Reports

Sale

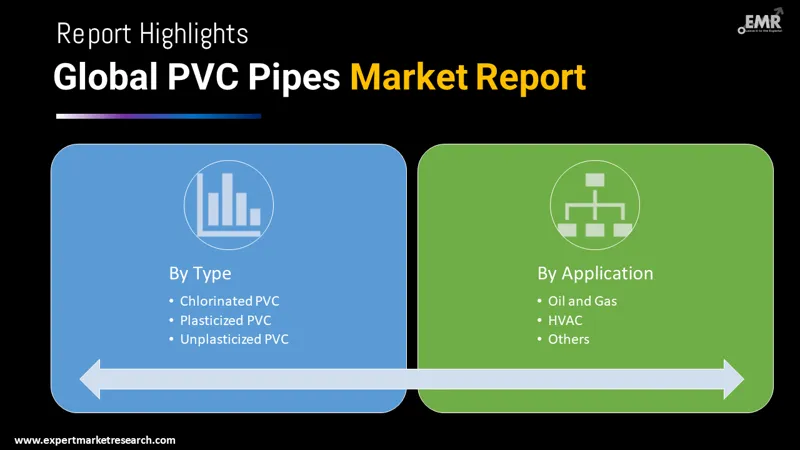

Global PVC Pipes Market Size, Share, Trends, Research: By Type: Chlorinated PVC, Plasticized PVC, Unplasticized PVC; By Application: Irrigation, Water Supply, Sewerage, Plumbing, Oil and Gas, Heating, Ventilation and Air Conditioning, Others; Regional Analysis; Competitive Landscape; Key Trends and Developments in the Market; 2024-2032

Global PVC Pipes Market Size

The global PVC pipes market reached a volume of approximately 28.93 million tons in 2023. The market is projected to grow at a CAGR of 4.3% between 2024 and 2032, reaching a volume of around 42.26 million tons by 2032.

PVC Pipes Market Outlook

- Technological improvements such as the development of molecularly oriented PVC pipes (PVC-O), offer enhanced strength, durability, and resistance.

- There is a noticeable shift towards the use of larger-diameter PVC pipes, especially for municipal applications.

- PVC pipes are increasingly favoured for the rehabilitation and replacement of ageing and deteriorating water and sewage infrastructure.

PVC Pipes Market Growth Rate

PVC pipe refers to piping that is made of PVC or polyvinyl chloride, a versatile thermoplastic that is a combination of plastic and vinyl. Highly versatile, PVC pipes can be used to transport sewage, water, and other liquids, in several end-use sectors and are durable, sturdy, and offer excellent resistance to corrosion.

The low cost of the polyvinyl chloride along with increased strength, improved durability, and easy installation of the PVC pipes has increased its popularity among various end users leading to the PVC pipes market growth. Rising awareness regarding the importance of clean water supply in rural areas is also fuelling the demand for PVC pipes. The high degree of inertness and corrosion resistance of PVC pipes helps them in preserving the quality of drinking water. Furthermore, increasing infrastructural development in residential and commercial sectors, particularly in emerging economies is surging the demand for PVC pipes. These pipes have extensive applications such as in plumbing, drinking water distribution, sewerage, and HVAC systems, among others.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Key Trends and Developments

Increased demand for larger-diameter pipes; rising demand for eco-friendly and sustainable solutions; focus on water conservation and efficient irrigation systems; and advancements in pipe technology and materials are the major trends impacting the PVC pipes market expansion

December 19th, 2023

Captain Pipes Ltd., a top provider of PVC Pipes, announced that it is planning to establish a PVC manufacturing facility near Ahmedabad, India.

September 25th, 2023

Sintex BAPL, a subsidiary of Welspun Corp Limited, announced that it is set to establish a manufacturing facility for PVC pipes, fittings, and water tanks in Telangana, India.

June 19th, 2023

Grasim Industries Limited announced that it is all set to start its operation on a chlorinated polyvinyl chloride (CPVC) resin-manufacturing plant, which is expected to have a production capacity of around 1,00,000 metric tonnes.

