Reports

Sale

Global Precious Metals Market Size, Report, Share, Growth: By Type: Gold, Silver, Palladium, Platinum, Rhodium; Regional Analysis; Market Dynamics: SWOT Analysis, Porter’s Five Forces Analysis, Key Indicators for Demand, Key Indicators for Price; Competitive Landscape; Key Trends and Developments in the Market; 2024-2032

Global Precious Metals Market Size

The global precious metals market reached a volume of 436.05 KMT in 2023. The market is further estimated to grow at a CAGR of 4.7% during 2024-2032 to reach a volume of 656.81 KMT by 2032.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Precious Metals Market Outlook

- The rapid transition from fossil fuels to renewable energy, such as solar power, supports silver use.

- Latin America has abundant reserves for silver as well as plenty of reserves for gold, and with limited local demand, the region has emerged as a natural exporter.

- Investors are inclined towards precious metals such as gold and silver as they are considered safe haven investments.

Global Precious Metals Market Growth Rate

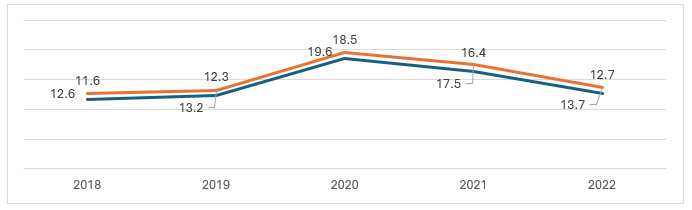

Precious metals are a popular investment among private investors, hedge funds, central banks, and governments as they maintain their value over time. The rising disposable incomes among consumers in tier 2 cities of developing countries support the investment in gold in the form of festive jewellery.

The growing middle-class population in emerging economies has increased the purchase of electrical appliances and medical products that use silver, including computers, mobile phones, cameras, batteries, and medical and protective equipment.

Figure: Gross Household Saving Rate (2018- 2022) (EU and EA)

Key Trends and Developments

Increasing use of precious metals as investments; technological advancements; rising trend of sustainability; and increasing consumption of jewellery in countries such as India and China are impacting the market growth

Apr 5, 2022

Kinross Gold Corporation announced that it has entered into a definitive agreement with the Highland Gold Mining group of companies and its affiliates to sell 100% of its Russian assets for total consideration of USD 680 million in cash.

Mar 9, 2022

Kinross Gold Corporation announced that its La Coipa project in Chile crossed a significant milestone with the production of its first gold bar. The project's plant began commissioning, on schedule and within budget, in early February 2022.

Rising Investments

Growing wealth in emerging markets is increasing investments in precious metals such as gold in the form of gold bars for saving purposes and as jewellery owing to its cultural significance. Gold, silver, platinum, and palladium are highly valued investments as they offer reliable long-term returns.

Technological advancements

The rollout of 5G technology is anticipated to boost the manufacturing of products such as semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT)-enabled gadgets, all of which require precious metals, like silver, gold, and platinum.

Shift to sustainability

The growing need for sustainability is increasing the demand for renewable energy, consequently boosting the market growth. Gold has the potential to act as a catalyst to convert solar energy into methane and methanol. Silver owing to its high conductivity is a crucial ingredient in producing solar technologies. When used as a paste in solar cells, the metal conducts electrons from sunlight resulting in electrical energy that can be used or stored in batteries.

Rising jewellery consumption in India and China

India and China are significant consumers of gold jewellery owing to its cultural significance, religious connotations, and association with wealth generation. Hence, there is a growing appetite for customised, personalised, and high-end gold jewellery.

Precious Metals Market Trends

Growing wealth among emerging economies is increasing investments in gold bars. Investors view precious metals, such as gold, silver, and platinum, as a valued investment class into which funds should be allocated and diversified owing to their track record of protecting wealth through a crisis.

With the growing environmental and social consciousness among consumers, the demand for jewellery offering transparency is anticipated to increase.

