Reports

Sale

Global Environmental Monitoring Market Size, Share, Report: By Product Type: Environmental Monitors, Fixed Environmental Monitors, Portable Environmental Monitors, Environmental Sensors, Analogue Sensors, Digital Sensors, Others; By Sampling Method; By Component; By Application; Regional Analysis; Competitive Landscape; 2024-2032

Global Environmental Monitoring Market Size

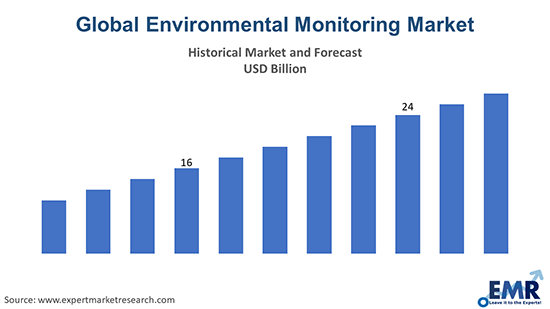

The global environmental monitoring market is expected to rise from USD 22.71 billion in 2023 to reach USD 39.39 billion by 2032, growing at a CAGR of 6.30% between 2024 and 2032.

Environmental Monitoring Market Outlook

- In 2022, approximately 66 million tons of pollution were emitted into the atmosphere in the United States, contributing significantly to the formation of ozone, particles, acid deposition, and visibility impairment.

- According to the World Health Organisation (WHO), air pollution is responsible for an estimated seven million deaths worldwide annually, with almost all the global population exposed to air pollution levels exceeding WHO guideline limits.

- Some successful examples of environmental regulation include the implementation of the Clean Air Act and the Clean Water Act in the United States, as they have significantly contributed to cleaner air and water in the country.

Environmental Monitoring Market Growth Rate

Environmental monitoring is the method of tracking and regulating the condition of the environment after the industrial processes and functions have been completed. Environmental monitoring aims at measuring the success of environmental policy targets and helps to recognise growing environmental issues.

The rising need for better natural resource management, a surge in health concerns, and increased deaths due to the rise in pollution levels are stimulating environmental monitoring market growth. Also, nine billion people are expected to live in cities or urban centers by 2050, leading to resource shortages and the need for innovation and digital technology to reduce energy consumption and enhance quality of life.

Additionally, increasing government support for the emergence of environmental checking stations, stricter regulations that encourage the increased adoption of pollution checking technologies, and technological advances in the field of environmental sensors are driving the environmental testing market growth. Implementation and expansion of pollution monitoring systems by small and medium-sized enterprises in emerging economies is also contributing to the market's expansion.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Implementation of laws and initiatives targeted at decreasing pollution; industrialisation; and technological advancements in monitoring devices are impacting the environmental monitoring market development

April 2024

The Massachusetts Department of Environmental Protection (MassDEP) is enhancing its air quality monitoring efforts by deploying over 200 small community air sensors across the state. This initiative, supported by a USD 775 thousand grant, aims to expand the air quality sensing network using more affordable and less intrusive "PurpleAir" sensors.

April 2024

China has established the world's largest ecological monitoring network system, demonstrating its commitment to addressing climate change challenges, promoting green and low-carbon development, and advancing scientific and technological projects.

March 2021

Sedaru Inc., a leading provider of water utility management software, was acquired by Danaher's Environmental Water Group. This acquisition aimed to integrate Sedaru's turnkey software-as-a-service application with Aquatic Informatics' solutions to improve operational efficiency of wastewater system assets like pipes, valves, and pumps.

Technological Advancements in Monitoring Devices

The development of compact air quality sensors like the PurpleAir PA-II-SD has revolutionised real-time air quality monitoring for both indoor and outdoor environments. These sensors leverage advanced technology to provide accurate and continuous data on pollutants like PM2.5 and PM10.

Increased Government Support and Regulations

Countries like China have implemented strict regulations to combat air pollution, leading to a surge in demand for air quality monitoring solutions. The deployment of networks like the China National Environmental Monitoring Center (CNEMC) showcases government support for environmental monitoring initiatives.

