Reports

Sale

United States Medical Cannabis Market Size, Share, Demand: By Product: Buds, Oils, Tinctures; By Species: Indica, Sativa, Hybrid; By Application: Chronic Pain, Mental Disorders, Cancer, Others; By Distribution Channel: Dispensaries, Others; Regional Analysis; Market Dynamics: SWOT Analysis; Competitive Landscape; 2024-2032

United States Medical Cannabis Market Outlook

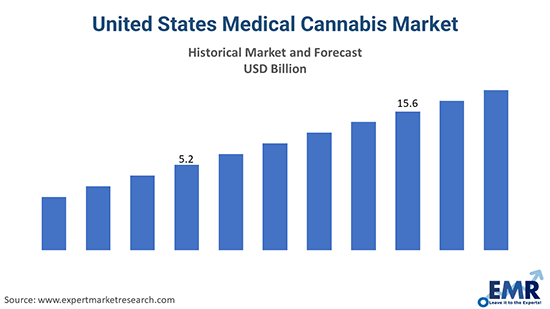

The United States medical cannabis industry attained a value of around USD 15.10 billion in 2023. The market is further expected to grow in the forecast period of 2024-2032 at a CAGR of 12.2% to reach a value of about USD 42.56 billion by 2032.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Segmentation

Cannabis refers to a psychoactive medication extracted from the Cannabaceae family cannabis plant. The drug was used in ancient Indian, Chinese, Egyptian as well as Islamic cultures. These days, cannabis is used in treating a wide range of diseases, such as cancer, chronic pain, depression, arthritis, diabetes, glaucoma, migraines, epilepsy, multi-sclerosis, AIDS, amyotrophic side sclerosis (ALS), Alzheimer's, post-traumatic stress disorder (PTSD), Parkinson's, and Tourette's. Cannabis has also been approved for medicinal use in multiple countries with varying levels of legal constraints due to its therapeutic benefits.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

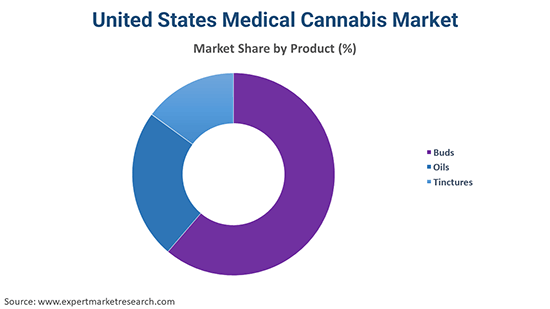

Based on the product, the industry can be divided into:

- Buds

- Oils

- Tinctures

Based on species, the industry is segmented into:

- Indica

- Sativa

- Hybrid

The market can be broadly categorised based on its applications into:

- Chronic Pain

- Mental Disorders

- Cancer

- Others

The distribution channels can be divided into:

- Dispensaries

- Pharmacies

- Online Retailers

The EMR report looks into the regional markets like New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Analysis

The ageing population in the region has played a vital role in raising the market for medical cannabis, as geriatric patients are more prone to developing chronic diseases and need more doctor visits. Clinical trials, R&D, and the commercialisation of indications based on cannabis are also anticipated to catalyse the market growth.

Although spending on health products is less likely to fluctuate, medical marijuana use is subject to unusual shifts in disposable incomes. As a result, higher disposable incomes will have a positive effect on medical cannabis demand. The application sector is being led by the chronic pain segment.

Competitive Landscape

The report presents a detailed analysis of the following key players in the United States medical cannabis industry, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

- Green Man Cannabis

- Los Sueños Farms LLC

- Copperstate Farms, LLC

- Harvest Health & Recreation, Inc.

- GrowHealthy Holdings, LLC

- Vireo Health of New York

- LivWell Enlightened Health LLC

- Others

The EMR report gives an in-depth insight into the market by providing a SWOT analysis as well as an analysis of Porter's Five Forces model.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2017-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Species |

|

| Breakup by Application |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 United States

