Reports

Sale

Global Household Cleaning Products Market Size, Industry: By Product Type: Laundry Detergents, Surface Cleaners, Dishwashing Products, Others; By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online, Others; Regional Analysis; Market Dynamics: SWOT Analysis; Competitive Landscape; 2024-2032

Global Household Cleaning Products Market Outlook

The global household cleaning products market size is projected to grow at a CAGR of 4.3% between 2024 and 2032.

Key Takeaways:

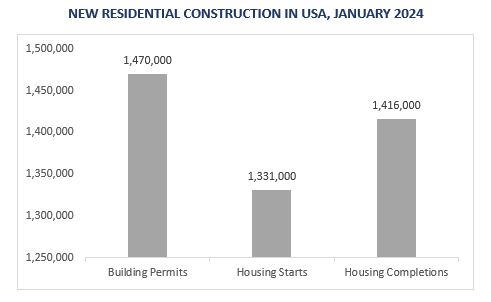

- Data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development showed a rise in residential buildings, completing 14,16,000 constructions in January 2024, boosting global household cleaning product market.

- The Swachh Bharat Mission, the world's largest sanitation initiative, led to the construction of over 100 million household toilets, raising sanitation coverage to 100% by 2019. This surge in cleanliness practices boosted the global household cleaning products market growth.

- Government initiatives, health organizations, and media campaigns play pivotal roles in promoting cleanliness practices, thereby strengthening the global household cleaning products market.

Household cleaners are products made for cleaning surfaces in homes, available as liquids, sprays, powders, or wipes. They eliminate dirt, stains, and germs with ingredients like water, detergents, and disinfectants, ensuring a clean, hygienic living space. Specific cleaners target tasks such as glass or floor cleaning, requiring careful use due to their chemical nature for optimal efficiency and surface protection.

As per the global household cleaning products market report, the industry experiences a notable impact from the growing emphasis on health and hygiene, resulting in a rise in the utilization of household cleaning products, particularly disinfectants. Vital contributions from government initiatives, health organizations, and media initiatives encourage cleanliness practices bolstering the market.

The construction of residential buildings is on the rise according to data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, which indicated that the number of housing completion in the United States reached 1,416,000 in January 2024, thus, fuelling global household cleaning products market.

Key Trends and Developments

The global household cleaning products market growth is propelled by factors such as environmental consciousness, shifts in lifestyles, the growth of e-commerce, and a focus on individual and societal well-being.

February 2024

iFlytek, an AI frontrunner, entered the smart home appliance industry with the AI Sweeping and Mopping Robot X3, delivering a cutting-edge cleaning solution. Featuring advanced AI technology, it detects stains and navigates strategically for efficient cleaning.

February 2024

Jelmar, LLC, producer of household and industrial cleaning solutions such as CLR Brands™ and Tarn-X®, introduces CLR PRO MAX™ industrial descaler. Engineered for rapid, thorough cleaning, it targets scale and rust in liquid-cooling equipment.

September 2023

Dow unveiled EcoSense™ 2470 surfactant that presents a sustainable option for customer formulations with cutting-edge carbon capture technology in the home care sector. Created alongside LanzaTech Global, Inc., it played a role in a circular carbon economy while upholding excellent performance standards.

June 2023

Puracy, a plant-based cleaning brand, introduced a new refill system allowing users to 'Crack, Snap, and Clean' in just 10 seconds. The aluminum-can format and reusable bottle simplify the refill process, removing existing product refill challenges.

Environmental concerns

As per the global household cleaning products market analysis, increasing environmental awareness and concerns over conventional cleaning products' adverse effects drive the household cleaner industry. Consumers seek eco-friendly solutions, spurring companies to develop biodegradable, non-toxic options with certifications like cruelty-free, meeting evolving regulations.

Lifestyle changes

The global household cleaning products market developments are impacted by the shift towards urbanization, which has altered lifestyles, highlighting the need for compact living spaces and heightened cleanliness awareness. Urban residents demand efficient, time-saving cleaning items, a trend amplified by busy schedules.

E-commerce growth

The global household cleaning products market has seen substantial growth due to the rise of e-commerce, offering consumers enhanced accessibility and convenience. Online platforms enable browsing, comparison, and purchase of cleaning products, benefiting brands, and reaching remote areas. E-commerce democratizes the market, enabling smaller brands to compete, and fostering innovation and variety.

Individual and societal wellness

Cleaning products play a vital role in preserving personal hygiene, eliminating dirt, minimizing germs, extending product longevity, and fostering healthier, more comfortable living and working spaces. Essential for cleanliness, hygiene, and sanitation, these products cater to various needs such as surface cleaning and laundry care within the diverse household cleaning products market.

Global Household Cleaning Products Market Trends

The widespread utilization of modern appliances such as dishwashers and washing machines has played a pivotal role in heightening the usage of diverse cleaning products like laundry and dishwasher detergents on a global scale. Furthermore, the increasing accessibility of branded cleaning goods in online and physical stores has expedited the global household cleaning products market growth in recent years.