Rising Awareness and Adoption of Monitoring Solutions

Organisations like the World Health Organisation (WHO) have been advocating for the adoption of water quality monitoring technologies to ensure safe drinking water globally. Devices such as the Water Quality Test Kit by LaMotte are gaining popularity due to increased awareness about the impact of water pollution on public health.

Global Urbanisation and Industrialisation

Cities like Singapore have implemented Smart Environmental Monitoring System (SEMS) to manage urban pollution effectively as it integrates various sensors to monitor air quality, noise levels, and weather conditions in real-time. Such initiatives demonstrate how urbanisation drives the demand for advanced monitoring technologies, fostering environmental monitoring market expansion.

Environmental Monitoring Market Trends

The demand for environmental monitoring & analysis is driven by factors such as the growing global population, implementation of policies and programs aimed at reducing pollution caused to air, soil, and water, and the increased government support for pollution prevention and control. The construction of various environmental monitoring stations, the design of environmentally friendly manufacturing environments, and the reduction of export tariffs on innovation monitoring across emerging and developed markets are the key factors expected to fuel the environmental sensor market growth.

Developing high-end nanotechnology-based environmental monitoring products, along with an ever-growing oil and gas industry, will further propel the environmental monitoring market growth. However, the excessive costs of using environmental monitoring technologies, delays in implementing pollution control legislation, and environmental innovation export barriers in emerging markets are factors that may hinder the market growth. The major market challenges faced by market players and investors are uncertainty in regulations and standards across emerging countries.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Environmental Monitoring Industry Segmentation

The EMR’s report titled “Environmental Monitoring Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

- Environmental Monitors

- Fixed Environmental Monitors

- Portable Environmental Monitors

- Environmental Sensors

- Analogue Sensors

- Digital Sensors

- Environmental Monitoring Software

Market Breakup by Sampling Method

- Continuous Monitoring

- Active Monitoring

- Passive Monitoring

- Intermittent Monitoring

Market Breakup by Component

- Particulate Detection

- Chemical Detection

- Biological Detection

- Temperature Sensing

- Moisture Detection

- Noise Measurement

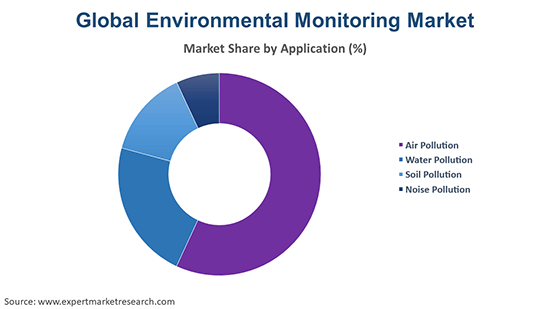

Market Breakup by Application

- Air Pollution

- Water Pollution

- Soil Pollution

- Noise Pollution

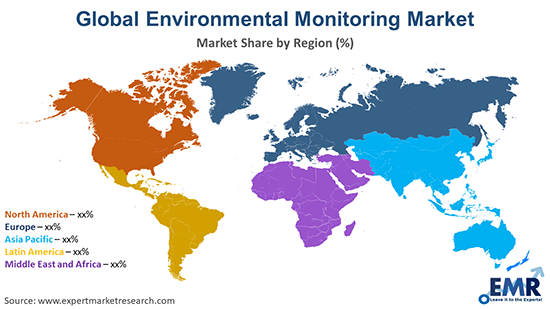

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Environmental Monitoring Market Share

Particulate detection components are high in demand due to the increasing awareness of the health risks associated with airborne particles

Particulate detection segment focuses on monitoring particulate matter in the environment, such as PM2.5 and PM10, which are crucial indicators of air quality. The demand for particulate detection technologies is driven by the increasing awareness of the health risks associated with airborne particles, especially in urban areas with high pollution levels.

Biological detection focuses on monitoring biological agents, such as bacteria, viruses, and other microorganisms, which can impact environmental quality. These detection systems are essential for assessing the microbial content of water sources, soil, and air. Biological detection technologies help in identifying potential health hazards, ensuring the safety of ecosystems, and guiding remediation efforts in case of contamination.

