence is attributed to the region's extensive agricultural production and increasing seed replacement rate. The Asia Pacific region encompasses a wide range of climates and agricultural zones, from the temperate zones of China and Japan to the tropical environments in Southeast Asia. This diversity results in a wide variety of crops being cultivated, each requiring specific seed types.

There is a strong demand for both food and cash crops in the region. Rice, wheat, and maize are staple food crops with a high demand for seeds. Many governments in the region actively support the agricultural sector through subsidies, research and development initiatives, and policies promoting the use of improved seed varieties.

Competitive Landscape

The report gives a detailed analysis of the following key players in the global seeds market, covering their competitive landscape, capacity, and latest developments like mergers and acquisitions, investments, capacity expansions, and plant turnarounds:

- Bayer AG

- Syngenta Group Co., Ltd.

- Groupe Limagrain Holding

- Corteva, Inc

- Sakata Seeds Corporation

- Rallis India Limited

- Others

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Crop Type |

|

| Breakup by Seed Type |

|

| Breakup by Genetically Modified Seed Traits |

|

| Breakup by Seed Treatment |

|

| Breakup by Seed Availability |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Seeds Market Analysis

8.1 Key Industry Highlights

8.2 Global Seeds Historical Market (2018-2023)

8.3 Global Seeds Market Forecast (2024-2032)

8.4 Global Seeds Market by Crop Type

8.4.1 Oilseeds

8.4.1.1 Market Share

8.4.1.2 Breakup by Type

8.4.1.2.1 Soybean

8.4.1.2.1.1 Market Share

8.4.1.2.1.2 Historical Trend (2018-2023)

8.4.1.2.1.3 Forecast Trend (2024-2032)

8.4.1.2.2 Sunflower

8.4.1.2.2.1 Market Share

8.4.1.2.2.2 Historical Trend (2018-2023)

8.4.1.2.2.3 Forecast Trend (2024-2032)

8.4.1.2.3 Cotton

8.4.1.2.3.1 Market Share

8.4.1.2.3.2 Historical Trend (2018-2023)

8.4.1.2.3.3 Forecast Trend (2024-2032)

8.4.1.2.4 Canola/RapeSeeds

8.4.1.2.4.1 Market Share

8.4.1.2.4.2 Historical Trend (2018-2023)

8.4.1.2.4.3 Forecast Trend (2024-2032)

8.4.2 Cereals and Grains

8.4.2.1 Market Share

8.4.2.2 Breakup by Type

8.4.2.2.1 Corn

8.4.2.2.1.1 Market Share

8.4.2.2.1.2 Historical Trend (2018-2023)

8.4.2.2.1.3 Forecast Trend (2024-2032)

8.4.2.2.2 Wheat

8.4.2.2.2.1 Market Share

8.4.2.2.2.2 Historical Trend (2018-2023)

8.4.2.2.2.3 Forecast Trend (2024-2032)

8.4.2.2.3 Rice

8.4.2.2.3.1 Market Share

8.4.2.2.3.2 Historical Trend (2018-2023)

8.4.2.2.3.3 Forecast Trend (2024-2032)

8.4.2.2.4 Sorghum

8.4.2.2.4.1 Market Share

8.4.2.2.4.2 Historical Trend (2018-2023)

8.4.2.2.4.3 Forecast Trend (2024-2032)

8.4.3 Fruits and Vegetables

8.4.3.1 Market Share

8.4.3.2 Breakup by Type

8.4.3.2.1 Tomatoes

8.4.3.2.1.1 Market Share

8.4.3.2.1.2 Historical Trend (2018-2023)

8.4.3.2.1.3 Forecast Trend (2024-2032)

8.4.3.2.2 Melons

8.4.3.2.2.1 Market Share

8.4.3.2.2.2 Historical Trend (2018-2023)

8.4.3.2.2.3 Forecast Trend (2024-2032)

8.4.3.2.3 Brassica

8.4.3.2.3.1 Market Share

8.4.3.2.3.2 Historical Trend (2018-2023)

8.4.3.2.3.3 Forecast Trend (2024-2032)

8.4.3.2.4 Pepper

8.4.3.2.4.1 Market Share

8.4.3.2.4.2 Historical Trend (2018-2023)

8.4.3.2.4.3 Forecast Trend (2024-2032)

8.4.3.2.5 Lettuce

8.4.3.2.5.1 Market Share

8.4.3.2.5.2 Historical Trend (2018-2023)

8.4.3.2.5.3 Forecast Trend (2024-2032)

8.4.3.2.6 Onion

8.4.3.2.6.1 Market Share

8.4.3.2.6.2 Historical Trend (2018-2023)

8.4.3.2.6.3 Forecast Trend (2024-2032)

8.4.3.2.7 Carrot

8.4.3.2.7.1 Market Share

8.4.3.2.7.2 Historical Trend (2018-2023)

8.4.3.2.7.3 Forecast Trend (2024-2032)

8.4.4 Others

8.4.4.1 Market Share

8.4.4.2 Breakup by Type

8.4.4.2.1 Alfalfa

8.4.4.2.1.1 Market Share

8.4.4.2.1.2 Historical Trend (2018-2023)

8.4.4.2.1.3 Forecast Trend (2024-2032)

8.4.4.2.2 Clovers and Other Forage

