Reports

Sale

Global Integration Platform as a Service (iPaaS) Market: By Deployment Model: Public, Private, Hybrid; By Service Type: Data Mapping and Transformation, Routing and Orchestration, Integration Flow Development and Life Cycle Management Tools, Others; By Organisation Size; By Industry; Regional Analysis; Competitive Landscape; 2024-2032

Global Integration Platform as a Service Market Outlook

The global integration platform as a service market size is expected to grow at a CAGR of 38% between 2024 and 2032, reaching almost USD 89.80 billion by 2032.

Key Takeaways:

- Eurostat data for 2022 showed the EU had 32 million businesses, employing around 160 million people, with a net turnover of €38 trillion, thereby contributing to the global integration platform as a service market growth.

- As reported by the Ministry of Electronics and Information Technology, India's IT services sector remains dominant with a USD 104 billion market. In FY2022, it experienced 8.3% year-on-year growth, stimulating the iPaaS market.

- According to the International Trade Administration, Canada's flourishing domestic tech industry, comprising over 43,200 ICT sector firms, fuels iPaaS market expansion.

Integration platform as a service (iPaaS) refers to a suite of automated utilities designed to seamlessly integrate software applications operating in diverse environments. iPaaS is commonly employed by large enterprises managing complex systems to unify applications and data residing on-premises, as well as in public and private cloud infrastructures.

As per the global integration platform as a service market report, iPaaS tools offer preconfigured connectors, business logic, mapping tools, and transformation capabilities to streamline application development and manage integration processes. Certain iPaaS providers also furnish bespoke development kits aimed at modernizing older applications and incorporating features like mobile compatibility, integration with social media platforms, and enhanced business data management functionalities.

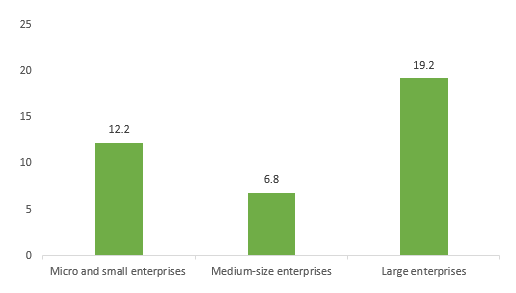

Eurostat reported that in 2022, the European Union (EU) comprised 32 million businesses, providing employment to approximately 160 million individuals and generating a net turnover of €38 trillion, thus boosting the global integration platform as a service market development.

ENTERPRISES NET TURNOVER IN THE EU, 2022, € TRILLION

Key Trends and Developments

The global integration platform as a service market growth is driven by growing media and entertainment companies, hybrid IT environments, scalability, and flexibility.

January 2023

Medius, a firm specialising in accounts payable (AP) management, collaborated with Launchpad Technologies to provide an Integration-Platform-as-a-Service (iPaaS) solution.

January 2023

Jetic emerged from stealth mode to unveil its proprietary integrated platform-as-a-service (IPaaS) solution, built upon the open-source Apache Camel software, which operated natively on Kubernetes clusters.

October 2023

Software AG broadened its offerings by introducing an advanced IPaaS solution, known as Super IPaaS.

July 2023

Google launched an independent Integration Platform as a Service (iPaaS) on their cloud platform.

Growing demand from media and entertainment companies

Media and entertainment companies utilise iPaaS to streamline operations and bolster digital supply chains, aiming to cut operational costs. Their increasing preference for cloud-based solutions, driven by the need to minimise IT expenses and efficiently manage vital data, contributes significantly to the growth of the iPaaS sector.

Growing business sector

The growing importance of real-time cloud monitoring grows across sectors is supporting the global integration platforms as a service market growth. Real-time monitoring involves continuously recording network performance snapshots, aiding in activity tracking, security enhancement, and issue detection. Businesses of all sizes benefit from this practice.

Hybrid IT Environments

Businesses are evolving digitally to compete better and meet customer needs. iPaaS blends digital tools, making businesses more adaptable and customer-focused. The rise of cloud computing drives iPaaS growth, as companies shift to cloud services. iPaaS simplifies integrating on-premises and cloud systems, crucial in hybrid IT setups.

Scalability and Flexibility

Modern software relies heavily on APIs. iPaaS platforms focus on managing APIs, enabling businesses to create, control, and use APIs for integration, and linking applications and services. iPaaS ensures scalability, aiding businesses in adapting to changing demands, and offers cost-effectiveness compared to custom integration projects, featuring subscription-based pricing.

Global Integration Platform as a Service Market Trends

IPaaS is vital for organisations aiming to modernise their applications, driven by the need for improved customer experiences and new applications affecting business and IT operations. It's a cloud-based hybrid integration service with a versatile platform enabling seamless connectivity and integration while cutting integration costs.