Moisture detection technologies are also gaining traction as they help in optimising irrigation practices, predicting drought conditions, and managing water resources efficiently to support agricultural productivity and ecosystem resilience. Meanwhile, noise measurement systems are utilised to monitor noise pollution levels in urban, industrial, and residential areas. Noise measurement technologies has helped in increasing noise monitoring system market size as they play a key role in urban planning, infrastructure development, and regulatory compliance to mitigate noise pollution effects.

Fixed environmental monitors hold a significant market share as they are used in critical environmental zones for early detection of any environmental issues

Fixed environmental monitors are stationary monitoring devices installed at specific locations to continuously monitor environmental parameters like air quality, water quality, and soil conditions. They provide real-time data and are crucial for long-term monitoring and trend analysis. Fixed environmental monitors dominate the environmental monitoring market share as they are commonly used in industrial areas, urban centers, and critical environmental zones to ensure ongoing surveillance and early detection of any environmental issues.

Portable environmental monitors are handheld or mobile monitoring devices that can be easily transported to various locations for on-the-go monitoring. Portable environmental monitors are versatile and ideal for conducting spot checks, assessing environmental conditions in various settings, and responding to emergencies. As per environmental monitoring market analysis, they are valuable for fieldwork, environmental assessments, and rapid monitoring needs.

Leading Companies in the Environmental Monitoring Market

Market players are focused on deploying advanced environmental monitoring sensors and software to cater to the growing demand for environmental monitoring solutions across various applications such as air, water, and soil pollution monitoring.

Danaher Corporation, founded in 1969 and headquartered in Washington, United States, is a diversified conglomerate known for designing, manufacturing, and marketing professional, medical, industrial, and commercial products and services. Within the realm of environmental monitoring, Danaher offers a range of solutions including sensors, instruments, software, and services for monitoring air, water, and soil quality.

Emerson Electric Co., established in 1890 and based in Missouri, United States, is a global technology and engineering company renowned for its environmental monitoring solutions that cater to air, water, and soil quality monitoring needs. Emerson's expertise in automation and control systems complements their environmental monitoring capabilities.

E.S.I. Environmental Sensors Inc., founded in 1993 and headquartered in British Columbia, Canada, specialises in manufacturing environmental monitoring sensors and instrumentation. E.S.I. Environmental Sensors' dedication to developing reliable and accurate monitoring devices has established them as a reputable provider in the market.

General Electric Company, with a founding year of 1892 and headquarters in Massachusetts, United States, is a multinational conglomerate offering a range of products and services for monitoring air, water, and soil quality, encompassing sensors, instrumentation, and software solutions.

Other major environmental monitoring companies in the market are Honeywell International, Inc., Agilent Technologies, Inc., TE Connectivity Ltd., and Siemens AG, among others.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Environmental Monitoring Market Analysis by Region

Asia Pacific leads the market due to its increased government support for environmental monitoring stations

North America holds a significant share in the environmental monitoring market, with the United States Environmental Protection Agency (EPA) playing a crucial role in driving stringent pollution regulations and fostering the adoption of pollution monitoring technologies. The region also benefits from a high proportion of smart city initiatives and progressive industrial manufacturing practices. For instance, the EPA's National Ambient Air Quality Standards (NAAQS) mandate the continuous monitoring of air pollutants.

The Asia Pacific region is expected to witness the highest growth rate in the market, primarily due to increased government support for environmental monitoring stations, strict regulations promoting pollution monitoring technologies, and advancements in environmental sensor technologies. The Chinese government has implemented the China National Environmental Monitoring Center (CNEMC) to establish a comprehensive air quality monitoring network across the country, driving the demand for air pollution monitoring solutions.

Europe also accounts for a notable share of the global environmental monitoring market due to a strong focus on environmental sustainability, leading to the adoption of advanced monitoring technologies and the implementation of stringent environmental regulations to combat pollution. The European Union's Air Quality Directive and Water Framework Directive have mandated the continuous monitoring of air and water quality, respectively, across member states, driving the demand for environmental monitoring solutions.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Sampling Method |

|

| Breakup by Component |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Environmental Monitoring Market Analysis

8.1 Key Industry Highlights

8.2 Global Environmental Monitoring Historical Market (2018-2023)

8.3 Global Environmental Monitoring Market Forecast (2024-2032)

8.4 Global Environmental Monitoring Market by Product Type

8.4.1 Environmental Monitors

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Fixed Environmental Monitors