Further, the trend of miniaturisation of electronics is encouraging the utilisation of silver conducting materials for denser packing technologies. With the increasing number of IoT devices, the use of semiconductor silver products in micro-electro-mechanical system (MEMS) packaging and processing is likely to surge. The rollout of 5G technology in both developed and developing countries is anticipated to drive the demand for silver in passive components, cabling, semiconductor chips, power distribution, and multi-layer ceramic capacitors (MLCC), among others.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Precious Metals Industry Segmentation

“Global Precious Metals Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Gold

- Jewellery

- Investment

- Coins and Medals

- Electronics

- Others

- Silver

- Electric and Electronics

- Jewellery

- Coins and Medals

- Investment

- Silverware

- Photography

- Others

- Palladium

- Automotive

- Electric and Electronics

- Medical Application

- Jewellery

- Platinum

- Automotive

- Jewellery

- Chemical Processing

- Medical Application

- Electric and Electronics

- Others

- Rhodium

- Automotive

- Glass Production

- Electric and Electronics

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Precious Metals Market Share

Based on type, gold dominates the global market for precious metals

Gold and silver are perceived as popular commodity investments to mitigate portfolio risk and diversify the overall portfolio.

Due to its rareness, exclusivity, strength, natural whiteness, and other unique properties, platinum has become a sought-after material for modern-day jewellery making, symbolising luxury and longevity.

The demand for gold, silver, and platinum jewellery from digital/online channels is significantly surging. Moreover, the emerging trend of fashion jewellery, personalised and customised jewellery, and the internationalisation of jewellery brands are expected to support the market.

As per the precious metals market analysis, vehicle sales are a key factor aiding the palladium and rhodium demand for ICEs. Further, the usage of platinum is anticipated to increase as the precious metal is also used in fuel cell electric vehicles (FCEVs) besides diesel cars, benefitting from the increasing demand for clean mobility.

With increasing environmental concerns, the demand for palladium, platinum, and rhodium in automotive catalytic converters to reduce vehicle carbon emissions is anticipated to rise.

Leading Precious Metals Market Manufacturers

Companies are actively using advanced chemical processes and cutting-edge technology to refine, evaluate, and generate significant volumes of precious metals.

Anglo American Plc

Headquartered in the UK, Anglo American Plc is a leading global mining company that explores and mines precious base and ferrous metals.

Southern Copper Corporation

Founded in 1952, Southern Copper Corporation is a subsidiary of Grupo México SAB de CV and is a leading mining-metallurgical company, a global producer of copper, and other valuable by-products.

Newmont Corporation

Newmont is primarily engaged in the production of gold with significant operations or assets in the US, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia and Ghana. The company is also engaged in the production of copper, silver, lead, and zinc.

Northam Platinum Holdings Limited

It specialises in the mining of platinum group metals (platinum, palladium, and rhodium). It operates three wholly owned mines; Zondereinde, Booysendal and Eland, located in the Bushveld Complex of South Africa, and also a PGM recycling facility in the United States of America (US).

Other notable players operating in the global precious metals market are Newcrest Mining Limited, and Kinross Gold Corporation, among others.

Precious Metals Market Analysis by Region

North America is one of the significant markets. Mineral exploration is a significant sector in Canada, with precious metals, in particular gold, being most sought-after. Gold is mined from 9 provinces and territories, led by Quebec and Ontario, with key uses including investment, jewellery, and technology.

Within Asia Pacific, the Chinese government is actively promoting the transition to a clean economy and the use of green hydrogen and fuel-cell electric vehicles to realise its aim to achieve carbon neutrality by 2060. This is anticipated to increase the demand for platinum, palladium, and rhodium, which play a critical role in proton-exchange membrane (PEM) electrolysers and power fuel hydrogen cell vehicles.

In Latin America, Mexico, Brazil, and Chile have significant reserves of precious metals such as gold and silver. Brazil is a sizable exporter of gold, with destination countries including Canada, Switzerland, the United Kingdom, the United Arab Emirates, and India. Gold imports in Brazil are substantially lower, and are primarily sourced from Singapore, South Korea, the United States, and Italy.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Our Top Selling Reports

United States Conferences, Concert, and Event Market

MENA Maintenance, Repair, and Operations (MRO) Market

Saudi Arabia Bottled Water Market

North America Natural and Organic Face Care Market

United Kingdom Oil and Gas Market

Latin America Vegetable Oil Market

Precious Metals Market Report Snapshots

Precious Metals Market Regional Analysis

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global Precious Metals Market Analysis