Integrated platform as a service provides pre-established connectors, rules, maps, and transformations, simplifying application development and integration coordination. Additionally, the expansion of cloud services and increasing demand in banking, finance, and insurance sectors foster the global integration platform as a service market development, with vendors offering online marketplaces for adapters and data mapping processes.

Market Segmentation

Global Integration Platform as a Service Market Report and Forecast 2024-2032 offers a detailed analysis of the market based on the following segments:

Market Breakup by Deployment Model

- Public

- Private

- Hybrid

Market Breakup by Service Type

- Data Mapping and Transformation

- Routing and Orchestration

- Integration Flow Development and Life Cycle Management Tools

- API Life Cycle Management

- Business to Business (B2B) And Cloud Integration

- Internet of Things (IoT)

- Real-Time Monitoring and Integration

- Others

Market Breakup by Organisation Size

- Small and Medium Enterprises

- Large Enterprises

Market Breakup by Industry

- BFSI

- Consumer Goods and Retail

- Education

- Government and Public Sector

- Healthcare and Life Sciences

- Media and Entertainment

- Telecommunication and IT

- Manufacturing

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Private deployment models are impacting the integration platform as a service market outlook, predominantly favoured by large organisations

Large organisations opt for private clouds over costly data centres for enhanced security and resource sharing with select entities, driving iPaaS market growth. iPaaS is a recent solution facilitating the seamless integration of AI technologies for public deployment.

Data mapping and transformation services are driving the integration platform as a service market growth by converting data between formats (e.g., XML to JSON)

API lifecycle management covers tasks such as API creation, publishing, securing, and monitoring. B2B integration facilitates the connection with trading partners, such as suppliers and customers. Cloud service and integration automate the deployment and management of cloud-based applications and services.

Based on industry, integration platform as a service market share is led by BFSI with an increasing emphasis on integrating both cloud services and on-premises systems

IPaaS solutions improve communication and connectivity within enterprises by integrating data and applications. Enterprises offer iPaaS solutions that include application integration, deployment, and business management in a unified hub, driving market growth. Cloud integration initiatives with multi-tenancy capabilities, especially in sectors like healthcare, government, and education, further fuel market expansion.

Global Integration Platform as a Service Market Analysis by Region

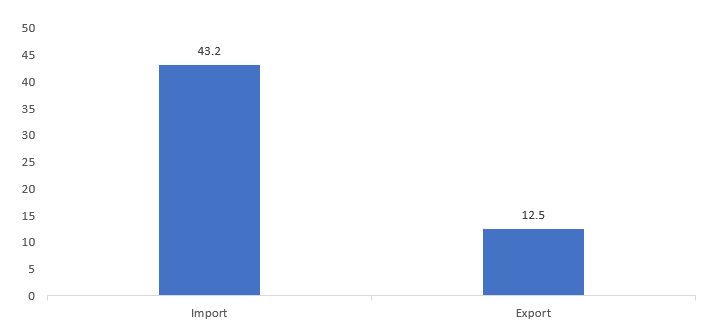

North America remains the dominant region in the market and is expected to maintain its leading position in the forecast period. This is primarily due to the region's advanced IT infrastructure and widespread adoption of cloud services across various industries. As per the International Trade Administration, Canada possesses a robust domestic technology industry, with over 43,200 companies in the ICT sector, thus, contributing to the growth of the iPaaS market.

CANADIAN ICT SECTOR TRADE, 2022, IN US$ BILLION

Asia Pacific is projected to experience the highest growth rate during the forecast period, driven by the extensive adoption of IT solutions in various industry sectors across the region. As per the Ministry of Electronics and Information Technology, in India, the IT services sector maintains its dominance with a market share of USD 104 billion. It was the top-performing segment in FY2022, witnessing a year-on-year growth of 8.3%, boosting the global integration platform as a service market share.

Competitive Landscape

The firms are increasingly adopting hybrid IT setups for their operations, prioritising scalability and adaptability to accommodate the expanding business landscape.

Boomi, LP established in 2000 and headquartered in the USA, serves as a hub for intelligent connectivity and automation. Its expertise lies in cloud, SaaS, on-premises solutions, integration, iPaaS (Integration Platform as a Service), MDM (Master Data Management), API Management, transformation services, digital transformation, cloud integration, workflow management, workflow automation, digital disruption, and business integration.

Celigo, Inc. was founded in 2011 and headquartered in the United States, the Celigo Integration Platform, facilitates the automation of various processes throughout your enterprise. This platform, built on the cloud and infinitely scalable, prioritizes enterprise-level data security and governance. It supports various integration types such as applications, data, and B2B interactions.

Informatica, Inc., established in 1993 in the United States, it is a company specializing in the design and creation of data integration software and services. Their product lineup encompasses infrastructure software, featuring data integration, cloud computing, complex event processing, application information lifecycle management, data quality assurance, data security, B2B data exchange, and associated services.