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.4.3 Portable Environmental Monitors

8.4.3.1 Historical Trend (2018-2023)

8.4.3.2 Forecast Trend (2024-2032)

8.4.4 Environmental Sensors

8.4.4.1 Historical Trend (2018-2023)

8.4.4.2 Forecast Trend (2024-2032)

8.4.5 Analogue Sensors

8.4.5.1 Historical Trend (2018-2023)

8.4.5.2 Forecast Trend (2024-2032)

8.4.6 Digital Sensors

8.4.6.1 Historical Trend (2018-2023)

8.4.6.2 Forecast Trend (2024-2032)

8.4.7 Environmental Monitoring Software

8.4.7.1 Historical Trend (2018-2023)

8.4.7.2 Forecast Trend (2024-2032)

8.5 Global Environmental Monitoring Market by Sampling Method

8.5.1 Continuous Monitoring

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Active Monitoring

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Passive Monitoring

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Intermittent Monitoring

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.6 Global Environmental Monitoring Market by Component

8.6.1 Particulate Detection

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Chemical Detection

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Biological Detection

8.6.3.1 Historical Trend (2018-2023)

8.6.3.2 Forecast Trend (2024-2032)

8.6.4 Temperature Sensing

8.6.4.1 Historical Trend (2018-2023)

8.6.4.2 Forecast Trend (2024-2032)

8.6.5 Moisture Detection

8.6.5.1 Historical Trend (2018-2023)

8.6.5.2 Forecast Trend (2024-2032)

8.6.6 Noise Measurement

8.6.6.1 Historical Trend (2018-2023)

8.6.6.2 Forecast Trend (2024-2032)

8.7 Global Environmental Monitoring Market by Application

8.7.1 Air Pollution

8.7.1.1 Historical Trend (2018-2023)

8.7.1.2 Forecast Trend (2024-2032)

8.7.2 Water Pollution

8.7.2.1 Historical Trend (2018-2023)

8.7.2.2 Forecast Trend (2024-2032)

8.7.3 Soil Pollution

8.7.3.1 Historical Trend (2018-2023)

8.7.3.2 Forecast Trend (2024-2032)

8.7.4 Noise Pollution

8.7.4.1 Historical Trend (2018-2023)

8.7.4.2 Forecast Trend (2024-2032)

8.8 Global Environmental Monitoring Market by Region

8.8.1 North America

8.8.1.1 Historical Trend (2018-2023)

8.8.1.2 Forecast Trend (2024-2032)

8.8.2 Europe

8.8.2.1 Historical Trend (2018-2023)

8.8.2.2 Forecast Trend (2024-2032)

8.8.3 Asia Pacific

8.8.3.1 Historical Trend (2018-2023)

8.8.3.2 Forecast Trend (2024-2032)

8.8.4 Latin America

8.8.4.1 Historical Trend (2018-2023)

8.8.4.2 Forecast Trend (2024-2032)

8.8.5 Middle East and Africa

8.8.5.1 Historical Trend (2018-2023)

8.8.5.2 Forecast Trend (2024-2032)

9 North America Environmental Monitoring Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Environmental Monitoring Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Environmental Monitoring Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Environmental Monitoring Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Environmental Monitoring Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Value Chain Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Company Profiles