8.1 Key Industry Highlights

8.2 Global Precious Metals Historical Market (2018-2023)

8.3 Global Precious Metals Market Forecast (2024-2032)

8.4 Global Precious Metals Market by Type

8.4.1 Gold

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.1.3 Gold by End Use

8.4.1.3.1 Jewellery

8.4.1.3.2 Investment

8.4.1.3.3 Coins and Medals

8.4.1.3.4 Electronics

8.4.1.3.5 Others

8.4.2 Silver

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.4.2.3 Silver by End Use

8.4.2.3.1 Electric and Electronics

8.4.2.3.2 Jewellery

8.4.2.3.3 Coins and Medals

8.4.2.3.4 Investment

8.4.2.3.5 Silverware

8.4.2.3.6 Photography

8.4.2.3.7 Others

8.4.3 Palladium

8.4.3.1 Historical Trend (2018-2023)

8.4.3.2 Forecast Trend (2024-2032)

8.4.3.3 Palladium by End Use

8.4.3.3.1 Automotive

8.4.3.3.2 Electric and Electronics

8.4.3.3.3 Medical Application

8.4.3.3.4 Jewellery

8.4.4 Platinum

8.4.4.1 Historical Trend (2018-2023)

8.4.4.2 Forecast Trend (2024-2032)

8.4.4.3 Platinum by End Use

8.4.4.3.1 Automotive

8.4.4.3.2 Jewellery

8.4.4.3.3 Chemical Processing

8.4.4.3.4 Medical Application

8.4.4.3.5 Electric and Electronics

8.4.4.3.6 Others

8.4.5 Rhodium

8.4.5.1 Historical Trend (2018-2023)

8.4.5.2 Forecast Trend (2024-2032)

8.4.5.3 Rhodium by End Use

8.4.5.3.1 Automotive

8.4.5.3.2 Glass Production

8.4.5.3.3 Electric and Electronics

8.5 Global Precious Metals Market by Region

8.5.1 North America

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Europe

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Asia Pacific

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Latin America

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Middle East and Africa

8.5.5.1 Historical Trend (2018-2023)

8.5.5.2 Forecast Trend (2024-2032)

9 North America Precious Metals Market Analysis

9.1 United States of America

9.1.1 Historical Trend (2018-2023)

9.1.2 Forecast Trend (2024-2032)

9.2 Canada

9.2.1 Historical Trend (2018-2023)

9.2.2 Forecast Trend (2024-2032)

10 Europe Precious Metals Market Analysis

10.1 United Kingdom

10.1.1 Historical Trend (2018-2023)

10.1.2 Forecast Trend (2024-2032)

10.2 Germany

10.2.1 Historical Trend (2018-2023)

10.2.2 Forecast Trend (2024-2032)

10.3 France

10.3.1 Historical Trend (2018-2023)

10.3.2 Forecast Trend (2024-2032)

10.4 Italy

10.4.1 Historical Trend (2018-2023)

10.4.2 Forecast Trend (2024-2032)

10.5 Others

11 Asia Pacific Precious Metals Market Analysis

11.1 China

11.1.1 Historical Trend (2018-2023)

11.1.2 Forecast Trend (2024-2032)

11.2 Japan

11.2.1 Historical Trend (2018-2023)

11.2.2 Forecast Trend (2024-2032)

11.3 India

11.3.1 Historical Trend (2018-2023)

11.3.2 Forecast Trend (2024-2032)

11.4 ASEAN

11.4.1 Historical Trend (2018-2023)

11.4.2 Forecast Trend (2024-2032)

11.5 Australia

11.5.1 Historical Trend (2018-2023)

11.5.2 Forecast Trend (2024-2032)

11.6 Others

12 Latin America Precious Metals Market Analysis

12.1 Brazil

12.1.1 Historical Trend (2018-2023)

12.1.2 Forecast Trend (2024-2032)

12.2 Argentina

12.2.1 Historical Trend (2018-2023)

12.2.2 Forecast Trend (2024-2032)

12.3 Mexico

12.3.1 Historical Trend (2018-2023)

12.3.2 Forecast Trend (2024-2032)

12.4 Others

13 Middle East and Africa Precious Metals Market Analysis

13.1 Saudi Arabia

13.1.1 Historical Trend (2018-2023)

13.1.2 Forecast Trend (2024-2032)

13.2 United Arab Emirates

13.2.1 Historical Trend (2018-2023)

13.2.2 Forecast Trend (2024-2032)

13.3 Nigeria

13.3.1 Historical Trend (2018-2023)

13.3.2 Forecast Trend (2024-2032)

13.4 South Africa

13.4.1 Historical Trend (2018-2023)

13.4.2 Forecast Trend (2024-2032)

13.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Trade Data Analysis (HS Code- 7106, 7108, 7110)