SnapLogic, Inc., established in 2006 in the United States, it is a commercial software enterprise offering integration platform as a service (iPaaS) solution. Their tools facilitate the connection of cloud data sources, SaaS applications, and on-premises business software applications.

Other global integration platform as a service market key players are Microsoft Corporation, Jitterbit, Inc., Salesforce, Inc., Workato, SAP SE, and Oracle Corporation, among others.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Deployment Model |

|

| Breakup by Service Type |

|

| Breakup by Organisation Size |

|

| Breakup by Industry |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Integration Platform as a Service Market Analysis

8.1 Key Industry Highlights

8.2 Global Integration Platform as a Service Historical Market (2018-2023)

8.3 Global Integration Platform as a Service Market Forecast (2024-2032)

8.4 Global Integration Platform as a Service Market by Deployment Model

8.4.1 Public

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Private

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.4.3 Hybrid

8.4.3.1 Historical Trend (2018-2023)

8.4.3.2 Forecast Trend (2024-2032)

8.5 Global Integration Platform as a Service Market by Service Type

8.5.1 Data Mapping and Transformation

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Routing and Orchestration

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Integration Flow Development and Life Cycle Management Tools

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 API Life Cycle Management

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Business-to-Business (B2B) And Cloud Integration

8.5.5.1 Historical Trend (2018-2023)

8.5.5.2 Forecast Trend (2024-2032)

8.5.6 Internet of Things (IoT)

8.5.6.1 Historical Trend (2018-2023)

8.5.6.2 Forecast Trend (2024-2032)

8.5.7 Real-Time Monitoring and Integration

8.5.7.1 Historical Trend (2018-2023)

8.5.7.2 Forecast Trend (2024-2032)

8.5.8 Others

8.6 Global Integration Platform as a Service Market by Organisation Size

8.6.1 Small and Medium Enterprises

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Large Enterprises

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.7 Global Integration Platform as a Service Market by Industry

8.7.1 BFSI

8.7.1.1 Historical Trend (2018-2023)

8.7.1.2 Forecast Trend (2024-2032)

8.7.2 Consumer Goods and Retail

8.7.2.1 Historical Trend (2018-2023)

8.7.2.2 Forecast Trend (2024-2032)

8.7.3 Education

8.7.3.1 Historical Trend (2018-2023)

8.7.3.2 Forecast Trend (2024-2032)

8.7.4 Government and Public Sector

8.7.4.1 Historical Trend (2018-2023)

8.7.4.2 Forecast Trend (2024-2032)

8.7.5 Healthcare and Life Sciences

8.7.5.1 Historical Trend (2018-2023)

8.7.5.2 Forecast Trend (2024-2032)

8.7.6 Media and Entertainment

8.7.6.1 Historical Trend (2018-2023)

8.7.6.2 Forecast Trend (2024-2032)

8.7.7 Telecommunication and IT

8.7.7.1 Historical Trend (2018-2023)

8.7.7.2 Forecast Trend (2024-2032)

8.7.8 Manufacturing

8.7.8.1 Historical Trend (2018-2023)

8.7.8.2 Forecast Trend (2024-2032)

8.7.9 Others

8.8 Global Integration Platform as a Service Market by Region

8.8.1 North America

8.8.1.1 Historical Trend (2018-2023)

8.8.1.2 Forecast Trend (2024-2032)

8.8.2 Europe

8.8.2.1 Historical Trend (2018-2023)

8.8.2.2 Forecast Trend (2024-2032)

8.8.3 Asia Pacific

8.8.3.1 Historical Trend (2018-2023)

8.8.3.2 Forecast Trend (2024-2032)

8.8.4 Latin America

8.8.4.1 Historical Trend (2018-2023)

8.8.4.2 Forecast Trend (2024-2032)

8.8.5 Middle East and Africa

8.8.5.1 Historical Trend (2018-2023)

8.8.5.2 Forecast Trend (2024-2032)

9 North America Integration Platform as a Service Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Integration Platform as a Service Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Integration Platform as a Service Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Integration Platform as a Service Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Integration Platform as a Service Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Competitive Landscape