March 13th, 2023

Finolex Industries announced that it has begun operations on its PVC pipes and fittings at its production facility in Maharashtra, India.

Increased demand for larger-diameter pipes

There is a growing trend towards the use of larger-diameter PVC pipes, particularly for municipal water and sewer applications.

Rising demand for eco-friendly and sustainable solutions

This trend is driving the development and use of eco-friendly PVC pipes made from bio-based or recycled PVC materials.

Focus on water conservation and efficient irrigation systems

With the increasing emphasis on water conservation, there is a significant demand for PVC pipes in efficient irrigation systems, including drip and sprinkler irrigation.

Advancements in pipe technology and materials

Technological advancements are leading to the development of PVC pipes that are more durable, flexible, and resistant to chemicals and extreme temperatures.

PVC Pipes Market Trends

The trend towards using larger-diameter PVC pipes in municipal water and sewer applications is driven by several factors related to the efficiency, reliability, and sustainability of urban infrastructure. Larger diameter pipes have a greater cross-sectional area, which significantly increases their capacity to carry water which results in improved flow rates, making these pipes highly effective for transporting large volumes of water or waste over long distances. Investing in larger-diameter pipes can be more cost-efficient in the long run in the PVC market. Although the initial installation cost may be higher compared to smaller pipes, the reduced risk of blockages and leaks, lower maintenance requirements, and the ability to handle increased future demand make it a financially sound choice.

Market players are increasingly establishing new PVC pipes and fittings manufacturing facilities to expand their operations. In December 2023, Captain Pipes Ltd., a prominent manufacturer in the PVC pipes sector, announced its intention to expand its production capabilities by setting up a new PVC manufacturing facility near Ahmedabad, India. This move is indicative of the company's strategic efforts to meet the increasing demand for PVC pipes and fittings, which are widely used in various sectors including construction, irrigation, water supply, and sewage systems.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

PVC Pipes Industry Segmentation

“PVC Pipes Market Report and Forecast 2024-2032” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Chlorinated PVC

- Plasticized PVC

- Unplasticized PVC

Market Breakup by Application

- Irrigation

- Water Supply

- Sewerage

- Plumbing

- Oil and Gas

- Heating, Ventilation and Air Conditioning

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

PVC Pipes Market Share

The unplasticised PVC segment maintains its dominance in the market owing to its growing applications in sewerage, waste, and drainage sectors

Unplasticised PVC pipes account for a significant share of the PVC pipes market owing to their rising application in the transportation of sewage, underground drainage, waste, and drinking water. They are a less porous material which increases the strength of the pipes and reduces the maintenance requirement. The lead-free property reduces the risk of contamination and increases its application in the healthcare and hospitality sectors. Increasing awareness regarding the importance of adequate sewage and plumbing maintenance is also anticipated to increase the demand for unplasticised PVC pipes further in the coming years.

Chlorinated PVC pipes are anticipated to witness sizeable growth in the coming years as CPVC pipes can withstand higher temperatures than standard PVC pipes. While PVC pipes are typically suitable for temperatures up to 140°F (60°C), CPVC pipes can handle temperatures up to 200°F (93°C). This makes CPVC pipes ideal for hot and cold water lines in residential and commercial buildings.

The sewerage sector accounts for a major PVC pipes market share as PVC pipes offer a corrosion-resistant and durable pipe solution for sewers

The sewerage sector occupies a dominant market share. PVC pipes are highly resistant to environmental degradation, chemical rotting, corrosion, and abrasion which makes them ideal for sewerage applications, where the pipe material may be exposed to a variety of substances, including acidic and basic effluents. Their durability leads to a longer service life, often exceeding 100 years, reducing the need for frequent replacements and repairs. The joining methods used for PVC pipes, such as gasketed bell and spigot joints or solvent welding, create a watertight seal that prevents the leakage of sewage and the infiltration of groundwater which is crucial for maintaining sanitary conditions and preventing the contamination of surrounding soil and water bodies.