15.1 Major Importing Countries

15.1.1 By Volume

15.1.2 By Value

15.2 Major Exporting Countries

15.2.1 By Volume

15.2.2 By Value

16 Price Analysis

17 Competitive Landscape

17.1 Market Structure

17.2 Company Profiles

17.2.1 Anglo American Plc

17.2.1.1 Company Overview

17.2.1.2 Product Portfolio

17.2.1.3 Demographic Reach and Achievements

17.2.1.4 Certifications

17.2.2 Southern Copper Corporation

17.2.2.1 Company Overview

17.2.2.2 Product Portfolio

17.2.2.3 Demographic Reach and Achievements

17.2.2.4 Certifications

17.2.3 Newmont Corporation

17.2.3.1 Company Overview

17.2.3.2 Product Portfolio

17.2.3.3 Demographic Reach and Achievements

17.2.3.4 Certifications

17.2.4 Northam Platinum Holdings Limited

17.2.4.1 Company Overview

17.2.4.2 Product Portfolio

17.2.4.3 Demographic Reach and Achievements

17.2.4.4 Certifications

17.2.5 Newcrest Mining Limited

17.2.5.1 Company Overview

17.2.5.2 Product Portfolio

17.2.5.3 Demographic Reach and Achievements

17.2.5.4 Certifications

17.2.6 Kinross Gold Corporation

17.2.6.1 Company Overview

17.2.6.2 Product Portfolio

17.2.6.3 Demographic Reach and Achievements

17.2.6.4 Certifications

17.2.7 Others

18 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global Precious Metals Market: Key Industry Highlights, 2018 and 2032

2. Global Precious Metals Historical Market: Breakup by Type (MT), 2018-2023

3. Global Precious Metals Market Forecast: Breakup by Type (MT), 2024-2032

4. Global Precious Metals Historical Market: Breakup by Region (MT), 2018-2023

5. Global Precious Metals Market Forecast: Breakup by Region (MT), 2024-2032

6. North America Precious Metals Historical Market: Breakup by Country (MT), 2018-2023

7. North America Precious Metals Market Forecast: Breakup by Country (MT), 2024-2032

8. Europe Precious Metals Historical Market: Breakup by Country (MT), 2018-2023

9. Europe Precious Metals Market Forecast: Breakup by Country (MT), 2024-2032

10. Asia Pacific Precious Metals Historical Market: Breakup by Country (MT), 2018-2023

11. Asia Pacific Precious Metals Market Forecast: Breakup by Country (MT), 2024-2032

12. Latin America Precious Metals Historical Market: Breakup by Country (MT), 2018-2023

13. Latin America Precious Metals Market Forecast: Breakup by Country (MT), 2024-2032

14. Middle East and Africa Precious Metals Historical Market: Breakup by Country (MT), 2018-2023

15. Middle East and Africa Precious Metals Market Forecast: Breakup by Country (MT), 2024-2032

16. Major Exporting Countries by Value

17. Major Importing Countries by Value

18. Major Exporting Countries by Volume

19. Major Importing Countries by Volume

20. Global Precious Metals Market Structure

The market reached a volume of 436.05 KMT in 2023.

The market is projected to grow at a CAGR of 4.7% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach a volume of 656.81 KMT by 2032.

The key types are gold, silver, platinum, palladium, and rhodium.

The key regional markets for precious metals are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The factors driving the growth of the market are the rising demand for precious metals in jewellery, the increasing use of platinum and palladium in the automotive sector, and the emerging demand for lightweight vehicles.

The key trends of the market include the increasing adoption of gold and silver as investments, rising technological advancements, and the expansion of the semiconductor manufacturing sector.

The key players in the market include Anglo American Plc, Southern Copper Corporation, Newmont Corporation, Northam Platinum Holdings Limited, Newcrest Mining Limited, and Kinross Gold Corporation, among others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.