8.4.4.2.2.1 Market Share

8.4.4.2.2.2 Historical Trend (2018-2023)

8.4.4.2.2.3 Forecast Trend (2024-2032)

8.4.4.2.3 Flower Seeds

8.4.4.2.3.1 Market Share

8.4.4.2.3.2 Historical Trend (2018-2023)

8.4.4.2.3.3 Forecast Trend (2024-2032)

8.4.4.2.4 Turf Grasses

8.4.4.2.4.1 Market Share

8.4.4.2.4.2 Historical Trend (2018-2023)

8.4.4.2.4.3 Forecast Trend (2024-2032)

8.5 Global Seeds Market by Seed Type

8.5.1 Genetically Modified Seeds

8.5.1.1 Market Share

8.5.1.2 Historical Trend (2018-2023)

8.5.1.3 Forecast Trend (2024-2032)

8.5.2 Conventional Seeds

8.5.2.1 Market Share

8.5.2.2 Historical Trend (2018-2023)

8.5.2.3 Forecast Trend (2024-2032)

8.6 Global Seeds Market by Genetically Modified Seed Traits

8.6.1 Herbicide-Tolerant

8.6.1.1 Market Share

8.6.1.2 Historical Trend (2018-2023)

8.6.1.3 Forecast Trend (2024-2032)

8.6.2 Insecticide-Resistant

8.6.2.1 Market Share

8.6.2.2 Historical Trend (2018-2023)

8.6.2.3 Forecast Trend (2024-2032)

8.6.3 Others

8.7 Global Seeds Market by Seed Treatment

8.7.1 Treated

8.7.1.1 Market Share

8.7.1.2 Historical Trend (2018-2023)

8.7.1.3 Forecast Trend (2024-2032)

8.7.2 Non-Treated

8.7.2.1 Market Share

8.7.2.2 Historical Trend (2018-2023)

8.7.2.3 Forecast Trend (2024-2032)

8.8 Global Seeds Market by Seed Availability

8.8.1 Commercial Seeds

8.8.1.1 Market Share

8.8.1.2 Historical Trend (2018-2023)

8.8.1.3 Forecast Trend (2024-2032)

8.8.2 Saved Seeds

8.8.2.1 Market Share

8.8.2.2 Historical Trend (2018-2023)

8.8.2.3 Forecast Trend (2024-2032)

8.9 Global Seeds Market by Region

8.9.1 North America

8.9.1.1 Market Share

8.9.1.2 Historical Trend (2018-2023)

8.9.1.3 Forecast Trend (2024-2032)

8.9.2 Europe

8.9.2.1 Market Share

8.9.2.2 Historical Trend (2018-2023)

8.9.2.3 Forecast Trend (2024-2032)

8.9.3 Asia Pacific

8.9.3.1 Market Share

8.9.3.2 Historical Trend (2018-2023)

8.9.3.3 Forecast Trend (2024-2032)

8.9.4 Latin America

8.9.4.1 Market Share

8.9.4.2 Historical Trend (2018-2023)

8.9.4.3 Forecast Trend (2024-2032)

8.9.5 Middle East and Africa

8.9.5.1 Market Share

8.9.5.2 Historical Trend (2018-2023)

8.9.5.3 Forecast Trend (2024-2032)

9 North America Seeds Market Analysis

9.1 United States of America

9.1.1 Market Share

9.1.2 Historical Trend (2018-2023)

9.1.3 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Market Share

9.2.2 Historical Trend (2018-2023)

9.2.3 Forecast Trend (2024-2032)

10 Europe Seeds Market Analysis

10.1 United Kingdom

10.1.1 Market Share

10.1.2 Historical Trend (2018-2023)

10.1.3 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Market Share

10.2.2 Historical Trend (2018-2023)

10.2.3 Forecast Trend (2024-2032)

10.3 France

10.3.1 Market Share

10.3.2 Historical Trend (2018-2023)

10.3.3 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Market Share

10.4.2 Historical Trend (2018-2023)

10.4.3 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Seeds Market Analysis

11.1 China

11.1.1 Market Share

11.1.2 Historical Trend (2018-2023)

11.1.3 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Market Share

11.2.2 Historical Trend (2018-2023)

11.2.3 Forecast Trend (2024-2032)

11.3 India

11.3.1 Market Share

11.3.2 Historical Trend (2018-2023)

11.3.3 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Market Share

11.4.2 Historical Trend (2018-2023)

11.4.3 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Market Share

11.5.2 Historical Trend (2018-2023)

11.5.3 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Seeds Market Analysis

12.1 Brazil

12.1.1 Market Share

12.1.2 Historical Trend (2018-2023)

12.1.3 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Market Share

12.2.2 Historical Trend (2018-2023)

12.2.3 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Market Share

12.3.2 Historical Trend (2018-2023)

12.3.3 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Seeds Market Analysis