Cultural perceptions of cleanliness and periodic trends in seasonal cleaning also impact consumer purchasing behaviours, adding to industry expansion. Additionally, advancements in product formulations, textures, and fragrances contribute to a favourable market forecast.

Market Segmentation

Global Household Cleaning Products Report and Forecast 2024-2032 offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

- Laundry Detergents

- Surface Cleaners

- Dishwashing Products

- Others

Market Breakup by Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

The global household cleaning products market offers a diverse array of products tailored to different cleaning requirements, encompassing surface cleaners designed to address various surfaces such as kitchen countertops, bathroom fixtures, glass surfaces, and electronics

The versatility of surface cleaners renders them indispensable for a variety of cleaning chores, appealing widely to consumers. Given the constant need for cleanliness in everyday life, surface cleaners fulfil a crucial role, often available in convenient spray or wipe forms for ease of use. Their user-friendly design is attractive to those seeking efficient and straightforward cleaning solutions.

Meanwhile, laundry detergents offer numerous advantages, boasting powerful cleaning properties capable of tackling a range of stains including blood, sweat, milk, and oil spills.

Based on distribution channel, the global household cleaning products market share is led by supermarket/hypermarket

Collaborations between manufacturers and these distribution channels have optimized supply chains, ensuring a steady availability of products. As consumers increasingly prioritize factors like eco-friendliness and cost-effectiveness, supermarkets and hypermarkets are adeptly meeting these preferences.

Moreover, the online retail channel is expanding rapidly, with platforms promising same-day deliveries, further driving its growth.

Competitive Landscape

The global household cleaning products market competitiveness is characterized by providing a varied array of offerings, such as air fresheners, laundry products, dishwashing detergents, disinfectant sprays, household cleaners, and personal care items.

Unilever PLC, founded in 1929 and based in the United Kingdom, is a distinguished manufacturer and distributor of fast-moving consumer goods. Its extensive product portfolio spans food items, beauty and personal care products, beverages, home care products, as well as vitamins, minerals, and supplements.

Reckitt Benckiser Group PLC, established in 2007 and headquartered in the United Kingdom, offers a diverse array of products including air fresheners, laundry detergents, dishwashing liquids, disinfectant sprays, household cleaners, and personal care items.

Henkel AG & Co. KGaA, founded in 1876 and based in Germany, operates in both industrial and consumer sectors, providing a range of products such as popular hair care products, laundry detergents, fabric softeners, as well as adhesives, sealants, and functional coatings.

The Procter & Gamble Company, established in 1837 and headquartered in the United States, is a leading manufacturer and marketer of fast-moving consumer goods. Its product line includes conditioners, shampoos, male and female razors and blades, toothbrushes, toothpaste, dishwashing liquids, detergents, surface cleaners, and air fresheners.

Other key players in the global household cleaning products market are Kao Corporation, S.C. Johnson & Son Inc., Colgate-Palmolive Company, Church & Dwight Co., Inc., McBride plc, and Goodmaid Chemical Corporation Bhd among others.

Global Household Cleaning Products Market by Region

In North America, the household cleaning industry experiences growth influenced by various market factors. Increased emphasis on health and hygiene, heightened by ongoing cleanliness concerns, has spurred a higher demand for efficient cleaning solutions in the region. Technological progressions further fuel industry innovation, with smart cleaning gadgets and advanced formulations gaining popularity.

In Asia Pacific, urbanization and shifting lifestyles have led to a surge in household numbers, thereby increasing the demand for convenient and effective cleaning items. Moreover, consumer preferences for environmentally friendly options have fuelled the need for sustainable, non-toxic cleaning products.

The Swachh Bharat Mission hailed as the world's largest sanitation initiative, resulted in the building of more than 100 million individual household toilets. This initiative raised sanitation coverage from 39% in 2014 to 100% in 2019, with approximately 600,000 villages declaring themselves Open Defecation Free (ODF). This increasing usage of cleaning products subsequently bolstered the global household cleaning products market.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Household Cleaning Products Market Analysis

8.1 Key Industry Highlights

8.2 Global Household Cleaning Products Historical Market (2018-2023)

8.3 Global Household Cleaning Products Market Forecast (2024-2032)

8.4 Global Household Cleaning Products Market by Product Type

8.4.1 Laundry Detergents

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Surface Cleaners

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.4.3 Dishwashing Products

8.4.3.1 Historical Trend (2018-2023)

8.4.3.2 Forecast Trend (2024-2032)

8.4.4 Others

8.5 Global Household Cleaning Products Market by Distribution Channel

8.5.1 Supermarkets/Hypermarkets

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Convenience Stores

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Online

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Others

8.6 Global Household Cleaning Products Market by Region

8.6.1 North America

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Europe

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Asia Pacific

8.6.3.1 Historical Trend (2018-2023)

8.6.3.2 Forecast Trend (2024-2032)

8.6.4 Latin America

8.6.4.1 Historical Trend (2018-2023)

8.6.4.2 Forecast Trend (2024-2032)

8.6.5 Middle East and Africa

8.6.5.1 Historical Trend (2018-2023)

8.6.5.2 Forecast Trend (2024-2032)

9 North America Household Cleaning Products Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Household Cleaning Products Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Household Cleaning Products Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Household Cleaning Products Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Household Cleaning Products Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Competitive Landscape