15.1 Market Structure

15.2 Company Profiles

15.2.1 Oracle Corporation

15.2.1.1 Company Overview

15.2.1.2 Product Portfolio

15.2.1.3 Demographic Reach and Achievements

15.2.1.4 Certifications

15.2.2 Boomi, LP

15.2.2.1 Company Overview

15.2.2.2 Product Portfolio

15.2.2.3 Demographic Reach and Achievements

15.2.2.4 Certifications

15.2.3 Celigo, Inc.

15.2.3.1 Company Overview

15.2.3.2 Product Portfolio

15.2.3.3 Demographic Reach and Achievements

15.2.3.4 Certifications

15.2.4 SAP SE

15.2.4.1 Company Overview

15.2.4.2 Product Portfolio

15.2.4.3 Demographic Reach and Achievements

15.2.4.4 Certifications

15.2.5 Informatica, Inc.

15.2.5.1 Company Overview

15.2.5.2 Product Portfolio

15.2.5.3 Demographic Reach and Achievements

15.2.5.4 Certifications

15.2.6 SnapLogic, Inc.

15.2.6.1 Company Overview

15.2.6.2 Product Portfolio

15.2.6.3 Demographic Reach and Achievements

15.2.6.4 Certifications

15.2.7 Microsoft Corporation

15.2.7.1 Company Overview

15.2.7.2 Product Portfolio

15.2.7.3 Demographic Reach and Achievements

15.2.7.4 Certifications

15.2.8 Jitterbit,Inc.

15.2.8.1 Company Overview

15.2.8.2 Product Portfolio

15.2.8.3 Demographic Reach and Achievements

15.2.8.4 Certifications

15.2.9 Salesforce, Inc.

15.2.9.1 Company Overview

15.2.9.2 Product Portfolio

15.2.9.3 Demographic Reach and Achievements

15.2.9.4 Certifications

15.2.10 Workato

15.2.10.1 Company Overview

15.2.10.2 Product Portfolio

15.2.10.3 Demographic Reach and Achievements

15.2.10.4 Certifications

15.2.11 Others

16 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Integration Platform as a Service Market: Key Industry Highlights, 2018 and 2032

2. Global Integration Platform as a Service Historical Market: Breakup by Deployment Model (USD Billion), 2018-2023

3. Global Integration Platform as a Service Market Forecast: Breakup by Deployment Model (USD Billion), 2024-2032

4. Global Integration Platform as a Service Historical Market: Breakup by Service Type (USD Billion), 2018-2023

5. Global Integration Platform as a Service Market Forecast: Breakup by Service Type (USD Billion), 2024-2032

6. Global Integration Platform as a Service Historical Market: Breakup by Organisation Size (USD Billion), 2018-2023

7. Global Integration Platform as a Service Market Forecast: Breakup by Organisation Size (USD Billion), 2024-2032

8. Global Integration Platform as a Service Historical Market: Breakup by Industry (USD Billion), 2018-2023

9. Global Integration Platform as a Service Market Forecast: Breakup by Industry (USD Billion), 2024-2032

10. Global Integration Platform as a Service Historical Market: Breakup by Region (USD Billion), 2018-2023

11. Global Integration Platform as a Service Market Forecast: Breakup by Region (USD Billion), 2024-2032

12. North America Integration Platform as a Service Historical Market: Breakup by Country (USD Billion), 2018-2023

13. North America Integration Platform as a Service Market Forecast: Breakup by Country (USD Billion), 2024-2032

14. Europe Integration Platform as a Service Historical Market: Breakup by Country (USD Billion), 2018-2023

15. Europe Integration Platform as a Service Market Forecast: Breakup by Country (USD Billion), 2024-2032

16. Asia Pacific Integration Platform as a Service Historical Market: Breakup by Country (USD Billion), 2018-2023

17. Asia Pacific Integration Platform as a Service Market Forecast: Breakup by Country (USD Billion), 2024-2032

18. Latin America Integration Platform as a Service Historical Market: Breakup by Country (USD Billion), 2018-2023

19. Latin America Integration Platform as a Service Market Forecast: Breakup by Country (USD Billion), 2024-2032

20. Middle East and Africa Integration Platform as a Service Historical Market: Breakup by Country (USD Billion), 2018-2023

21. Middle East and Africa Integration Platform as a Service Market Forecast: Breakup by Country (USD Billion), 2024-2032

22. Global Integration Platform as a Service Market Structure

The market is projected to grow at a CAGR of 38% between 2024 and 2032.

The revenue generated from the market is expected to reach USD 89.80 billion in 2032.

The market is growing due to the growing hybrid IT environments, rising focus on scalability and flexibility, and growing business sector.

Based on the service type, the market is divided into data mapping and transformation, routing and orchestration, integration flow development and life cycle management tools, API life cycle management, business to business (B2B) and cloud integration, Internet of Things (IoT), real-time monitoring and integration and others.

Key players in the industry are Boomi, LP, Celigo, Inc., Informatica, Inc., SnapLogic, Inc., Microsoft Corporation, Jitterbit, Inc., Salesforce, Inc., Workato, SAP SE, and Oracle Corporation, among others.

Based on organisation type, the market is divided into small and medium enterprises and large enterprises.

The market breakup by region North America, Europe, Asia Pacific, Latin America, Middle East, and Africa.

Integration platform as a service (iPaaS) finds applications in industries such as BFSI, consumer goods and retail, education, government and public sector, healthcare and life sciences, media and entertainment, telecommunication and IT, manufacturing, and others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.