The water supply sector is also anticipated to gain robust growth in the PVC pipes market in the coming years. Unlike metal pipes, PVC pipes do not corrode when exposed to water, which makes them ideal for water supply systems. This corrosion resistance ensures that the water remains free from contamination that can occur from corroded metal pipes.

Leading Manufacturers of PVC Pipes

The market players are establishing new production facilities to gain a competitive edge in the PVC pipes market

JM Eagle, Inc., established in 1982 in California, United States, specializes in manufacturing high-density polyethylene pipes and polyvinyl chloride.

Formosa Plastics Corporation, founded in 1954 in Kaohsiung City, Taiwan, produces polyvinyl chloride resins and intermediate plastic products, including chlor-alkali, polyethylene, and suspension PVC.

Shin-Etsu Chemical Co., Ltd, established in 1926 in Tokyo, Japan, manufactures synthetic resins and other chemical products such as fertilizers.

Finolex Industries Limited, founded in 1981 in Maharashtra, India, produces PVC-U pipes, fittings, and PVC-insulated electrical cables.

Other major players in the PVC pipe market include Westlake Corporation, IPEX Inc., Cresline Plastic Pipe Co., Inc., Dura-Line LLC, Tigre S/A, Diamond Plastics Corporation, and National Pipe and Plastics, Inc., among others.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

PVC Pipes Market Analysis by Region

The Asia Pacific occupies a sizable share of the global market and is expected to grow further in the forecast period owing to growing urbanisation and increasing construction activities in the region. Various governments in the region are taking initiatives to increase maintenance and repair activities, replacing older pipes with PVC for greater effectiveness and durability. The large population in countries such as China and India are surging the demand for PVC pipes for water supply, sewerage, and irrigation applications.

The North America PVC pipes market is expected to gain a sizeable share of the market in the foreseeable future as there is an increasing emphasis on using materials that have a lower environmental impact. PVC pipes are favoured in many cases because they are durable, reduce the need for frequent replacements, and are recyclable, contributing to circular economy practices. Additionally, regulatory standards in North America that demand safe drinking water push for the use of materials that do not leach harmful chemicals, a criterion that PVC meets.

Key Highlights of the Report

| REPORT FEATURES | DETAILS |

| Base Year | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Our Best Selling Reports

PVC Pipes Market Report Snapshots

PVC Pipes Market Regional Analysis

*At Expert Market Research, we strive to always give you current and accurate information. The numbers depicted in the description are indicative and may differ from the actual numbers in the final EMR report.