13.1 Saudi Arabia

13.1.1 Market Share

13.1.2 Historical Trend (2018-2023)

13.1.3 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Market Share

13.2.2 Historical Trend (2018-2023)

13.2.3 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Market Share

13.3.2 Historical Trend (2018-2023)

13.3.3 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Market Share

13.4.2 Historical Trend (2018-2023)

13.4.3 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Company Profiles

16.2.1 Bayer AG

16.2.1.1 Company Overview

16.2.1.2 Product Portfolio

16.2.1.3 Demographic Reach and Achievements

16.2.1.4 Certifications

16.2.2 Syngenta Group Co.,Ltd.

16.2.2.1 Company Overview

16.2.2.2 Product Portfolio

16.2.2.3 Demographic Reach and Achievements

16.2.2.4 Certifications

16.2.3 Groupe Limagrain Holding

16.2.3.1 Company Overview

16.2.3.2 Product Portfolio

16.2.3.3 Demographic Reach and Achievements

16.2.3.4 Certifications

16.2.4 Corteva, Inc.

16.2.4.1 Company Overview

16.2.4.2 Product Portfolio

16.2.4.3 Demographic Reach and Achievements

16.2.4.4 Certifications

16.2.5 Sakata Seeds Corporation

16.2.5.1 Company Overview

16.2.5.2 Product Portfolio

16.2.5.3 Demographic Reach and Achievements

16.2.5.4 Certifications

16.2.6 Rallis India Limited

16.2.6.1 Company Overview

16.2.6.2 Product Portfolio

16.2.6.3 Demographic Reach and Achievements

16.2.6.4 Certifications

16.2.7 Others

17 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Seeds Market: Key Industry Highlights, 2018 and 2032

2. Global Seeds Historical Market: Breakup by Crop Type (USD Billion), 2018-2023

3. Global Seeds Market Forecast: Breakup by Crop Type (USD Billion), 2024-2032

4. Global Seeds Historical Market: Breakup by Seed Type (USD Billion), 2018-2023

5. Global Seeds Market Forecast: Breakup by Seed Type (USD Billion), 2024-2032

6. Global Seeds Historical Market: Breakup by Traits (USD Billion), 2018-2023

7. Global Seeds Market Forecast: Breakup by Traits (USD Billion), 2024-2032

8. Global Seeds Historical Market: Breakup by Seed Treatment (USD Billion), 2018-2023

9. Global Seeds Market Forecast: Breakup by Seed Treatment (USD Billion), 2024-2032

10. Global Seeds Historical Market: Breakup by Seed Availability (USD Billion), 2018-2023

11. Global Seeds Market Forecast: Breakup by Seed Availability (USD Billion), 2024-2032

12. Global Seeds Historical Market: Breakup by Region (USD Billion), 2018-2023

13. Global Seeds Market Forecast: Breakup by Region (USD Billion), 2024-2032

14. North America Seeds Historical Market: Breakup by Country (USD Billion), 2018-2023

15. North America Seeds Market Forecast: Breakup by Country (USD Billion), 2024-2032

16. Europe Seeds Historical Market: Breakup by Country (USD Billion), 2018-2023

17. Europe Seeds Market Forecast: Breakup by Country (USD Billion), 2024-2032

18. Asia Pacific Seeds Historical Market: Breakup by Country (USD Billion), 2018-2023

19. Asia Pacific Seeds Market Forecast: Breakup by Country (USD Billion), 2024-2032

20. Latin America Seeds Historical Market: Breakup by Country (USD Billion), 2018-2023

21. Latin America Seeds Market Forecast: Breakup by Country (USD Billion), 2024-2032

22. Middle East and Africa Seeds Historical Market: Breakup by Country (USD Billion), 2018-2023

23. Middle East and Africa Seeds Market Forecast: Breakup by Country (USD Billion), 2024-2032

24. Global Seeds Market Structure

In 2023, the global seeds market attained a value of nearly USD 75.02 billion.

In the forecast period of 2024-2032, the seeds market is projected to grow at a CAGR of 7.00%.

By 2028, the seeds market is estimated to reach a value of about USD 112.64 billion.

The major drivers of the market are rising disposable incomes, increasing population, rapid urbanisation, and growing demand from food and non-food sectors in developing countries.

The growing shift towards biofuels globally and the rising adoption of genetically modified (GM) seeds are major trends expected to drive the growth of the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The leading crop type in the global seeds market are oilseeds.

The most significant seed type in the market are conventional seeds.

Herbicide-tolerant is the leading genetically modified seed trait of the product in the market.

Treated seeds hold the largest market share based on seed treatment.

On the basis of availability, the market is divided into commercial and saved seeds.

The leading players in the seeds market are Bayer AG, Syngenta Group Co.,Ltd., Groupe Limagrain Holding, Corteva, Inc., Sakata Seeds Corporation, and Rallis India Limited, among others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.