3 Reasons Digital Fraudsters Might Target Your Organization

If your organization is working to expand its digital user base, exposure is a great strategy. But the wrong kind of exposure can make your business the perfect target for fraud rings, bot attacks, and other online threats. If you want to guard against these threats, you want to ensure your business doesn’t look like an appealing target.

The world of online fraud detection has changed significantly in recent years. If you aren’t an expert, you might feel intimidated by this fast-paced, high-stakes game of cat-and-mouse. But with the right tools, you can secure growth for your company and keep the bad guys at bay—even if you don’t have a degree in computer science.

As important as knowing how to detect fraud is, it’s also vital to know what not to do along the way. Here are three signs that digital fraudsters might target your business.

You Use PII for ID Verification

When it comes to authenticating new users, you simply can’t trust that people are always who they claim to be. You need accurate, robust identity verification tools to ensure your genuine customers can enroll easily and the bad guys stay out, where they belong.

PII-based ID verification systems don’t cut it anymore. With so much compromised, stolen, and leaked PII available for purchase on the darknet, fraudsters have everything they need to fool these outdated defense strategies. Instead, modern fraud detection tools use the power of behavioral analytics to catch bad actors at the point of attack.

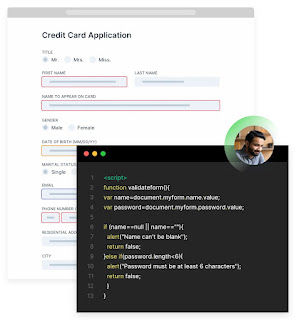

Instead of examining static PII to assess risk, behavioral analytics tools capture your users’ clicks, swipes, and keystrokes as they interact with your site forms. This software spots indicators that a user is unfamiliar with the PII they’re inputting. Then, in real time, the system flags the user as “risky,” so your step-up verification measures can intervene rapidly.

You Don’t Leverage Crowd-Level Monitoring to Detect Fraud Rings

Fraud rings are becoming increasingly sophisticated. Cunning cybercriminals strike quickly, without warning, and can make off with incredible sums before you even realize something’s wrong. If your organization’s fraud detection systems can’t see the whole picture, odds are the bad guys know it and will use your weaknesses against you.

One of the best ways you can leverage behavioral analytics technology is to monitor digital identity at scale. This software simultaneously reads the digital body language of all your site users, visualizes crowd-level behavior, and identifies spikes in risky activity. With modern fraud detection tools, you’ll receive alerts about behavior associated with fraud rings, along with every relevant user session ID.

You Don’t Take Advantage of Identity Orchestration

Bad actors know precisely how to take advantage of disorganized, reactionary digital defenses to commit new account opening fraud. It pays to be proactive, which is why savvy leaders should search for tools that can deliver early identity orchestration. Leading identity orchestration tools use behavioral analytics technology to provide smarter decision-making and clear customer insights.

By sorting users into three subgroups based on behavior—genuine, neutral, and risky—identity orchestration tools allow your step-up verification measures to target only the questionable users who need additional screening. Your real customers can continue unburdened. Plus, the best identity orchestration software eliminates the need for manual review and automatically augments your current identity verification flows.

About NeuroID

Expanding your user base in the face of online threats can be intimidating. Still, you can’t afford to be deterred by bad actors. NeuroID offers groundbreaking technology and innovative tools to help you get the job done. With NeuroID, you can secure growth in the digital space without falling victim to fraudsters. Using the power of behavioral analytics, NeuroID reads a user’s digital body language as they interact with forms on your site to spot signs of fraud. ID Crowd Alert™ from NeuroID allows you to monitor digital identity at scale. It visualizes crowd-level behavior and provides alerts about fraud ring activity, bot attacks, and more. NeuroID also offers their ID Orchestrator™ tool for rapid, accurate identity orchestration. With NeuroID, you can navigate the digital identity crisis and stop would-be fraudsters at the point of attack.

Get groundbreaking fraud detection technology from NeuroID at https://www.neuro-id.com/

Comments

Post a Comment