16.2.1 Danaher Corporation

16.2.1.1 Company Overview

16.2.1.2 Product Portfolio

16.2.1.3 Demographic Reach and Achievements

16.2.1.4 Certifications

16.2.2 Emerson Electric Co.

16.2.2.1 Company Overview

16.2.2.2 Product Portfolio

16.2.2.3 Demographic Reach and Achievements

16.2.2.4 Certifications

16.2.3 E.S.I. Environmental Sensors Inc.

16.2.3.1 Company Overview

16.2.3.2 Product Portfolio

16.2.3.3 Demographic Reach and Achievements

16.2.3.4 Certifications

16.2.4 General Electric Company

16.2.4.1 Company Overview

16.2.4.2 Product Portfolio

16.2.4.3 Demographic Reach and Achievements

16.2.4.4 Certifications

16.2.5 Honeywell International, Inc.

16.2.5.1 Company Overview

16.2.5.2 Product Portfolio

16.2.5.3 Demographic Reach and Achievements

16.2.5.4 Certifications

16.2.6 Agilent Technologies, Inc.

16.2.6.1 Company Overview

16.2.6.2 Product Portfolio

16.2.6.3 Demographic Reach and Achievements

16.2.6.4 Certifications

16.2.7 TE Connectivity Ltd.

16.2.7.1 Company Overview

16.2.7.2 Product Portfolio

16.2.7.3 Demographic Reach and Achievements

16.2.7.4 Certifications

16.2.8 Siemens AG

16.2.8.1 Company Overview

16.2.8.2 Product Portfolio

16.2.8.3 Demographic Reach and Achievements

16.2.8.4 Certifications

16.2.9 Others

17 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Environmental Monitoring Market: Key Industry Highlights, 2018 and 2032

2. Global Environmental Monitoring Historical Market: Breakup by Product Type (USD Billion), 2018-2023

3. Global Environmental Monitoring Market Forecast: Breakup by Product Type (USD Billion), 2024-2032

4. Global Environmental Monitoring Historical Market: Breakup by Sampling Method (USD Billion), 2018-2023

5. Global Environmental Monitoring Market Forecast: Breakup by Sampling Method (USD Billion), 2024-2032

6. Global Environmental Monitoring Historical Market: Breakup by Component (USD Billion), 2018-2023

7. Global Environmental Monitoring Market Forecast: Breakup by Component (USD Billion), 2024-2032

8. Global Environmental Monitoring Historical Market: Breakup by Application (USD Billion), 2018-2023

9. Global Environmental Monitoring Market Forecast: Breakup by Application (USD Billion), 2024-2032

10. Global Environmental Monitoring Historical Market: Breakup by Region (USD Billion), 2018-2023

11. Global Environmental Monitoring Market Forecast: Breakup by Region (USD Billion), 2024-2032

12. North America Environmental Monitoring Historical Market: Breakup by Country (USD Billion), 2018-2023

13. North America Environmental Monitoring Market Forecast: Breakup by Country (USD Billion), 2024-2032

14. Europe Environmental Monitoring Historical Market: Breakup by Country (USD Billion), 2018-2023

15. Europe Environmental Monitoring Market Forecast: Breakup by Country (USD Billion), 2024-2032

16. Asia Pacific Environmental Monitoring Historical Market: Breakup by Country (USD Billion), 2018-2023

17. Asia Pacific Environmental Monitoring Market Forecast: Breakup by Country (USD Billion), 2024-2032

18. Latin America Environmental Monitoring Historical Market: Breakup by Country (USD Billion), 2018-2023

19. Latin America Environmental Monitoring Market Forecast: Breakup by Country (USD Billion), 2024-2032

20. Middle East and Africa Environmental Monitoring Historical Market: Breakup by Country (USD Billion), 2018-2023

21. Middle East and Africa Environmental Monitoring Market Forecast: Breakup by Country (USD Billion), 2024-2032

22. Global Environmental Monitoring Market Structure

In 2023, the global environmental monitoring market attained a value of nearly USD 22.71 billion.

The market is projected to grow at a CAGR of 6.30% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to USD 39.39 billion by 2032.

Major market drivers are the growing oil and gas industry, increasing global population, implementation of laws and initiatives targeted at decreasing pollution produced by air, soil, and water, and building of various environmental monitoring stations.

Key trends aiding market expansion include the development of high-end nanotechnology-based environmental monitoring products, and the increased support of various governments for pollution prevention and control.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The product types in the market are environmental monitors, fixed environmental monitors, portable environmental monitors, environmental sensors, analogue sensors, digital sensors, and environmental monitoring software.

The various sampling methods include continuous monitoring, active monitoring, passive monitoring, and intermittent monitoring.

Based on components, the market can be divided into particulate detection, chemical detection, biological detection, temperature sensing, moisture detection, and noise measurement.

Key players in the market are Danaher Corporation, Emerson Electric Co., E.S.I. Environmental Sensors Inc., General Electric Company, Honeywell International, Inc., Agilent Technologies, Inc., TE Connectivity Ltd., and Siemens AG, among others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.