1 Preface

2 Report Coverage – Key Segmentation and Scope

3 Report Description

3.1 Market Definition and Outlook

3.2 Properties and Applications

3.3 Market Analysis

3.4 Key Players

4 Key Assumptions

5 Executive Summary

5.1 Overview

5.2 Key Drivers

5.3 Key Developments

5.4 Competitive Structure

5.5 Key Industrial Trends

6 Market Snapshot

6.1 Global

6.2 Regional

7 Opportunities and Challenges in the Market

8 Global PVC Pipes Market Analysis

8.1 Key Industry Highlights

8.2 Global PVC Pipes Historical Market (2018-2023)

8.3 Global PVC Pipes Market Forecast (2024-2032)

8.4 Global PVC Pipes Market by Type

8.4.1 Chlorinated PVC

8.4.1.1 Historical Trend (2018-2023)

8.4.1.2 Forecast Trend (2024-2032)

8.4.2 Plasticized PVC

8.4.2.1 Historical Trend (2018-2023)

8.4.2.2 Forecast Trend (2024-2032)

8.4.3 Unplasticized PVC

8.4.3.1 Historical Trend (2018-2023)

8.4.3.2 Forecast Trend (2024-2032)

8.5 Global PVC Pipes Market by Application

8.5.1 Irrigation

8.5.1.1 Historical Trend (2018-2023)

8.5.1.2 Forecast Trend (2024-2032)

8.5.2 Water Supply

8.5.2.1 Historical Trend (2018-2023)

8.5.2.2 Forecast Trend (2024-2032)

8.5.3 Sewerage

8.5.3.1 Historical Trend (2018-2023)

8.5.3.2 Forecast Trend (2024-2032)

8.5.4 Plumbing

8.5.4.1 Historical Trend (2018-2023)

8.5.4.2 Forecast Trend (2024-2032)

8.5.5 Oil and Gas

8.5.5.1 Historical Trend (2018-2023)

8.5.5.2 Forecast Trend (2024-2032)

8.5.6 Heating, Ventilation and Air Conditioning

8.5.6.1 Historical Trend (2018-2023)

8.5.6.2 Forecast Trend (2024-2032)

8.5.7 Others

8.6 Global PVC Pipes Market by Region

8.6.1 North America

8.6.1.1 Historical Trend (2018-2023)

8.6.1.2 Forecast Trend (2024-2032)

8.6.2 Europe

8.6.2.1 Historical Trend (2018-2023)

8.6.2.2 Forecast Trend (2024-2032)

8.6.3 Asia Pacific

8.6.3.1 Historical Trend (2018-2023)

8.6.3.2 Forecast Trend (2024-2032)

8.6.4 Latin America

8.6.4.1 Historical Trend (2018-2023)

8.6.4.2 Forecast Trend (2024-2032)

8.6.5 Middle East and Africa

8.6.5.1 Historical Trend (2018-2023)

8.6.5.2 Forecast Trend (2024-2032)

9 North America PVC Pipes Market Analysis

9.1 Market by Type

9.2 Market by Application

9.3 Market by Country

9.3.1 United States of America

9.3.1.1 Historical Trend (2018-2023)

9.3.1.2 Forecast Trend (2024-2032)

9.3.2 Canada

9.3.2.1 Historical Trend (2018-2023)

9.3.2.2 Forecast Trend (2024-2032)

10 Europe PVC Pipes Market Analysis

10.1 Market by Type

10.2 Market by Application

10.3 Market by Country

10.3.1 United Kingdom

10.3.1.1 Historical Trend (2018-2023)

10.3.1.2 Forecast Trend (2024-2032)

10.3.2 Germany

10.3.2.1 Historical Trend (2018-2023)

10.3.2.2 Forecast Trend (2024-2032)

10.3.3 France

10.3.3.1 Historical Trend (2018-2023)

10.3.3.2 Forecast Trend (2024-2032)

10.3.4 Italy

10.3.4.1 Historical Trend (2018-2023)

10.3.4.2 Forecast Trend (2024-2032)

10.3.5 Others

11 Asia Pacific PVC Pipes Market Analysis

11.1 Market by Type

11.2 Market by Application

11.3 Market by Country

11.3.1 China

11.3.1.1 Historical Trend (2018-2023)

11.3.1.2 Forecast Trend (2024-2032)

11.3.2 Japan

11.3.2.1 Historical Trend (2018-2023)

11.3.2.2 Forecast Trend (2024-2032)

11.3.3 India

11.3.3.1 Historical Trend (2018-2023)

11.3.3.2 Forecast Trend (2024-2032)

11.3.4 ASEAN

11.3.4.1 Historical Trend (2018-2023)

11.3.4.2 Forecast Trend (2024-2032)

11.3.5 South Korea

11.3.5.1 Historical Trend (2018-2023)

11.3.5.2 Forecast Trend (2024-2032)

11.3.6 Australia

11.3.6.1 Historical Trend (2018-2023)

11.3.6.2 Forecast Trend (2024-2032)

11.3.7 Others

12 Latin America PVC Pipes Market Analysis

12.1 Market by Type

12.2 Market by Application