7 Industry Opportunities and Challenges

8 United States Medical Cannabis Market Analysis

8.1 Key Industry Highlights

8.2 United States Medical Cannabis Historical Market (2018-2023)

8.3 United States Medical Cannabis Market Forecast (2024-2032)

8.4 United States Medical Cannabis Market by Product

8.4.1 Buds

8.4.1.1 Market Share

8.4.1.2 Historical Trend (2018-2023)

8.4.1.3 Forecast Trend (2024-2032)

8.4.2 Oils

8.4.2.1 Market Share

8.4.2.2 Historical Trend (2018-2023)

8.4.2.3 Forecast Trend (2024-2032)

8.4.3 Tinctures

8.4.3.1 Market Share

8.4.3.2 Historical Trend (2018-2023)

8.4.3.3 Forecast Trend (2024-2032)

8.5 United States Medical Cannabis Market by Species

8.5.1 Indica

8.5.1.1 Market Share

8.5.1.2 Historical Trend (2018-2023)

8.5.1.3 Forecast Trend (2024-2032)

8.5.2 Sativa

8.5.2.1 Market Share

8.5.2.2 Historical Trend (2018-2023)

8.5.2.3 Forecast Trend (2024-2032)

8.5.3 Hybrid

8.5.3.1 Market Share

8.5.3.2 Historical Trend (2018-2023)

8.5.3.3 Forecast Trend (2024-2032)

8.6 United States Medical Cannabis Market by Application

8.6.1 Chronic Pain

8.6.1.1 Market Share

8.6.1.2 Historical Trend (2018-2023)

8.6.1.3 Forecast Trend (2024-2032)

8.6.2 Mental Disorders

8.6.2.1 Market Share

8.6.2.2 Historical Trend (2018-2023)

8.6.2.3 Forecast Trend (2024-2032)

8.6.3 Cancer

8.6.3.1 Market Share

8.6.3.2 Historical Trend (2018-2023)

8.6.3.3 Forecast Trend (2024-2032)

8.6.4 Others

8.7 United States Medical Cannabis Market by Distribution Channel

8.7.1 Dispensaries

8.7.1.1 Market Share

8.7.1.2 Historical Trend (2018-2023)

8.7.1.3 Forecast Trend (2024-2032)

8.7.2 Pharmacies

8.7.2.1 Market Share

8.7.2.2 Historical Trend (2018-2023)

8.7.2.3 Forecast Trend (2024-2032)

8.7.3 Online Retailers

8.7.3.1 Market Share

8.7.3.2 Historical Trend (2018-2023)

8.7.3.3 Forecast Trend (2024-2032)

8.8 United States Medical Cannabis Market by Region

8.8.1 Market Share

8.8.1.1 New England

8.8.1.2 Mideast

8.8.1.3 Great Lakes

8.8.1.4 Plains

8.8.1.5 Southeast

8.8.1.6 Southwest

8.8.1.7 Rocky Mountain

8.8.1.8 Far West

9 Regional Analysis

9.1 New England

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Mideast

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

9.3 Great Lakes

9.3.1 Historical Trend (2018-2023)

9.3.2 Forecast Trend (2024-2032)

9.4 Plains

9.4.1 Historical Trend (2018-2023)

9.4.2 Forecast Trend 2024-2032)

9.5 Southeast

9.5.1 Historical Trend (2018-2023)

9.5.2 Forecast Trend (2024-2032)

9.6 Southwest

9.6.1 Historical Trend (2018-2023)

9.6.2 Forecast Trend (2024-2032)

9.7 Rocky Mountain

9.7.1 Historical Trend (2018-2023)

9.7.2 Forecast Trend (2024-2032)

9.8 Far West

9.8.1 Historical Trend (2018-2023)

9.8.2 Forecast Trend (2024-2032)

10 Market Dynamics

10.1 SWOT Analysis

10.1.1 Strengths

10.1.2 Weaknesses

10.1.3 Opportunities

10.1.4 Threats

10.2 Porter’s Five Forces Analysis

10.2.1 Supplier’s Power

10.2.2 Buyer’s Power

10.2.3 Threat of New Entrants

10.2.4 Degree of Rivalry

10.2.5 Threat of Substitutes

10.3 Key Indicators for Demand

10.4 Key Indicators for Price

11 Value Chain Analysis

12 Competitive Landscape

12.1 Market Structure

12.2 Company Profiles

12.2.1 Green Man Cannabis

12.2.1.1 Company Overview

12.2.1.2 Product Portfolio

12.2.1.3 Demographic Reach and Achievements

12.2.1.4 Certifications

12.2.2 Los Sueños Farms LLC

12.2.2.1 Company Overview

12.2.2.2 Product Portfolio

12.2.2.3 Demographic Reach and Achievements

12.2.2.4 Certifications

12.2.3 Copperstate Farms, LLC

12.2.3.1 Company Overview

12.2.3.2 Product Portfolio

12.2.3.3 Demographic Reach and Achievements

12.2.3.4 Certifications

12.2.4 Harvest Health & Recreation, Inc.

12.2.4.1 Company Overview

12.2.4.2 Product Portfolio

12.2.4.3 Demographic Reach and Achievements

12.2.4.4 Certifications

12.2.5 GrowHealthy Holdings, LLC

12.2.5.1 Company Overview

12.2.5.2 Product Portfolio

12.2.5.3 Demographic Reach and Achievements

12.2.5.4 Certifications

12.2.6 Vireo Health of New York

12.2.6.1 Company Overview

12.2.6.2 Product Portfolio

12.2.6.3 Demographic Reach and Achievements

12.2.6.4 Certifications

12.2.7 LivWell Enlightened Health LLC