15.1 Market Structure

15.2 Company Profiles

15.2.1 Unilever PLC

15.2.1.1 Company Overview

15.2.1.2 Product Portfolio

15.2.1.3 Demographic Reach and Achievements

15.2.1.4 Certifications

15.2.2 Reckitt Benckiser Group PLC

15.2.2.1 Company Overview

15.2.2.2 Product Portfolio

15.2.2.3 Demographic Reach and Achievements

15.2.2.4 Certifications

15.2.3 Henkel AG & Co. KGaA

15.2.3.1 Company Overview

15.2.3.2 Product Portfolio

15.2.3.3 Demographic Reach and Achievements

15.2.3.4 Certifications

15.2.4 Procter & Gamble Company

15.2.4.1 Company Overview

15.2.4.2 Product Portfolio

15.2.4.3 Demographic Reach and Achievements

15.2.4.4 Certifications

15.2.5 Kao corporation

15.2.5.1 Company Overview

15.2.5.2 Product Portfolio

15.2.5.3 Demographic Reach and Achievements

15.2.5.4 Certifications

15.2.6 S.C. Johnson & Son Inc.

15.2.6.1 Company Overview

15.2.6.2 Product Portfolio

15.2.6.3 Demographic Reach and Achievements

15.2.6.4 Certifications

15.2.7 Colgate-Palmolive Company

15.2.7.1 Company Overview

15.2.7.2 Product Portfolio

15.2.7.3 Demographic Reach and Achievements

15.2.7.4 Certifications

15.2.8 Church & Dwight Co., Inc.

15.2.8.1 Company Overview

15.2.8.2 Product Portfolio

15.2.8.3 Demographic Reach and Achievements

15.2.8.4 Certifications

15.2.9 McBride plc

15.2.9.1 Company Overview

15.2.9.2 Product Portfolio

15.2.9.3 Demographic Reach and Achievements

15.2.9.4 Certifications

15.2.10 Goodmaid Chemicals Corporation Sdn. Bhd

15.2.10.1 Company Overview

15.2.10.2 Product Portfolio

15.2.10.3 Demographic Reach and Achievements

15.2.10.4 Certifications

15.2.11 Others

16 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Household Cleaning Products Market: Key Industry Highlights, 2018 and 2032

2. Global Household Cleaning Products Historical Market: Breakup by Product Type (USD Million), 2018-2023

3. Global Household Cleaning Products Market Forecast: Breakup by Product Type (USD Million), 2024-2032

4. Global Household Cleaning Products Historical Market: Breakup by Distribution Channels (USD Million), 2018-2023

5. Global Household Cleaning Products Market Forecast: Breakup by Distribution Channels (USD Million), 2024-2032

6. Global Household Cleaning Products Historical Market: Breakup by Region (USD Million), 2018-2023

7. Global Household Cleaning Products Market Forecast: Breakup by Region (USD Million), 2024-2032

8. North America Household Cleaning Products Historical Market: Breakup by Country (USD Million), 2018-2023

9. North America Household Cleaning Products Market Forecast: Breakup by Country (USD Million), 2024-2032

10. Europe Household Cleaning Products Historical Market: Breakup by Country (USD Million), 2018-2023

11. Europe Household Cleaning Products Market Forecast: Breakup by Country (USD Million), 2024-2032

12. Asia Pacific Household Cleaning Products Historical Market: Breakup by Country (USD Million), 2018-2023

13. Asia Pacific Household Cleaning Products Market Forecast: Breakup by Country (USD Million), 2024-2032

14. Latin America Household Cleaning Products Historical Market: Breakup by Country (USD Million), 2018-2023

15. Latin America Household Cleaning Products Market Forecast: Breakup by Country (USD Million), 2024-2032

16. Middle East and Africa Household Cleaning Products Historical Market: Breakup by Country (USD Million), 2018-2023

17. Middle East and Africa Household Cleaning Products Market Forecast: Breakup by Country (USD Million), 2024-2032

18. Global Household Cleaning Products Market Structure

The market is projected to grow at a CAGR of 4.3% between 2024 and 2032.

The global household cleaning products market demand is propelled by factors such as environmental consciousness, shifts in lifestyles, the growth of e-commerce, and a focus on individual and societal well-being.

The market is categorised according to its product type, which includes laundry detergents, surface cleaners, dishwashing products, and others.

Who are the key players in the global household cleaning products industry, according to the report?

The market key players are Unilever PLC, Reckitt Benckiser Group PLC, Henkel AG & Co. KGaA, Procter & Gamble Company, Kao Corporation, S.C. Johnson & Son Inc., Colgate-Palmolive Company, Church & Dwight Co., Inc., McBride plc, and Goodmaid Chemical Corporation Bhd among others.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The various distribution channels of the market are supermarkets and hypermarkets, convenience stores, and online, among others. Currently, supermarkets and hypermarkets hold the largest market share.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.