12.3 Market by Country

12.3.1 Brazil

12.3.1.1 Historical Trend (2018-2023)

12.3.1.2 Forecast Trend (2024-2032)

12.3.2 Argentina

12.3.2.1 Historical Trend (2018-2023)

12.3.2.2 Forecast Trend (2024-2032)

12.3.3 Mexico

12.3.3.1 Historical Trend (2018-2023)

12.3.3.2 Forecast Trend (2024-2032)

12.3.4 Others

13 Middle East and Africa PVC Pipes Market Analysis

13.1 Market by Type

13.2 Market by Application

13.3 Market by Country

13.3.1 Saudi Arabia

13.3.1.1 Historical Trend (2018-2023)

13.3.1.2 Forecast Trend (2024-2032)

13.3.2 United Arab Emirates

13.3.2.1 Historical Trend (2018-2023)

13.3.2.2 Forecast Trend (2024-2032)

13.3.3 Nigeria

13.3.3.1 Historical Trend (2018-2023)

13.3.3.2 Forecast Trend (2024-2032)

13.3.4 South Africa

13.3.4.1 Historical Trend (2018-2023)

13.3.4.2 Forecast Trend (2024-2032)

13.3.5 Others

14 Market Dynamics

14.1 SWOT Analysis

14.1.1 Strengths

14.1.2 Weaknesses

14.1.3 Opportunities

14.1.4 Threats

14.2 Porter’s Five Forces Analysis

14.2.1 Supplier’s Power

14.2.2 Buyer’s Power

14.2.3 Threat of New Entrants

14.2.4 Degree of Rivalry

14.2.5 Threat of Substitutes

14.3 Key Indicators for Demand

14.4 Key Indicators for Price

15 Price Analysis

16 Competitive Landscape

16.1 Market Structure

16.2 Company Profiles

16.2.1 JM Eagle, Inc.

16.2.1.1 Company Overview

16.2.1.2 Product Portfolio

16.2.1.3 Demographic Reach and Achievements

16.2.1.4 Certifications

16.2.2 Formosa Plastics Corporation

16.2.2.1 Company Overview

16.2.2.2 Product Portfolio

16.2.2.3 Demographic Reach and Achievements

16.2.2.4 Certifications

16.2.3 Shin-Etsu Chemical Co., Ltd

16.2.3.1 Company Overview

16.2.3.2 Product Portfolio

16.2.3.3 Demographic Reach and Achievements

16.2.3.4 Certifications

16.2.4 Westlake Corporation

16.2.4.1 Company Overview

16.2.4.2 Product Portfolio

16.2.4.3 Demographic Reach and Achievements

16.2.4.4 Certifications

16.2.5 IPEX Inc.

16.2.5.1 Company Overview

16.2.5.2 Product Portfolio

16.2.5.3 Demographic Reach and Achievements

16.2.5.4 Certifications

16.2.6 Cresline Plastic Pipe Co., Inc

16.2.6.1 Company Overview

16.2.6.2 Product Portfolio

16.2.6.3 Demographic Reach and Achievements

16.2.6.4 Certifications

16.2.7 Dura-Line LLC

16.2.7.1 Company Overview

16.2.7.2 Product Portfolio

16.2.7.3 Demographic Reach and Achievements

16.2.7.4 Certifications

16.2.8 Tigre S/A

16.2.8.1 Company Overview

16.2.8.2 Product Portfolio

16.2.8.3 Demographic Reach and Achievements

16.2.8.4 Certifications

16.2.9 Finolex Industries Limited

16.2.9.1 Company Overview

16.2.9.2 Product Portfolio

16.2.9.3 Demographic Reach and Achievements

16.2.9.4 Certifications

16.2.10 Diamond Plastics Corporation

16.2.10.1 Company Overview

16.2.10.2 Product Portfolio

16.2.10.3 Demographic Reach and Achievements

16.2.10.4 Certifications

16.2.11 National Pipe and Plastics, Inc

16.2.11.1 Company Overview

16.2.11.2 Product Portfolio

16.2.11.3 Demographic Reach and Achievements

16.2.11.4 Certifications

16.2.12 Others

17 Key Trends and Developments in the Market

List of Key Figures and Tables

1. Global PVC Pipes Market: Key Industry Highlights, 2018 and 2032

2. Global PVC Pipes Historical Market: Breakup by Type (MMT), 2018-2023

3. Global PVC Pipes Market Forecast: Breakup by Type (MMT), 2024-2032

4. Global PVC Pipes Historical Market: Breakup by Application (MMT), 2018-2023

5. Global PVC Pipes Market Forecast: Breakup by Application (MMT), 2024-2032

6. Global PVC Pipes Historical Market: Breakup by Region (MMT), 2018-2023

7. Global PVC Pipes Market Forecast: Breakup by Region (MMT), 2024-2032

8. North America PVC Pipes Historical Market: Breakup by Country (MMT), 2018-2023