12.2.7.1 Company Overview

12.2.7.2 Product Portfolio

12.2.7.3 Demographic Reach and Achievements

12.2.7.4 Certifications

12.2.8 Others

13 Industry Events and Developments

List of Key Figures and Tables

1. United States Medical Cannabis Market: Key Industry Highlights, 2018 and 2032

2. United States Medical Cannabis Historical Market: Breakup by Product (USD Billion), 2018-2023

3. United States Medical Cannabis Market Forecast: Breakup by Product (USD Billion), 2024-2032

4. United States Medical Cannabis Historical Market: Breakup by Species (USD Billion), 2018-2023

5. United States Medical Cannabis Market Forecast: Breakup by Species (USD Billion), 2024-2032

6. United States Medical Cannabis Historical Market: Breakup by Application (USD Billion), 2018-2023

7. United States Medical Cannabis Market Forecast: Breakup by Application (USD Billion), 2024-2032

8. United States Medical Cannabis Historical Market: Breakup by Distribution Channel (USD Billion), 2018-2023

9. United States Medical Cannabis Market Forecast: Breakup by Distribution Channel (USD Billion), 2024-2032

10. United States Medical Cannabis Historical Market: Breakup by Region (USD Billion), 2018-2023

11. United States Medical Cannabis Market Forecast: Breakup by Region (USD Billion), 2024-2032

12. United States Medical Cannabis Market Structure

In 2023, the United States medical cannabis market attained a value of nearly USD 15.10 billion.

The market is projected to grow at a CAGR of 12.2% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach about USD 42.56 billion by 2032.

The major drivers of the industry, such as the rising ageing population and clinical trials, increasing disposable income, and the increasing commercialisation of the product, are expected to aid the market growth.

The key market trend guiding the growth of the market includes the rising research and development activities in the industry.

The major regions in the industry are New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

The dominant products of medical cannabis in the industry are buds, oils, and tinctures.

The leading species of the product in the market are indica, sativa, and hybrid.

The major applications of medical cannabis in the industry are chronic pain, mental disorders, and cancer, among others.

The significant distribution channels of the product are dispensaries, pharmacies, and online retailers.

The major players in the industry are Green Man Cannabis, Los Sueños Farms LLC, Copperstate Farms, LLC, Harvest Health & Recreation, Inc., and GrowHealthy Holdings, LLC, among others.

The United States medical cannabis market attained a value of USD 15.10 billion in 2023 driven by rising geriatric patients. Aided by the rising research and development activities, the market is expected to witness a further growth in the forecast period of 2024-2032, growing at a CAGR of 12.2%. The United States medical cannabis market is projected to reach USD 42.56 billion by 2032.

EMR’s meticulous research methodology delves deep into the market, covering the macro and micro aspects of the industry. Based on products, the market can be segmented into buds, oils, and tinctures. On the basis of applications, the industry is divided into chronic pain, mental disorders, cancer, and others. By species, the market is categorised into indica, sativa, and hybrid. Based on distribution channel, the industry is segmented into dispensaries, pharmacies, and online retailers. The major regional markets for medical cannabis in the United States are New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West. The key players in the above market include Green Man Cannabis, Los Sueños Farms LLC, Copperstate Farms, LLC, Harvest Health & Recreation, Inc., GrowHealthy Holdings, LLC, Vireo Health of New York, and LivWell Enlightened Health LLC, among others.

EMR’s research methodology uses a combination of cutting-edge analytical tools and the expertise of their highly accomplished team, thus, providing their customers with market insights that are accurate, actionable, and help them remain ahead of their competition.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.