9. North America PVC Pipes Market Forecast: Breakup by Country (MMT), 2024-2032

10. Europe PVC Pipes Historical Market: Breakup by Country (MMT), 2018-2023

11. Europe PVC Pipes Market Forecast: Breakup by Country (MMT), 2024-2032

12. Asia Pacific PVC Pipes Historical Market: Breakup by Country (MMT), 2018-2023

13. Asia Pacific PVC Pipes Market Forecast: Breakup by Country (MMT), 2024-2032

14. Latin America PVC Pipes Historical Market: Breakup by Country (MMT), 2018-2023

15. Latin America PVC Pipes Market Forecast: Breakup by Country (MMT), 2024-2032

16. Middle East and Africa PVC Pipes Historical Market: Breakup by Country (MMT), 2018-2023

17. Middle East and Africa PVC Pipes Market Forecast: Breakup by Country (MMT), 2024-2032

18. Global PVC Pipes Market Structure

The market for PVC pipes reached a volume of approximately 28.93 million tons in 2023.

The market is expected to grow at a CAGR of 4.3% between 2024 and 2032.

The market is estimated to witness a healthy growth in the forecast period of 2024-2032 to reach around 42.26 million tons by 2032.

The major drivers in the market are growing urbanisation, increasing construction activities, and rising demand from oil and gas industry.

The key PVC pipes market trends include low cost and easy installation of PVC pipes, rising awareness regarding the high degree of inertness of PVC pipes, and expansion of production capacities.

The major regions in the market are North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

The various types of PVC pipes in the market are chlorinated PVC, plasticized PVC, and unplasticized PVC.

The major players in the market are JM Eagle, Inc., Formosa Plastics Corporation, Shin-Etsu Chemical Co., Ltd, Westlake Corporation, IPEX Inc., Cresline Plastic Pipe Co., Inc, Dura-Line LLC, Tigre S/A, Finolex Industries Limited, Diamond Plastics Corporation, and National Pipe and Plastics, Inc, among others.

Mini Report

-

Selected Sections, One User

-

Printing Not Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Single User License

-

All Sections, One User

-

One Print Allowed

-

Email Delivery in PDF

-

Free Limited Customisation -

Post Sales Analyst Support -

50% Discount on Next Update

Five User License

-

All Sections, Five Users

-

Five Prints Allowed

-

Email Delivery in PDF

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Corporate License

-

All Sections, Unlimited Users

-

Unlimited Prints Allowed

-

Email Delivery in PDF + Excel

-

Free Limited Customisation

-

Post Sales Analyst Support

-

50% Discount on Next Update

Any Question? Speak With An Analyst

View A Sample

Did You Miss Anything, Ask Now

Right People

We are technically excellent, strategic, practical, experienced and efficient; our analysts are hand-picked based on having the right attributes to work successfully and execute projects based on your expectations.

Right Methodology

We leverage our cutting-edge technology, our access to trusted databases, and our knowledge of the current models used in the market to deliver you research solutions that are tailored to your needs and put you ahead of the curve.

Right Price

We deliver in-depth and superior quality research in prices that are reasonable, unmatchable, and shows our understanding of your resource structure. We, additionally, offer attractive discounts on our upcoming reports.

Right Support

Our team of expert analysts are at your beck and call to deliver you optimum results that are customised to meet your precise needs within the specified timeframe and help you form a better understanding of the industry.